Convolutional Neural Network Stock Market And Stock Analysis 2024

A specific kind of deep learning model called a Convolutional Convolutional Neural Network Stock Market (CNN) is used in the stock market to evaluate technical indicators, historical price data, and other pertinent financial variables in order to assess and forecast changes in stock prices. CNNs use convolutional layers, in contrast to conventional neural networks, to automatically extract characteristics from input data, such as time-series charts or pictures that show the performance of stocks over time. CNNs may assist traders and investors make well-informed judgments by identifying patterns in this data, predicting future stock values, and identifying trends. CNNs are used in finance because of their capacity to identify spatial hierarchies in data, which makes them especially useful for applications like multi-dimensional time series forecasting and image-based stock chart analysis. **Short Response:** By identifying patterns and trends via its convolutional layers, a Convolutional Neural Network (CNN) for the stock market is a deep learning model that evaluates past price data and financial variables to forecast changes in stock prices.

Convolutional Neural Network Stock Market Applications

Because of its capacity to recognize spatial Convolutional Neural Network Stock Market, Convolutional Neural Networks (CNNs) have become an extremely effective tool for stock market analysis. CNNs may be used to evaluate time-series data and extract characteristics from price charts in stock market applications, allowing for the forecasting of future trends or stock prices. CNNs are able to spot patterns that conventional analytical techniques may miss by considering past price movements like pictures. To improve prediction accuracy, they may also be combined with data from other sources, such social media trends or sentiment analysis of news. All things considered, the use of CNNs in the stock market marks a substantial development in financial forecasting methods. **Short Response:** By spotting intricate patterns and combining many data sources, CNNs are used in stock market applications to evaluate price charts and time-series data, improving forecasts of stock prices and trends.

Read Also: Why investors should buy into an 'egregiously expensive' stock market, Bank of America says

Convolutional Neural Network Stock Market Benefits

The capacity of Convolutional Neural Networks (CNNs) to process and evaluate intricate data patterns is the main reason why they provide a number of advantages in stock market research. More precise forecasts of future stock prices are made possible by CNNs' ability to efficiently capture spatial hierarchies in time-series data, such as price changes and trade volumes, by using their design. Furthermore, CNNs may include a variety of input data sources, such as technical indicators and historical price charts, allowing for a thorough study that conventional approaches could miss. They are useful tools for traders and investors looking to maximize their strategies in the ever-changing stock market environment because of their resilience to noise and capacity to generalize from training data. **Short Response:** By precisely identifying intricate patterns in time-series data, combining a variety of inputs, and producing reliable forecasts, CNNs improve stock market research and eventually help traders maximize their investing strategies.

Convolutional Neural Network Stock Market Difficulties

Because of its capacity to recognize spatial hierarchies in data, Convolutional Neural Networks (CNNs) have become more popular in the prediction of the stock market. Nevertheless, a number of obstacles limit their efficacy in this area. First of all, it might be challenging for CNNs to identify significant patterns in financial data as it is often noisy and non-stationary. CNNs are not naturally suited for handling time-series data, which is another need due to the temporal structure of stock values. Because CNNs can readily recall training data, overfitting is a serious risk that may result in poor generalization on unknown data. Lastly, the interpretability of CNNs presents a problem since traders and investors need to comprehend how predictions are made. **Short Response:** Dealing with noisy and non-stationary data, the need for efficient time-series handling, the dangers of overfitting, and problems with model interpretability are some of the difficulties associated with using convolutional neural networks to stock market prediction.

How Can I Create My Own Stock Market Using Convolutional Neural Networks?

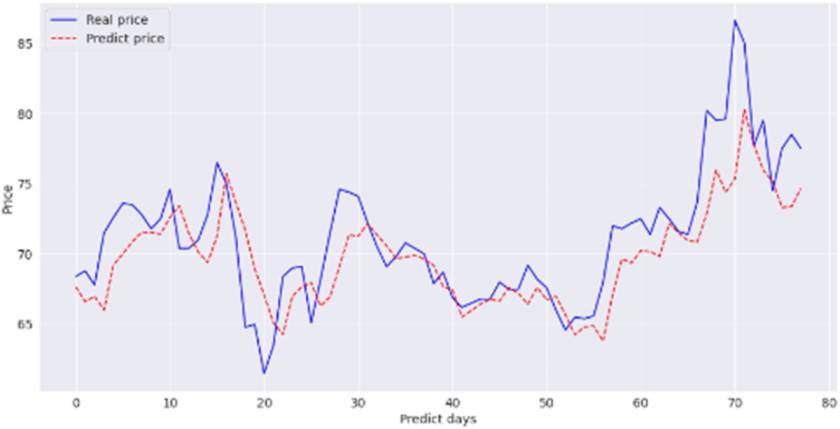

There are numerous crucial elements involved in creating your own Convolutional Neural Network (CNN) for stock market prediction. First, collect past stock price information together with pertinent characteristics including technical indicators, moving averages, and trading volume. Preprocess the data by normalizing it and converting it into an appropriate format, often by reshaping time-series data into sequences or pictures that CNNs can understand. Next, create your CNN's architecture, which usually consists of fully connected layers for final predictions, pooling layers for dimensionality reduction, and convolutional layers for feature extraction. Use a labeled dataset to train the model, with future stock prices or trends serving as the goal variable. Lastly, adjust hyperparameters to enhance outcomes and assess the model's performance using measures like accuracy or mean squared error. To make sure your model is reliable in practical applications.

Must Read: Top 9 Best Long Term Growth Stocks To Invest In

FAQs

How accurate is LSTM stock prediction?

Data scientists have predicted the stock market with 95.8% accuracy by utilizing deep learning models like LSTM.

Which neural network is best for stock prediction?

Highlights. Artificial Convolutional Neural Network Stock Market (ANNs) are the most effective technique for forecasting the direction of stock indexes. In the NYSE 100, FTSE 100, DAX 30, and FTSE MIB, ANNs perform very well; in the NIKKEI 225, CAC 40, and TSX, Logistic Regression (LR) performs better.

Can neural networks be used for stock market?

In addition to saving investors time during the decision-making process, neural network-based stock price forecasting models in the form of unsupervised algorithms may also assist lower investment risk and losses brought on by market swings.

Can CNN be used for stock prediction?

Using a convolutional neural network (CNN) model trained using visual representations of stock price data and technical indicators, we forecast future stock prices with an emphasis on image-type big data. We discover that accuracy is somewhat increased by the use of technical indicators.