What was the stock market return for the last 5 years?

The U.S. financial exchange is the biggest stock market on the planet, representing 43% of the $106 trillion worldwide value market a year ago. U.S. stocks have made significant abundance over the long haul, something Warren Buffett credits to a novel blend of business and development. Right now, 17 of the 20 biggest organizations on the planet are U.S. organizations.

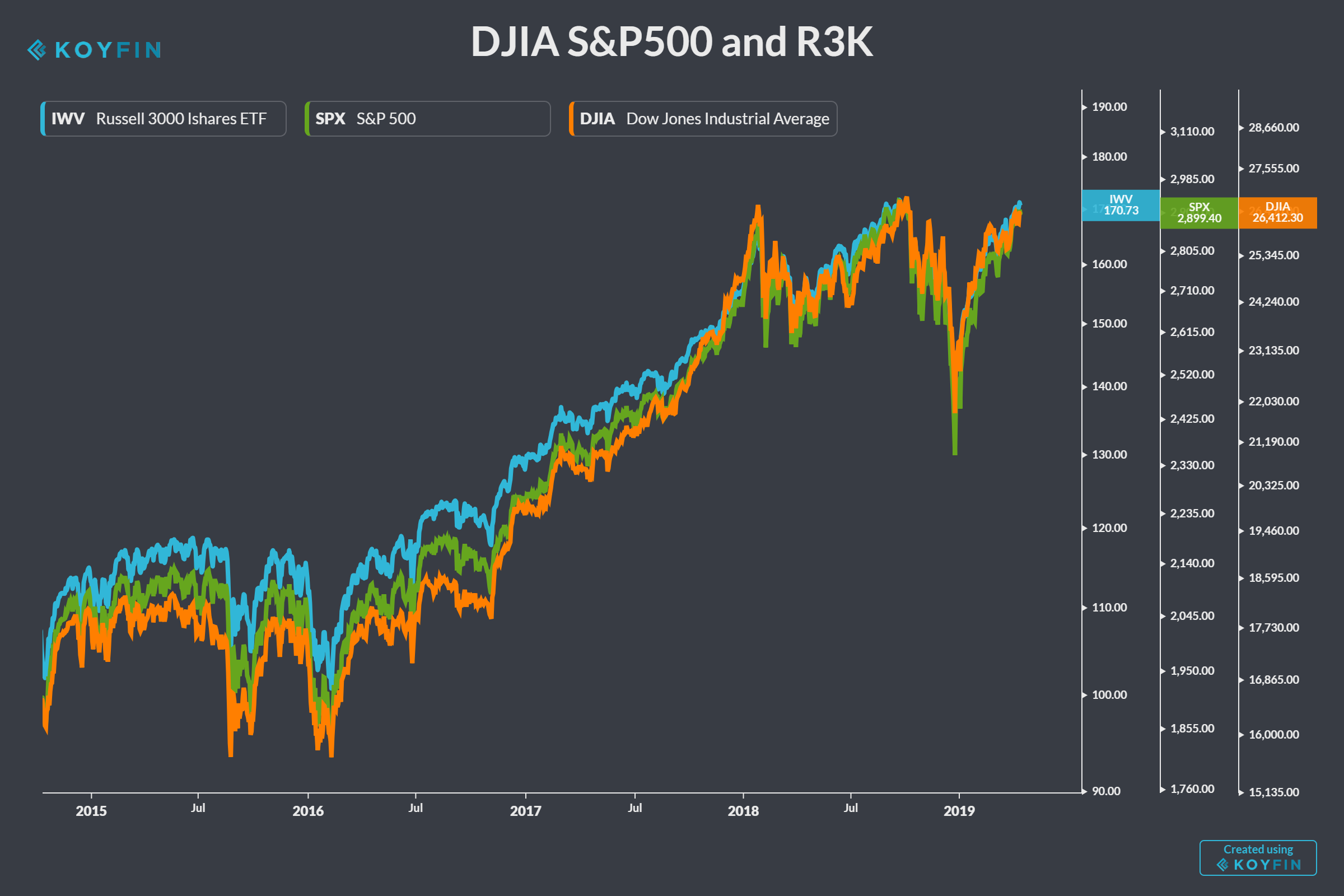

The U.S. stock market is partitioned in various ways, yet its presentation is fundamentally estimated through three significant monetary lists: the S&P 500 (SNPINDEX: ^GSPC), the Dow Jones Modern Normal (DJINDICES: ^DJI), and the Nasdaq Composite (NASDAQINDEX: ^IXIC).

Those files share specific stocks in like manner, yet financial backers view them in an unexpected way. Peruse on to perceive how each of the three files performed over the course of the past ten years as of Jan. 15, 2024.

S&P 500

The cutting edge S&P 500 was sent off in 1957, yet its underlying foundations date back to a forerunner list made in 1923. The S&P 500 estimates the exhibition of 500 huge U.S. organizations addressing a mix of significant worth stocks and development stocks. The file represents around 80% of homegrown values by market capitalization, so it's generally viewed as the best benchmark for the whole U.S. stock market.

The five biggest parts of the S&P 500 are nitty gritty beneath:

Microsoft: 7.1%

Apple: 6.8%

Alphabet: 3.9%

Amazon: 3.5%

Nvidia: 3.3%

The S&P 500 returned 163% throughout the past ten years, compounding at 10.2% yearly. Financial backers can get immediate openness to the file with the Vanguard S&P 500 ETF (NYSEMKT: VOO). Warren Smorgasbord has frequently suggested that system on the grounds that not many financial backers figure out how to beat the S&P 500. That incorporates proficient cash supervisors. As a matter of fact, under 15% of all huge cap supports beat the S&P 500 over the course of the past ten years.

Dow Jones Industrial Average

The Dow Jones Modern Normal estimates the presentation of 30 enormous U.S. organizations, which are all commonly remembered for the S&P 500. Choice is restricted to organizations that meet three standards: amazing standing, supported income development, and broad premium among financial backers. Hence, the Dow Jones is normally viewed as a benchmark for blue chip stocks.

The five biggest parts of the Dow Jones are itemized beneath:

Apple: 12.3%

Microsoft: 11.5%

Alphabet: 6.7%

Amazon: 6.5%

Nvidia: 5.1%

The Dow Jones returned 131% throughout the last ten years, compounding at 8.7% yearly. Financial backers can get immediate openness to the list with the SPDR Dow Jones Modern Normal ETF (NYSEMKT: DIA). While the record has failed to meet expectations the S&P 500 over the course of the last ten years, it has additionally been less unpredictable than the S&P 500 because of its blue chip arrangement.

Nasdaq Composite

The Nasdaq Composite estimates the presentation of in excess of 3,000 organizations, all of which exchange on the Nasdaq Stock Trade. By far most of its constituents are U.S. organizations, however the record gives a limited quantity of global openness. The Nasdaq is vigorously weighted toward the high-development innovation and customer optional areas, and it's normally viewed as a benchmark for development stocks.

The five biggest parts of the Nasdaq are itemized beneath:

Apple: 12.3%

Microsoft: 11.5%

Letter set: 6.7%

Amazon: 6.5%

Nvidia: 5.1%

The Nasdaq returned 264% throughout the past ten years, compounding at 13.8% yearly. Financial backers can get immediate openness to the file with the Devotion Nasdaq Composite ETF (NASDAQ: ONEQ). As a proviso, while the file beat the S&P 500 throughout the past 10 years, it has likewise been more unpredictable than the S&P 500 because of its profoundly thought organization.

Financial backers can gain proficiency with a significant illustration by examining verifiable stock market returns. Every one of the three significant monetary records have experienced numerous redresses and two bear markets during the previous ten years, yet the S&P 500 and the Dow Jones has dramatically increased in esteem, and the Nasdaq has dramatically multiplied.

To make correlations simpler, I've nitty gritty the profits across each of the three files in the outline beneath.

|

STOCK MARKET INDEX |

10-YEAR RETURN |

ANNUALIZED RETURN |

|---|---|---|

|

S&P 500 |

163% |

10.2% |

|

Dow Jones Industrial Average |

131% |

8.7% |

|

Nasdaq Composite |

264% |

13.8% |

Here is the primary concern: The three significant U.S. stock market records were productive ventures over the course of the past 10 years, and financial backers have not a great explanation to anticipate an alternate result over the course of the following ten years. That implies any of the record supports talked about above are probably going to be moneymaking ventures throughout the following 10 years (and then some).

Should you invest $1,000 in S&P 500 Index right now?

Before you purchase stock in S&P 500 File, think about this:

The Diverse Numb-skull Stock Counselor examiner group just recognized what they accept are the 10 best stocks for financial backers to purchase now... also, S&P 500 List wasn't one of them. The 10 stocks that got it done could create beast returns before very long.

Stock Counselor furnishes financial backers with a simple to-follow plan for progress, remembering direction for building a portfolio, customary updates from examiners, and two new stock picks every month. The Stock Guide administration has dramatically multiplied the arrival of S&P 500 since 2002