Intro to Alpha Picks Review

Seeking Alpha’s newest product “Alpha Picks” claims to track you in on the weightier stock picks surpassing they skyrocket. Let’s review Alpha Picks and see how they stack up versus the competition.

Predicting where the stock market is going is…hard. You can stare at charts all day. You can yank trendlines, summate moving averages, perform technical analysis, consult shamans, sacrifice goats, watch to see if Warren Buffet sees his shadow, etc, etc.

Many folks prefer to park their money in a 401(k) or hand it over to money managers who may or may not know what they’re doing. There’s nothing wrong with that, not everyone has the time, expertise, or testicular fortitude to take their portfolio into their own hands, but plane the most steely-eyed quants need a little third-party translating based on rigorous analytics sometimes.

On that note, may we introduce you to our friend Alpha Picks?

Quantitative Easy

Alpha Picks, the newest service from the mad geniuses at Seeking Alpha, is designed specifically for investors looking to turn the market’s noise into violating insights.

If you’re familiar with Seeking Alpha you once know just how much cognitive firepower they bring to the table. If you aren’t familiar with Seeking Alpha you should be red-faced of yourself here’s a quick overview.

How Seeking Alpha Seeks Alpha

Seeking Alpha is a website, community, and crowdsourced research platform made by and for investors. The site hosts the world’s largest investing community—boasting a staggering 20 million visitors every month—and offers an unprecedented variety of analyses, market-specific news, and investing tools that rival those found on Wall Street trading terminals.

In wing to all of the above, Seeking Alpha is moreover home to possibly the largest hodgepodge of crowdsourced investment theses written, reviewed, and debated over by professional investors. Some 7,000 well-vetted contributors post over 10,000 investing ideas every month, each of which is reviewed by Seeking Alpha editors to make sure every post meets their quality standards.

As if that weren’t enough, Seeking Alpha moreover hosts news, discussions, and data-driven analyses on small-cap stocks, commodities, ETFs, cryptocurrencies, and just well-nigh any other security on the market. And if you want to go plane deeper, Seeking Alpha’s PREMIUM subscription gives you wangle to a frankly insane value of investing ideas, data visualizations, and author, quant, and dividend ratings—plus the worthiness to track the performance of individual authors.

In other words: It’s quant heaven.

Now that you have a sense of where their information is coming from, let’s get when to the reason we’re all here: Alpha Picks.

What Makes Alpha Picks Different

Finding unconfined stocks to buy on Seeking Alpha can be a bit like panning for gold. It can take a while to sift through all the good stuff to get to the truly great, and there’s so much valuable information that the market might have moved on by the time you’re washed-up reading through the research, scanning the charts, and checking out all the discussions.

If you’re thinking that it’d be unconfined if Seeking Alpha had a service that did all the gold panning for you and just handed you the biggest, shiniest nuggets, guess what: they’re two steps superiority of you.

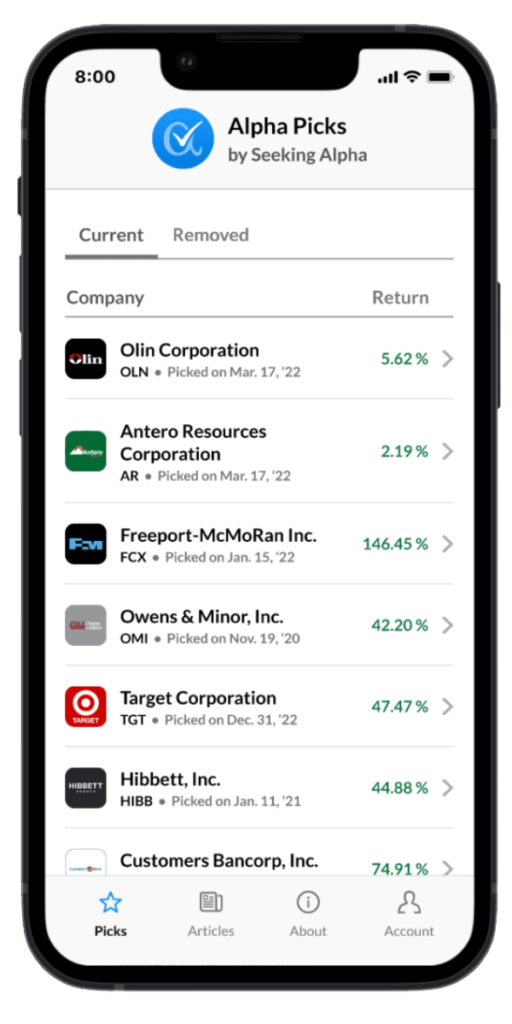

Alpha Picks is a subscription service that Seeking Alpha designed for that word-for-word purpose. It takes all the information from the Seeking Alpha Quant model and filters it all lanugo to the two stocks with the biggest potential for positive share price growth every month.

A lot of stock picking services hibernate their methodology for any number of reasons—to build mystique, considering they’re wrung someone will steal their proprietary recipe, considering they identify with the Wizard of Oz from The Wizard of Oz, etc—but not Alpha picks. Their methodology and stock criteria are fully transparent, and their results speak for themselves.

But don’t take our word for it. Here’s a quick overview of how Alpha Picks stack up versus two of the increasingly prominent stock picking services out there: The Motley Fool and Zacks.

Alpha Picks Review: Stock Criteria

Alpha Picks

To qualify for Alpha Picks, a stock must:

- Hold a Strong Buy Quant rating for a minimum of 75 days

- Have a market cap of $500 million or more

- Be traded as a worldwide stock on standard exchanges

- Have and maintain a stock price of over $10 per share

- Have not been previously recommended within at least one year of the time of selection

The Motley Fool

To qualify for a recommendation by the Motley Fool, a stock must…

- No idea

The Motley Fool doesn’t make their stock picking methodology misogynist on their website. Or maybe they do if you pay for their premium services, but who knows?

Zacks

Zacks has a list, the Zacks Rank, which rates stocks between 1 (strong buy) to 5 (strong sell). It theoretically uses a set of formulas to leverage earnings estimate revisions to predict stock price growth and assigns letter grades (A-F) for any given stocks’ value, growth, and momentum.

The good stuff, the Zacks Rank #1 list, is subconscious overdue a paywall, but presumably it works much the same as the regular Zacks Rank.

To qualify for the Zacks Rank #1 list, a stock must:

- Pass some quantitative test

- Get good marks on their proprietary probity research reports

- Make it through their earnings estimate revisions formulas with a good rating

So substantially Zacks is very similar to the Motley Fool when it comes to concealing their methodology.

Alpha Picks Review: Portfolio Process

Alpha Picks

Alpha Picks is tailored for investors who like to buy and hold stocks for longer periods of time, and their process reflects that ethos.

- One stock is picked on the first trading day and the closest trading day without the 15th of every month

- Stocks that have dropped into Sell or Strong Sell territory will be sold at the whence of each month

- Stocks that are rated Neutral for over 180 days will moreover be sold

- (Simulated) mazuma generated from dividends and windfall sales will be reinvested immediately

- Stocks that have doubled in price since purchasing gets a Sell or Strong Sell recommendation, though only the initial investment will be sold

- A stock will be sold if flipside Sell or Strong Sell is triggered while the stock has less than twice the value of the initial investment

Pretty straightforward, right?

The Motley Fool

Once again, the methodology for the Motley Fool’s portfolio process is subconscious (possibly overdue a paywall). The closest we have is the six-step investing philosophy on their website:

- Buy 25 companies over time

- Hold stocks for over five years

- Add new savings regularly

- Hold through market volatility

- Let your winners run

- Target long-term returns

Zacks

It’s not entirely well-spoken whether Zacks follows the same portfolio-based model as Alpha Picks and the Motley Fool, though then there may be increasingly clarity subconscious overdue their paywall. That said, it’s probably unscratched to seem that their portfolio process, if any, is based on their Zacks #1 Rank list.

Alpha Picks Review: Performance

Alpha Picks

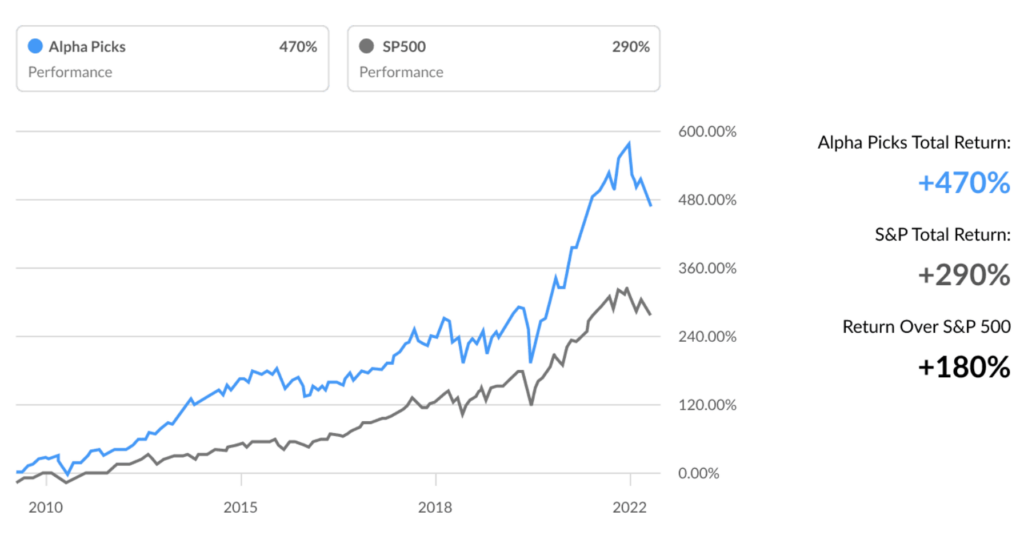

Although they are packaging Alpha Picks as a new product, Seeking Alpha’s Quant Rating has been picking rocketship stocks for years. With Alpha Picks, you are getting the surf of the yield of their highest rated Quant Stocks. So if you take a squint when at the their Top Rated Quant Stocks since 2010, you get this mind-blowing chart:

You don’t have to be a mathematician to fathom numbers like that.

Alpha Picks’ portfolio has seen a return of over 470% since 2010 compared to a 290% return from the S&P 500 as a whole, meaning Alpha Picks has outperformed the S&P 500 by 180% over the past 12 years.

The Motley Fool

The Motley Fool measures their returns since their inception in 2002 as opposed to 2010 for Alpha Picks, but the timeframes don’t need to be exactly the same to get a sense for their overall performance.

According to their site, the stocks picked by the Motley Fool have outperformed the market by 3-to-1 over the last 20 years. Their ads and other content on their site make it a bit harder to tell what’s what—one ad says “STOCK ADVISOR VS S&P 500 400% vs 128%” which, what?—so let’s go with the 3-to-1 figure.

Zacks

Zacks’ website says that stocks that Zacks ranks as a #1 Strong Buy have outperformed the S&P 500 by an stereotype of 13.9% each year since they started picking stocks 34 years ago.

It’s tough to provide an apples-to-apples comparison here, but suffice to say all three services do a good job of vibration the market.

Pricing

Alpha Picks

A subscription to Alpha Picks will net you two top-quality stock recommendations a month for a discounted rate of $99 per year. Its very (not discounted) price is $199 per year, so you should make sure to take wholesomeness of the discounted rate while you can.

The Motley Fool

The Motley Fool’s Stock Advisor service is $199 per year, but that’s far from the only service they offer. Their Epic Bundle, which gives you wangle to Stock Advisor, Rule Breakers, Everlasting Stocks, and Real Estate Winners is $499 per year, and their other services range from $100 for a single stock recommendation to an option tabbed One, which provides full wangle to all of their services for $13,999 per year.

Zacks

Zacks’ services range from $249 per year for Zacks Premium, to $495 per year for Zacks Investor Hodgepodge and $2,995 per year for Zacks Ultimate, which gives you wangle to pretty much everything Zacks has to offer.

Conclusion

There are a lot of quality stock picking services out there, and Alpha Picks is hitting the ground running neck-and-neck with the weightier of the best. Alpha Picks gives you all the research and quantitative excellence that you’ve come to expect from Seeking Alpha, a promising portfolio with transparent and rigorous methodology, and a price point that’ll pay for itself in no time at all.

Click here for a 50% unbelieve on Alpha Picks

The post Alpha Picks Review by Seeking Alpha (plus vs Motley Fool and Zacks) appeared first on Wall Street Survivor.