Artificial intelligence technology leader Nvidia (NVDA) late Wednesday beat Money Road's objectives for its financial first quarter and directed higher than sees for the ongoing time frame. It likewise reported a 10-for-1 stock split. Nvidia stock rose in expanded exchanging.

The St Nick Clara, Calif.- based chipmaker procured a changed $6.12 an offer on deals of $26 billion in the quarter finished April 28. Examiners surveyed by FactSet had expected income of $5.60 an offer on deals of $24.59 billion. On a year-over-year premise, Nvidia income soared 461% while deals impacted 262% higher.

Nvidia's monetary Q1 results denoted its fourth consecutive quarter of triple-digit rate development in deals and profit.

For the ongoing quarter, Nvidia hopes to produce deals of $28 billion, versus the agreement gauge of $26.62 billion. In the year-sooner quarter, Nvidia posted deals of $13.51 billion.

Nvidia Stock Jumps After Report

In late night exchanging on the financial exchange today, Nvidia stock hopped 5.9% to 1,005.89, which would be record high. During the normal meeting Wednesday, Nvidia stock plunged 0.5% to close at 949.50, in purchase range.

"The following modern transformation has started — organizations and nations are joining forces with Nvidia to move the trillion-dollar customary server farms to sped up figuring and fabricate another kind of server farm — man-made intelligence plants — to deliver another ware: computerized reasoning," CEO Jensen Huang said in a news discharge.

He added, "Computer based intelligence will bring huge efficiency gains to essentially every industry and assist organizations with being more expense and energy-proficient, while growing income potential open doors."

In the main quarter, Nvidia's server farm deals hopped 427% year more than year to $22.6 billion as endeavors gobbled up designs processors to run artificial intelligence applications. Server farm deals expanded 23% from the final quarter.

Stock Split, Increased Dividend

Nvidia said its 10-for-1 stock split will be effective on June 7.

The organization likewise raised its quarterly money profit by 150% to a penny an offer on a post-split premise. On a pre-parted premise, Nvidia's profit expanded from 4 pennies an offer to a dime.

On a telephone call with examiners, CFO Colette Kress said enormous distributed computing specialist co-ops drove Nvidia's server farm business last quarter. Those clients addressed mid-40% of the organization's server farm income, she said.

Past cloud specialist co-ops, different organizations purchasing Nvidia gear for generative simulated intelligence incorporate customer web organizations, sovereign countries, auto and medical care firms.

Interest for Nvidia's illustrations handling units, or GPUs, is probably going to surpass supply well into the following year, Kress said.

Nvidia Stock: 'Next Wave Of Growth' Ahead

:max_bytes(150000):strip_icc()/GettyImages-2154045576-171bf27b649e4e69a9e4e29eced8e6d0.jpg)

Solid interest for Nvidia's Container series processors for generative simulated intelligence preparing and surmising powered the organization's server farm development in the primary quarter, Huang said.

"We are ready for our next flood of development," Huang said. "The Blackwell stage is in full creation and structures the establishment for trillion-boundary scale generative simulated intelligence. Range X opens a shiny new market for us to carry enormous scope simulated intelligence to Ethernet-just server farms. Furthermore, Nvidia NIM is our new programming offering that conveys venture grade, improved generative computer based intelligence to run on CUDA all over — from the cloud to on-prem server farms and RTX artificial intelligence laptops — through our broad organization of biological system accomplices."

Blackwell Revenue Accelerated

Nvidia climbed the timetable for acknowledging Blackwell series income. The organization anticipates creation shipments of Blackwell items in the ongoing quarter and sloping in the second from last quarter, Huang said. What's more, server farms utilizing Blackwell processors will be going in the final quarter, he said.

"We will see a ton of Blackwell income this year," Huang said on the phone call.

A few Financial backer Concerns

Financial backer worries heading into Nvidia's report incorporated the effect of U.S. exchange limitations with China and the organization's capacity to source an adequate number of parts from its agreement producers to fulfill need.

Experts likewise are stressed over a potential "air pocket" in deals of current Container series designs handling units when Blackwell series GPUs become accessible not long from now.

The significant cloud specialist organizations have been spending intensely on Nvidia GPUs to increase their ability for generative man-made brainpower applications.

Nvidia Development On A 'Extremely Quick Mood'

On the telephone call, an examiner asked how Nvidia is satisfying its developing excess of orders.

Huang focused on that the interest serious areas of strength for is what he depicted as a significant stage shift. "We're dashing each and every day. Clients are coming down on us to convey," he said.

Another expert asked what Nvidia is intending to propose after its ongoing Blackwell processors.

Huang said: "All things considered, I can declare that after Blackwell, there's another chip. What's more, we are on a one-year musicality. You can likewise depend on us having new systems administration innovation on an exceptionally quick cadence."

Nvidia Report Lifts Other computer based intelligence Plays

Nvidia profit and direction gave an unobtrusive lift to some other simulated intelligence plays. Artificial intelligence chipmakers Broadcom (AVGO), High level Miniature Gadgets (AMD), Taiwan Semiconductor Assembling (TSM) and Astera Labs (ALAB) rose 1% to 3% in late exchanging.

ServiceNow (Presently) rose marginally, while Dow goliath Microsoft (MSFT) edged higher.

Vertiv (VRT) and Powell Enterprises (POWL) additionally progressed.

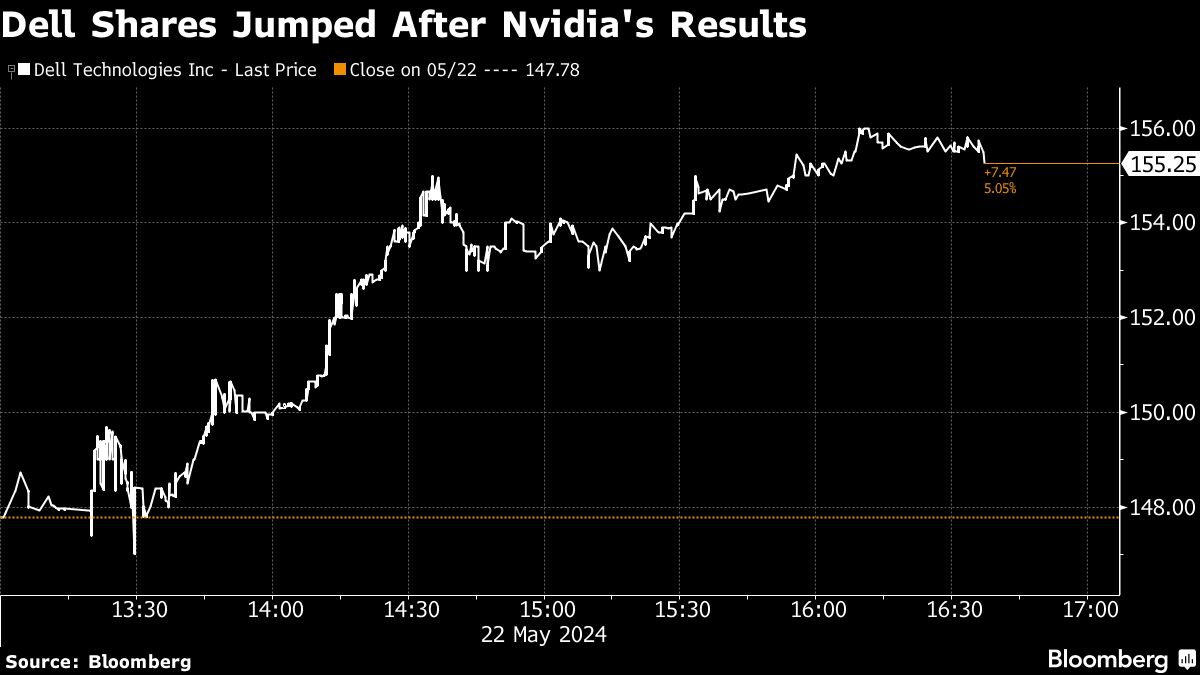

Very Miniature PC (SMCI) and Dell PC (DELL), which both use Nvidia contributes their simulated intelligence servers, rose 4.5% and 3.9%, individually.

'Get The Popcorn Out'

To say Nvidia's financial Q1 report is overall firmly watched would be putting it mildly.

"At the point when Nvidia holds its phone call), (you will actually want to barely hear anything at all on exchanging floors across Money Road when (President) Jensen (Huang) gets the mouthpiece," Wedbush Protections examiner Daniel Ives said Wednesday morning in a client note named "Get the Popcorn Out."

He added, "The artificial intelligence Unrest begins with Nvidia and in our view the artificial intelligence party is simply beginning with the popcorn preparing."

Wedbush rates Nvidia stock as outflank with a value focus of 1,000.

Nvidia Stock Weighs Heavily In Indexes

Nvidia's taking off stock cost has given it a critical load in key financial exchange records and trade exchanged reserves. As of Monday, Nvidia represented 5.3% of the S&P 500, 6.5% of the Nasdaq 100 and 20.6% of the VanEck Semiconductor ETF, Mizuho Protections said.

Last year, Nvidia stock soared 239% to 495.22. Year to date through Wednesday's nearby, Nvidia stock is up 92%.

The following expected impetus for Nvidia stock will be Huang's feature discourse June 2 at the Computex career expo. The CEOs of chipmakers AMD (AMD), Intel (INTC) and Qualcomm (QCOM) likewise are talking at the Taiwan show.