Stocks With Golden Star Technical Signs

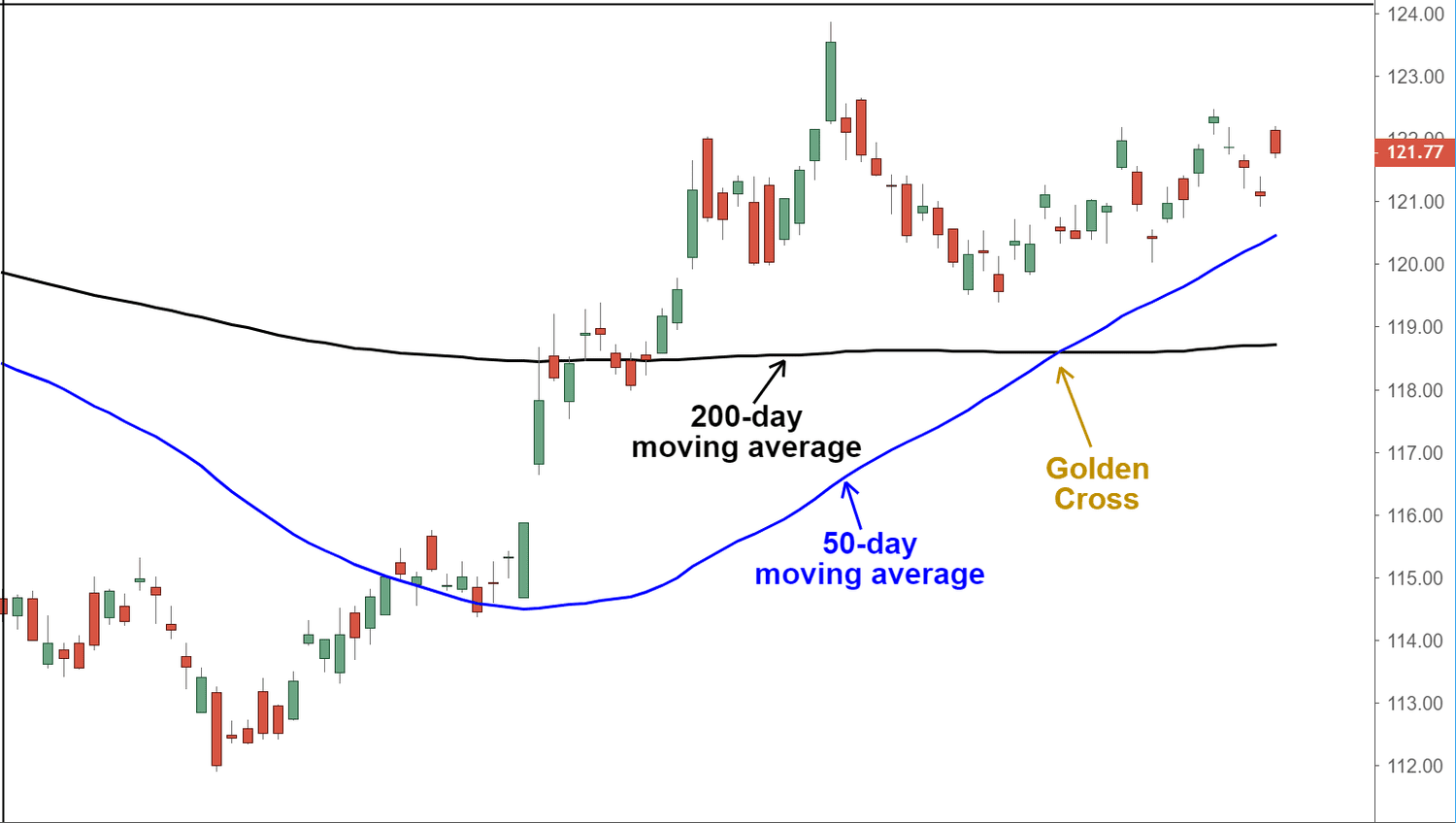

Whenever the 50-day moving mean crosses over the 200-day Moving Average on a stock chart, it is known as the Golden Cross. In the hope that a notable upswing would continue, some investors could interpret this as a buy signal. By using the 50-day / 200-day rule found in the Momentum area of the Rule Picker, you can use the Stockopedia screener to find stocks with golden star technical signs.

What is a Death Cross?

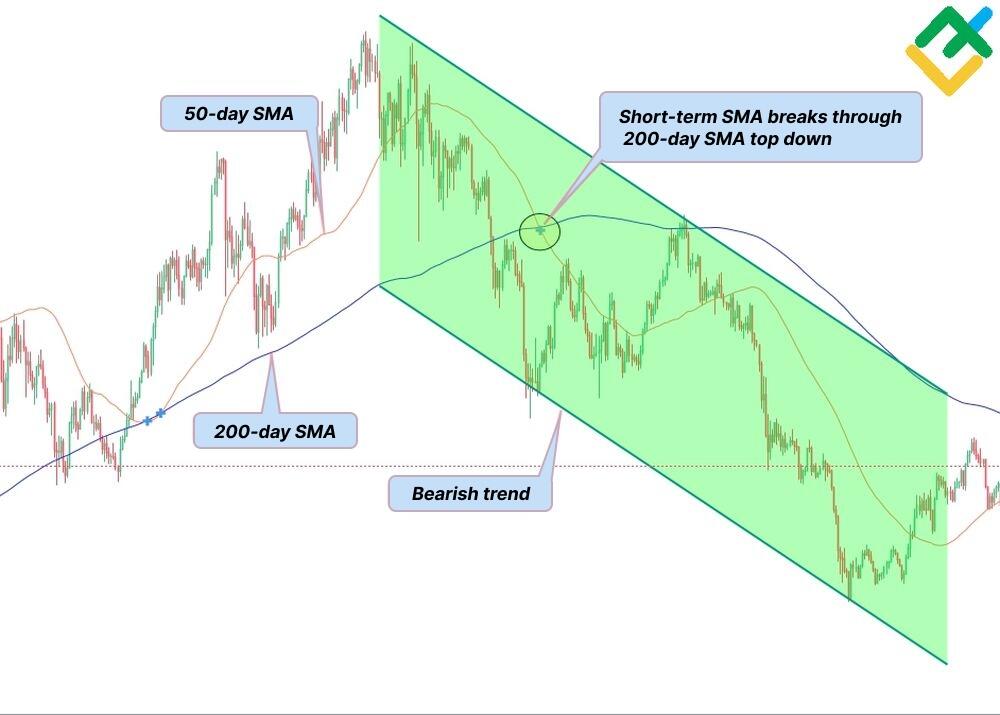

A chart pattern known as the death cross signifies the change from a bull market to a bear market. When a security's short-term moving average (such as the 50-day) crosses above or below a long-term moving average (such as the 200-day), this technical indicator is activated.

Read Also: Inflation trap? Stock market’s near-record run faces the most crucial CPI reading of 2024.

A death cross in the NASDAQ 100 Index during the 2000 Dotcom crisis is seen in the chart below.

Associated with the Golden Cross

The death cross is a chart pattern that is the complete opposite of the stocks with golden star technical signs.

When a stock's 50-day moving average surpasses its 200-day moving average, it is known as the "golden cross." The golden cross is a powerful bullish market indicator that signals the beginning of a long-term rise, in stark contrast to the cross of death.

How to Assess a Death Cross Signal's Strength?

When additional technical indicators validate the death cross pattern's signal, traders and market analysts can use it more effectively. Trading volume is one of the most often used technical indicators to validate a long-term trend shift. If the bearish cross pattern is accompanied by strong trade volumes, it is seen as a more trustworthy indicator. Increased trade volume suggests that more investors are purchasing—or rather, disposing of—the notion of a significant shift in the trend.

For confirmation, momentum indicators like the MACD might also be employed. They are effective because long-term trends sometimes lose some of their impetus shortly before the market turns.

An Indicator That Is Lagging

Because the death cross pattern is sometimes a highly lagging indication, several traders and market experts place only a limited degree of trust in it. When the trend turns from bullish to bearish, the downside moving average crossing could not happen until much later. Prior to the crossing death signal, the price of a security may have already dropped significantly.

A modified modification of the pattern is used by some analysts to get over this potential drawback of trailing behind price activity. In this variant, when the price of the security drops below the 200-day moving average instead of a short-term moving average, a death cross is considered to have taken place. Usually, this occurrence takes place far before the crossover of the 50-day moving average.

You May Also Like: Top 9 Best Long Term Growth Stocks To Invest In

Additional Variations

The most popular moving averages for spotting a death cross are the 50-day and 200-day ones. Other moving averages, however, are preferred by certain market observers. A 20-day moving average downward cross of the 50-day moving average is a typical death signal variant. Another variant uses the 100-day moving average as the long-term average instead of stocks with golden star technical signs.

When there is a very large gap between the 50- and 200-day moving averages, the aforementioned modifications could be more beneficial. (since the crossover may lag behind price activity the farthest the two averages are from one another.) Additionally, traders use hourly or four-hour charts instead of daily charts to search for the pattern in shorter time periods.

A Concluding Remark on the Death Cross

Every technical indicator has its detractors, but many investors view the death cross as a noteworthy chart pattern. Numerous significant bear market downturns were precisely predicted by the death cross pattern, according to analysis of leading market indices. The 1929 crash was heralded by a death cross pattern in the Dow Jones Industrial Average. Four months before to the 2008 catastrophe, in May 2008, the S&P 500 Index saw a stocks with golden star technical signs.