Admission Open: Value Investing Workshops – Offline (Bangalore & Chennai) and Online

1. Offline Workshop (Bangalore and Chennai): The Bangalore session is planned on Sunday, 12th March. Chennai is on Sunday, 19th March. I am unsuspicious only 50 students for each of these sessions, and first 25 can requirement an early bird discount. Click here to know increasingly and join the workshop.

2. Online Workshop – Admissions are moreover unshut for the March 2023 cohort of my online value investing workshop. The workshop involves 26 hours of pre-recorded, detailed lectures and Q&A sessions, plus a 3-hour live online Q&A session scheduled on Sunday, 5th March 2023. I am unsuspicious only 50 students in this cohort, and now less than 20 seats remain. Click here to know increasingly and join the workshop.

What do you undeniability an investor who earned 16% per annum on stereotype over a 47 year period – that’s a 1,070-bagger – and is not tabbed Warren Buffett?

What if I told you that this investor…

- Did not superintendency well-nigh corporate earnings

- Rarely spoke to managements and analysts

- Did not watch the stock market during the day

- Never owned a computer, and

- Did not plane go to college

…you would not say anything but just ask me to reveal his name fast, so as to re-confirm whether such a super-investor has overly existed in the investment circles.

Well, surpassing I tell you this man’s name, you must read what Buffett had to say well-nigh him…

…He doesn’t worry well-nigh whether it it’s January, he doesn’t worry well-nigh whether it’s Monday, he doesn’t worry well-nigh whether it’s an referendum year. He simply says, if a merchantry is worth a dollar and I can buy it for 40 cents, something good may happen to me. And he does it over and over and over again. He owns many increasingly stocks than I do — and is far less interested in the underlying nature of the business; I don’t seem to have very much influence on him. That’s one of his strengths; no one has much influence on him.

Now, if you haven’t once read unelevated to find out who I am talking about, let me now unroll the name of this man, whom Buffett termed a Super Investor in his famous essay, The Superinvestors of Graham-And-Doddsville.

The Name is Schloss…Walter Schloss

“Walter who?” you may wonder if you have not read much well-nigh the world’s best-ever investors.

Walter Schloss was an outlier among outliers, and yet you’ve probably never heard of him. Plane I didn’t hear well-nigh him until a few years back, while I was in the process of discovering well-nigh value investing.

Schloss graduated upper school in 1934 during the Unconfined Depression and got a job as a “runner” at a small brokerage firm. As a runner, his job was to run and unhook securities and paperwork by hand to various brokers on Wall Street.

The next year, in a stroke of luck, when he asked his senior for a largest profile at the brokerage, he was asked to read a typesetting tabbed Security Analysis by Ben Graham.

After Schloss read Security Analysis, he wanted more, so he convinced his employer to pay for him to shepherd Graham’s classes. Subsequently, he started working during the daytime while studying at Ben Graham’s classes at night.

Schloss became an thermogenic follower of Graham, and plane helped him write part of The Intelligent Investor. Anyways, this was when World War II tapped out and Schloss enlisted in the unwashed for four years.

He, however, stayed in contact with Graham, which paid off when he got an offer to work for Graham’s partnership upon returning from the war in 1946…under the man who had once rejected Warren Buffett for a job.

So, if you wish to wilt a successful value investor yourself (who doesn’t?), and wonder which MBA to do or which brokerage to start your career with, you can take a leaf from Schloss’ books.

As he showed, you don’t need a prestigious stratum or a unconfined pedigree to start your work towards rhadamanthine a sensible, successful value investor.

Of course, Schloss had his stars extremely well-aligned in terms of getting to work slantingly Graham and Buffett, but then remember that he started as just a ‘paperboy’ without a higher degree, surpassing working his way through investing stardom.

As a matter of fact, Schloss left Graham-Newman in 1955 and, with US$ 100,000 from a few investors, began ownership stocks on his own.

But Where is Schloss Hiding?

You may wonder why there’s not much overly written well-nigh Schloss, despite the fact that his investment track record scrutinizingly compares to Buffett’s and Graham’s?

Perhaps the reason is that Schloss’ investment philosophy was so simple that there isn’t much to say well-nigh it.

Schloss, as his friends including Buffett reveal, hated stress and tried to stave it by keeping things simple.

“Investing should be fun and challenging, not stressful and worrying,” he once said.

His son Edwin, who worked for him for many years, said this in a memoir without Schloss died in 2012 at the age of 95…

A lot of money managers today worry well-nigh quarterly comparisons in earnings. They’re up wintry their fingernails until 5 in the morning. My dad never worried well-nigh quarterly comparisons. He slept well.

Investing Lessons from Schloss

Keeping things simple and keeping stress away while investing are two of the several big lessons that Schloss has to teach us investors.

When it comes to analyzing stocks/businesses, a lot of people get stressed trying to perfect their analyses, and thus work extremely nonflexible to seek a lot of information, most of which is useless.

But as Schloss’ life and wits teaches, unless complexity can modernize the subtitle of something, it is largest to proceed toward simpler theories.

While fund managers and other stock experts were breaking their heads with ramified financial models and theories, Schloss stuck with the simple using of value investing that had been virtually for decades…at least since the time Graham was teaching. He multiplied his original wanted 1,070 times over 47 years while handsomely vibration the S&P 500 by simply comparing price to value.

Warren Buffett wrote this in his 2006 letter to shareholders…

When Walter and Edwin (his son) were asked in 1989 by Outstanding Investors Digest, “How would you summarize your approach?” Edwin replied, “We try to buy stocks cheap.”

So much for Modern Portfolio Theory, technical analysis, macroeconomic thoughts and ramified algorithms.

Another big lesson Schloss taught was the importance of paying right prices for stocks. He perfectly mastered Graham’s teaching that you must buy stocks like you buy groceries (you want them cheap), not the way you buy perfumes (expensive is better).

He moreover laid importance on ownership good businesses when their stock prices fell from where he bought them the first time.

As he said in one of the very few conference speeches he gave…

…you have to have a stomach and be willing to take an unrealized loss. Don’t sell it but be willing to buy increasingly when it goes down, which is contrary, really, to what people do in this business.

Schloss moreover stressed well-nigh the importance of self-sustaining thinking. When asked at the same priming that given the market sometimes knows increasingly than the investors, how can one justify whether ownership a falling stock would be a right visualization or not, Schloss replied…

You have to use your judgment and have the guts to follow it through and the fact that the market doesn’t like it doesn’t midpoint you are wrong. But, again, everybody has to make their own judgments on this. And that’s what makes the stock market very interesting considering they don’t tell you what’s going to happen later.

Staying true to your own self and knowing our strengths and weaknesses was moreover what Schloss was unconfined at.

He told this to students at a lecture in Columbia Merchantry School in 1993…

Ben Graham didn’t visit managements considering he thought the figures told the story. Peter Lynch visited literally thousands of companies and did a superb job in his picking. I never felt that we could do this kind of work and would either have to quit without a few years or I’d be dead.

I didn’t like the alternatives and therefore, went with a increasingly passive tideway to investing which may not be as profitable but if practiced long unbearable would indulge the compounding to offset the fellow who was running virtually visiting managements.

I moreover liked the idea of owning a number of stocks. Warren Buffett is happy with owning a few stocks and he is right if he’s Warren but when you aren’t, you have to do it the way that’s well-appointed for you and I like to sleep nights.

Revisiting Schloss’ Legacy

Schloss stuck to a strict set of rules when he was making his investment decisions, and invested purely on wastefulness sheet wringer and valuation metrics that he knew and understood. Also, as I mentioned earlier, he never visited the visitor managements and if he couldn’t understand something, he would just stay away.

As a matter of fact, both these factors – not meeting managements and lamister things I don’t understand – have moreover worked very well for me in my personal topics as an investor.

Anyways, Schloss’ ripened his investment wisdom through his closeness to Graham and Buffett and decades of practicing what really worked in the stock market.

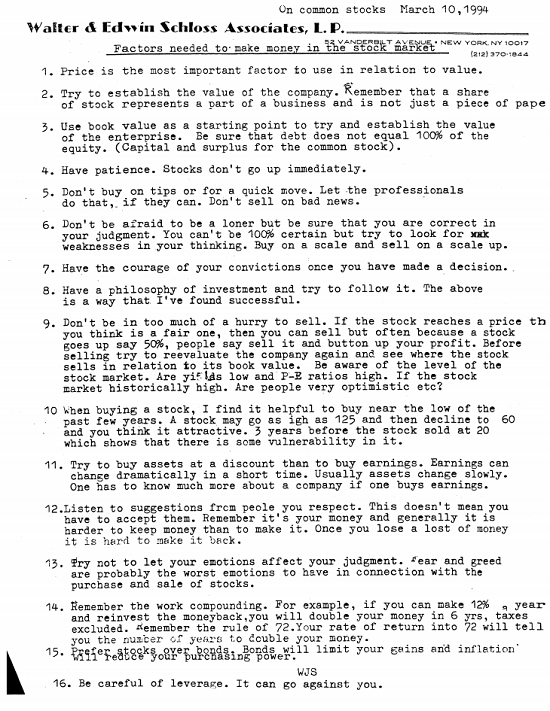

But as a readymade guide for us, he put together a list of 16 timeless principles for rhadamanthine a largest investor. These principles were published by Schloss on a one-page note in March 1994 titled – Factors needed to make money in the stock market.

Click here to download the original note, or click on the image below.

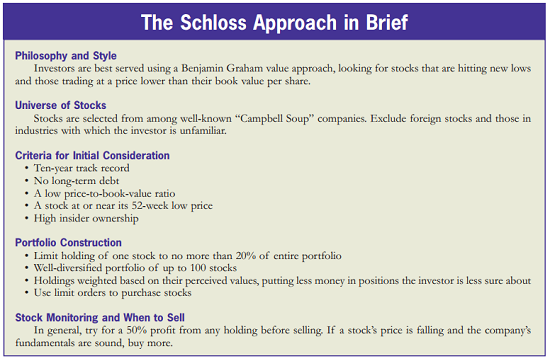

Here is a summary of Schloss’ investment tideway as he practiced over 47 long years…

Source: The American Association of Individual Investors; * ‘Campbell Soup Companies’ meant those with a long history and that Schloss considered stable and well known

Overall, Schloss screened for companies ideally trading at discounts to typesetting value, with no or low debt, and managements that owned unbearable visitor stock to make them want to do the right thing by shareholders.

If he liked what he saw, he bought a little and tabbed the visitor for financial statements. He read these documents, paying special sustentation to footnotes.

One question he tried to wordplay from the numbers was: Was the management honest (meaning not overly greedy)?

All this paid Schloss and his investors very well, expressly considering he stayed true to this philosophy for a long-long time.

Before I close, here is Buffett then on what Schloss was all about, as he wrote in his 1986 letter…

Tens of thousands of students (who were taught Efficient Market Theory) were therefore sent out into life yoyo that on every day the price of every stock was “right” (or, increasingly accurately, not demonstrably wrong) and that attempts to evaluate businesses – that is, stocks – were useless. Walter meanwhile went on overperforming, his job made easier by the misguided instructions that had been given to those young minds. Without all, if you are in the shipping business, it’s helpful to have all of your potential competitors be taught that the earth is flat.

Maybe it was a good thing for his investors that Walter didn’t go to college.

While it might be difficult to practice Schloss’ tideway (especially of ownership things very cheap) in the current times of most quality businesses lacking margin of safety, there still are many lessons that we can learn from this master of deep value tideway to investing.

Schloss was truly a Super Investor, who deserved a greater limelight than he received.

But then, thanks to stuff in the shadows, he was and still must be sleeping peacefully.

More on Walter Schloss:

- Sixty Five Years on Wall Street

- Walter Schloss’ Lecture at Columbia Merchantry School

- The Superinvestors of Graham-And-Doddsville

The post 16 Investing Lessons from a Superinvestor the World Forgot appeared first on Safal Niveshak.