Editors' Note: This is the transcript of the podcast we posted last week. Please note that due to time and audio constraints, transcription may not be perfect. We encourage you to listen to the podcast, embedded below, if you need any clarification. We hope you enjoy.

Sign up for Let's Talk ETFs on your favorite podcast platform:

Jonathan Liss: Welcome to Let's Talk ETFs. I'm your host Jonathan Liss, and I've been closely tracking the ETF space for more than 13 years through a variety of roles here at seekingalpha.com. Each week, a different guest and I will take an in-depth look at a particular aspect of the rapidly evolving exchange traded fund space with a focus on how investors can best utilize ETFs to reach their investing goals.

Before we begin, a brief disclaimer, this podcast is for entertainment and educational purposes only. Nothing said here should be taken as investment advice. All opinions expressed on this show are those of the individuals expressing them alone. A full set of disclosures will be included at the end of this show. You can subscribe to Let's Talk ETFs on Apple podcasts, Google podcasts, Spotify, or whichever podcast platform you prefer.

For reference purposes, this podcast is being recorded on the morning of Wednesday, September 30, 2020. My guests today are Stacey Morris, Director of Research at Alerian; and Paul Baiocchi, Senior Investment Strategy Advisor at SS&C ALPS. Stacey is the Director of Research at Alerian where her role is to help investors make and form decisions about energy infrastructure and master limited partnerships, MLPs.

She was previously the investor relations manager for Alon USA Energy overseeing investor communications for the corporation and its variable distribution MPL Alon USA Partners. Prior to Alon, Stacey covered the integrated majors and refiners at Raymond James as a Senior Associate and the firm’s equity research division. She graduated summa cum laude with a Bachelor of Science in Business Administration from Stetson University, and is a CFA Charterholder.

Paul is a Senior Investment Strategy Advisor at SS&C ALPS spearheading the firm’s distribution strategy and execution for the Alerian MLP and Energy Infrastructure ETF suite, working closely with the distribution teams to tailor the firms messaging around AMLP and ENFR to meet the needs of varied institutional clients. Previously, Paul was Vice President of ETF Business Development at Fidelity Institutional Asset Management where he helped build and grow the firms ETF line item.

Before that he worked at ETF.com building an ETF analytics platform writing about the ETF industry and moderating panels at inside ETFs conferences. He holds a Bachelors Degree in Business Administration from California State University in Chico, and MBA from the University of British Columbia’s Sauder School of Business and is also a CFA Charterholder.

Anyway welcome to the show Stacey and Paul. It’s great to have you here.

Stacey Morris: Thanks Jonathan. Great to be here.

Paul Baiocchi: Yeah, absolutely.

JL: It’s great to have both here to do our first show on MLPs for 60 something episodes in here. And this is a subject, I admittedly am far from an expert on. I don’t own any MLP related products. I guess, still relatively early on in my investing career, probably not going to retire for another 30 years or so. And so, current income is not really something I have personally focused on all that much. Before we get into the MLP space and MLP related ETFs though, I'd love to just ask you a question. I've been asking a lot of our guests. And that is how COVID has changed your work lives and how you've been managing to maintain a work life balance with all the craziness going on around us?

SM: Sure. So, maybe I'll start and Paul you can share your perspective. For me, I've been working from home since mid-March. And it just saves so much time not commuting to and from work, not spending as much time in the mornings getting ready to get out the door. And that's I think been helpful for me. But as a lot of people have probably told you, there's also you know, challenges around kind of drawing that line between work time and personal time. And there's an element of kind of always feeling like you're on call. And because people are kind of working around the clock and you have to be kind of accommodating that as well. But overall, from a work life balance perspective, I think it's just been helpful in terms of the amount of time saved, not commuting, and not making way into and out of the office every day, but certainly miss the personal interaction with my colleagues and my team. Overall, it's been a big time saver, I think.

JL: Yeah, totally. No, I have not been in my office since March either. And I mean, it's definitely important to draw those lines in terms of work life balance, but it's really difficult also because like you say, people are online at all kinds of godforsaken hours and somebody reaches out to you even if it's midnight, you kind of just feel like alright, I'll just jump on my email and respond and before you know you get sucked back in. So, yeah definitely looking forward to having that dividing line between the office and home space at some point in the future.

PB: Yeah, I sort of echo what Stacey said, I actually had been, at least for the prior, let's call it three plus years working from home working remotely and in my previous role, and so I had sort of settled into a groove in terms of a lot of the dynamics of working from home managing the, the sort of difference between what is work and what is normal life, if you will, and I joined ALPS at the beginning of the year, and was commuting into the office for the first time in quite some time. And so, when March rolled around, and they told us that we were going fully remote, I felt like I was somewhat well equipped to handle it, because I had some experience doing it and I had some of the sort of office equipment that you need, right. I had some additional screens that I could plug my laptop into, that made it easier to be a little more productive, and things of that nature. And so that certainly helped. I mean, Stacey and I are in similar situations in that.

We have young ones, younger young ones at home, and so that's sort of the blessing or the silver lining. And some of this is that, when I take a break to go get a new cup of coffee, or to get a glass of water or whatever, I can sort of see my daughter for a couple minutes. Whereas if I were commuting to the office every day, you know, I might get home after a long day after she's already asleep, which would, you know, be challenging in and of itself. And so there is a silver lining underneath all of this, but at the same time, to Stacey's point, there are things that you miss. I mean, there is something to being together in an office environment and collaborating in person that isn't necessarily as effective via Zoom or via video conferencing.

And then, you know, furthermore, in roles like ours, where we're supporting the wholesalers who are trying to get home office insertions in the model portfolios are trying to be supportive of some of the national accounts or even, you know, at the ground level, and some of these branch offices not being able to travel and do some of these in person meetings, I think is somewhat limiting, because there is still some value to that, even if we've learned through this period that a lot more can be achieved remotely than perhaps people thought before.

JL: Yeah, certainly. And, you know, I kind of hope we had some, some balance down the road where maybe people can still have an office they go into, but they're not necessarily obligated to be there five days a week, 50, 60 hours a week. So, they can kind of have their cake and eat it too, in terms of those advantages of working from home, but also all the things that we're missing right now with those in-person interactions. So, I'd love to jump right in here with you, Stacey, and start really at the very beginning, what makes a company Master Limited Partnership, and what are the benefits of this structure? Why would a company structure in this way?

SM: To qualify as a Master Limited Partnership, you have to earn 90% of your gross income from qualifying sources. And those are outlined as transportation, processing, storage, and production of natural resources and minerals. Historically, there used to be a wide variety of MLPs, even the Boston Celtics were an MLP, but the scope was really narrowed in the late 1980s. And from the Alerian perspective, we're really focused on midstream energy, infrastructure MLPs. And those are the MLPs that are owning an operating pipelines, natural gas processing facilities, and storage terminals.

In terms of the benefit of the structure, it's really the tax advantages. MLPs don't pay taxes at the entity level. They're structured as pass-throughs, and that's historically allow these companies to pay out attractive distributions, which is just the MLP word for dividends. For investors, which in MLPs are called unitholders distributions are typically 70% to 100%, a tax deferred return of capital. And that just means you don't pay taxes on that portion of the distribution until you sell your units. So, there's benefits at the company level in terms of avoiding the double taxation of most corporations, with the pass-through structure and then there's benefits for the individual investor in terms of the distributions that were received and the tax deferred nature of those distributions. So the attraction of the structure is that it's really the most tax efficient way to own assets that qualify.

JL: And in terms of that breakdown there between let's say natural gas development versus crude oil or other types of energy, what is the breakdown there in this space?

SM: So, it's roughly about half natural gas focused and half oil focused. At Alerian, we kind of break the space up into the primary business activities looking at pipeline transportation of natural gas, pipeline transportation of petroleums or crude and refined products like gasoline and diesel, and then gathering and processing, which refers to gathering pipelines that take hydrocarbons from wells to central hubs, and then processing just refers to the processing of natural gas and natural gas liquids.

So those are kind of the three main areas of where these companies are operating. There are some other smaller, midstream segments of the MLP space, but if you kind of look at that group, it's roughly half focused on the natural gas side of things. So, pipeline transportation of natural gas and gathering and processing, and then roughly half is focused on pipeline transportation of petroleum.

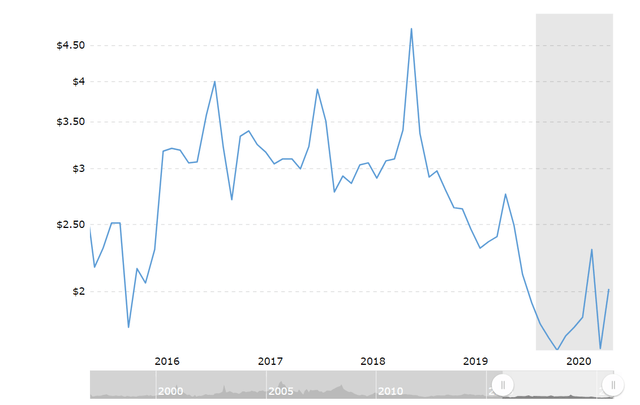

JL: Sure. And if you look at energy prices, particularly in 2020, but you could go back further on natural gas, they've really been in a long-term bear market at this point. That seems to affect the midstream players less than it does exploration and production side of the business. Why is that exactly that these MLPs seem to be more insulated from those day-to-day price movements of crude oil and natural gas?

SM: Sure. So, midstream companies are typically performing services for a fee. So, the price of the commodity isn't as impactful for these companies, because they're mostly just collecting a fee for, you know transporting each barrel of crude through a pipeline or processing each MMCF of natural gas. So, the fee-based nature of the business really helps insulate cash flows from the volatility that we've seen in both oil and natural gas prices over recent years and in 2020. Specifically, for the midstream space, because of the fee-based cash flows, the outlook for EBITDA generation for example, for next year has actually been really stable, compared to other sectors of energy that are more dependent on the commodity price.

So, midstream is a more defensive sector of the energy space, just given the fee-based nature of midstream cash flows. That said, this space is not totally immune from what happens with commodity prices. And it just seems like across energy that oil prices tend to dominate sentiment. So, this space is still, you know, sold off this year, amidst kind of the broader energy macro headwinds that we've seen, even though the fundamental outlook for these companies is very different from most other energy companies.

JL: And because they are fee-based service providers, I assume that were we to actually see large numbers of insolvencies in the energy space further downstream? I assume that would actually affect MLPs very directly at that point.

SM: Well, so that's one concern in this space is, you what is the counterparty risk like for these companies? And typically from the midstream MLPs that we look at, they tend to either have a diversified customer base, so that helps you mitigate some of that risk or they have a primary customer that's high credit quality. If you have, for example, you know, an EMP, that's a producer customer and they're going through financial hardship, well, chances are they are going to be one of your smaller customers. The other thing that we tend to see through bankruptcy processes is that the assets themselves continue to operate and continue to need midstream infrastructure.

So, typically the midstream provider is still needed to provide a service and still being paid for that service. And generally, we don't see a lot of bankruptcies in the midstream space, because of the fee-based nature of these contracts. EMPs have been, you know, the area where we've seen, you know, more bankruptcy announcements and more financial distress, but even there in the midstream names tend to be protected because of the diversified customer base and contract protections and the need to operate assets even through a bankruptcy proceeding. So, midstream is actually in a very good spot in terms of being protected from some of that counterparty risk.

JL: You mentioned that in terms of the outlook for next year that it's actually quite stable despite the price pressure and the macro headwinds against energy prices. And I'm just curious, particularly looking at the natural gas part of the MLP space, the midstream players there, but I guess that's really applies to the oil side of things also. If you look at the long-term price patterns, it's just been pushed further and further down the price of natural gas as more and more supply has been discovered and come online. And I'm just curious what your outlook is at this point and current price points and just basically where prices should level off? It seems like it'd be hard for them to get much lower than they are without essentially going practically to zero at this point.

SM: Well, so for natural gas, natural gas prices were struggling well before COVID-19 came along. And now if you look at natural gas price performance year to date, the prices are only down about 4% through September 28. So, relative to oil prices this year, your natural gas has held up all right, but that's starting from a very low base. So, I think your natural gas has actually benefited from some of the volatility in oil, because you've seen your production shift, and associated gas, which is natural gas produced from oil wells, is starting to decline.

So, the natural gas market has actually been you improving over the last several weeks. And that's kind of been a relative bright spot from an energy perspective. In terms of oil prices, we've seen a lot of volatility in September and weakness after a fairly stable kind of trading period between June and August. And I think where oil prices are today is just not going to be sustainable over the long-term. So, I think we are going to see improvements over time, but a lot just depends on what happens with demand and what happens with the COVID-19 vaccine, and the timetable for that.

So demand uncertainty continues to be the story from an oil perspective, and is something that continues to bear watching, but to bring it back to the midstream MLP space, if you look at 2021 estimates and where they were for EBITDA, prior to COVID-19 at the end of January, and then where they are more recently here in September, the midstream MLPs in our index the numbers have only come down about 13%. If you look at ENPs, those companies that are producing oil and gas 2021 EBITDA estimates have fallen by about 60% over that time frame.

So, even though we've seen a lot of commodity price volatility, and it could, you know, potentially continue the midstream space, stands apart from the rest of energy in terms of having more defensive cash flows, more resilient cash flows, and just benefiting from the contracts in fee-based nature of this business.

JL: Sure. And you've actually made the case in writing that you expect there to be meaningful increases in both free cash flow and distributions in 2021 correct?

SM: So, we've really talked about increasing free cash flow in 2021. And dividends, I think, can increase over time, but I think the macro environment will need to be more stable for companies to get more comfortable with buybacks and dividend increases. In the current environment, I think that excess cash flow is probably going to debt reduction and just shoring up the balance sheet, especially for those companies that may be running with a little bit higher leverage. To kind of frame the setup here, you have pretty stable cash flows from the midstream space as I talked about, and then you have a significant decline in growth capital spending into 2021.

We think capital spending for the midstream space probably peaked in 2018 or 2019. And if you just think about the fact that U.S. energy production has just been transformed over the last decade. These companies really facilitated that by building out the pipeline infrastructure, by building out the terminals export capacity, and just all the infrastructure needed to facilitate the tremendous growth that we've seen as the U.S. has become the world's largest producer of both oil and natural gas.

So, you have capital spending starting to moderate. And the combination of that and stable cash flows really creates the potential for significant free cash flow generation. And many of these midstream companies also stand to generate free cash flow even after dividends. So, we think there's a really compelling free cash flow story here, even though most people tend to be looking at the space for income and yield. The free cash flow element in the potential for buybacks and maybe even dividend increases as the macro environment stabilizes is certainly a positive story here as well.

JL: Yeah, definitely.

PB: I would just add a little bit from the perspective of investors and flows and how they impact the space. I think it's important context because ultimately, if you look at AMLPs portfolio of MLPs, these companies aren't eligible for inclusion in many of the major market indexes, S&P 500, Russell, etcetera. And so, in that way, investors don't have exposure to MLPs unless they go and seek it out at the individual company level or within a structure product or something like AMLP, closed end fund, mutual fund, whatever it might be, and so, ultimately, this space is perhaps most uniquely influenced by flows into and out of products tracking this category.

And so, Stacey laid out a tremendous case for the fundamentals of these companies, the relative earnings, resiliency, the fee-based nature of these cash flows, and the outlook for generating free cash flow, and in some cases after distribution, so, you combine that fundamental case with the valuation case, which relative to their historical enterprise value, the EBITDA and free cash flow yield over the course of the past three years are trading at a discount, as well as at a discount to the market and various market indexes. All of that's compelling, and it's a story we're telling to advisors and to investors, but the reality is, is that the incremental investor is also going to be supportive of performance here, not necessarily performance at the company level, but in terms of improving and expanding the footprint of investment in this category.

And you think about model portfolio providers in the income space, you think about advisors are who aggregate the business of a number of different advisors around the country, wirehouses, broker-dealers, independent broker-dealers, etcetera. They all have some version of income models, or they typically do and right now AMLP has a very compelling yield relative to its own history and relative to other income producing asset classes. And so we feel strongly that that the incremental investor, whether it be advisors or institutional investors will return to this space. But that is another sort of dynamic at work here in terms of the outlook for MLPs moving into 2021.

JL: Yeah, sure. And I'd love to touch on at least one element of MLPs and that is taxation, which may be scares, at least some investors away from the space and non-tax deferred accounts. Many MLPs individually, at least issue K-1s to shareholders. And yet, you managed to get around that and simply issue 1099s for funds like AMLP and ENFR, just curious how that works exactly, and how that may be a [swage as] some investors that are thinking about maybe buying individual MLPs, but they don't want to deal with K-1, so maybe there's a better route for them to go not talking to anybody specifically, just generally, of course?

PB: Sure. And I mean, the reality is, is that in any sort of compiling a portfolio of MLPs, you have some trade-offs to make regardless. So, if you want to own individual MLPs, you're going to get a K-1, that's not necessarily something that individual investors like or advisors like doing on behalf of their clients. And so, in order to have a portfolio exclusively invested in MLPs, under the various IRS guidelines around diversification requirements for mutual funds, open-end funds, there's a cap of 25% on MLPs in a mutual fund. So, you can invest in something like ENFR, which caps its exposure at 25% to MLPs, and fills out the balance with [C-Corp’s] or Canadian energy infrastructure companies, or the workaround that AMLP and the ALPS came up with in partnership with the Alerian or that other closed-end funds prior to that had come up with was to build a C-Corp around the ETF.

So, in this case, AMLP is a C-Corp, and that allows the funds to invest exclusively in MLPs, but also introduces some nuances in terms of tracking and in terms of the calculation of the portfolio's value on a given day, specifically deferred tax assets and deferred tax liabilities that have to be accounted for on a daily basis as it would with any C-Corp whether it's an ETF or a company selling iPhones, for example. So that's the trade-off the good news for investors is that you don't get a K-1 in a C-Corp ETF and you do, in many ways, still get the benefits of tax deferral that Stacey articulated earlier, whereby 80% plus historically of the distributions from AMLP have been considered tax deferred return to capital, which is applied against your cost basis and not tax in the year that it's distributed and so therefore, allows for some estate planning or something of that ilk.

And so in that way, you know, in a taxable account, you still get to realize many of the benefits of tax deferral that you would get in the individual MLP portfolio, but you don't get the K-1, you get, as you said, a 1099. Now, there are other options to get exposure to the space, ETNs based on Alerian Indexes as well that don't have any of the tax deferral benefits of AMLP or individual MLPs. But rather just give you sort of proxy exposure to a basket of MLPs, and the income is taxes, as a coupon payment or ordinary income tax rates.

And that might be a product that's more appropriate for a deferred tax account, an IRA, a ruled over 401(K) or whatever it might be in. And even the products like ENFR that adhere to RIC rules, registered investment company rules, and therefore cap exposure of MLPs at 25%, might also be a better choice for a deferred investor, because ultimately, much more of the return would be expected to come from capital appreciation as opposed to sort of a pure income play, and therefore might be more appropriate for someone who's not facing taxes on an ongoing basis within that account.

JL: Sure, that’s well put. So, I'd love to get into more specifics of these two funds, the ALPS, Alerian, MLP, ETF, AMLP, and the ALPS Alerian Energy Infrastructure ETF, ticker symbol ENFR and maybe come back to Stacey here, if possible, in terms of the index or side, how are holdings selected for these indexes that underlie these funds. What is the weighting methodology? How often are holdings replaced? Or how often are the indexes reconstituted?

SM: Yeah, sure. So AMLP tracks are Alerian MLP Infrastructure Index, the index ticker is AMZI; and then ENFR tracks are Alerian Midstream Energy Select Index, and that index ticker is AMEI. Those are rules based indexes, the methodologies publicly available on our website. The indexes rebalanced and are reconstituted every quarter. And they're weighted based on float adjusted market cap with a 10% cap for individual names. Specifically to be in the AMZI, you have to be an MLP or an LLC, you have to generate the majority of your cash flows from midstream activities. You have to pay to distribution for the trailing two quarters.

And then there's also a liquidity requirement to meet as well. To be an AMEI you have to be based in the U.S. or Canada generated most of your cash flows from midstream, activities and then also meet a smaller liquidity requirement. For AMEI as Paul discussed, it's a brick compliant index. So, the index caps MLP is at 25%, and then the other 75% of the index is U.S. and Canadian Midstream C-Corps. Recently Canadian names were about a third of the index. So, it's a little bit more diversified provides kind of broader exposure to the North American midstream universe, whereas an MLP only index like the AMZI is going to have more of a yield component, just given that it's predominantly MLPs.

JL: And I mean, I guess accounting for the differences in construction there, ENFR has significantly outperformed AMLP on a total return basis, which I think is the key metric relevant and to most investors here, over a pretty much all time periods measured. And I would love it if I'm guessing you're not going to be able to address this necessarily, Stacey, but Paul, maybe if you could address what accounts for this outperformance if you could just drill in a little deeper there to explain why that's been the case that ENFR has just been such a better performer than AMLP?

PB: So, I think there's a few things and it's hard to point to any one dynamic at play here, but there are some things that are relevant to this discussion. I mean, the first is that if you look at the C-Corps that have recently converted from MLPs, to C-Corps, Kinder Morgan, OneOak, Williams, they were sort of significant scaled operators in AMLP and have since converted the C-Corp, and because they're C-Corps, they're eligible for inclusion, unlike MLPs in some of these major market indexes.

So, you do have some exposure to index flows, broad market index flows, and I don't need to tell you, Jonathan, just how significant flows have been into both index ETFs and index mutual funds in recent years. And so that is sort of a significant tailwind from a valuation perspective or otherwise structural flows into these companies as a result of index investments. The other piece of this is that, for that reason, or for other reasons, there's been a premium from a valuation perspective placed on these C-Corps relative to MLPs in recent years, and whether or not that's sustainable or durable remains to be seen, but that also helps explain the divergence in performance.

And then finally, there is a significant portion of ENFR that's invested in Canadian energy infrastructure companies, C-Corp’s listed on Canadian exchanges, who do operate and own assets in the United States. So, they are part of the United States energy infrastructure story, but they're Canadian listed companies. And those companies have also had a premium placed on their shares relative to their U.S. counterparts. So there's some sort of valuation dynamics at work, there's some flow dynamics at work.

And then furthermore, there's also sort of investor sentiment and perception at work here, whereby the C-Corp’s relative to the MLPs have seen all else equal, more flows into the category and investors, at least over the course of the past few years have been more positive for lack of a better word towards that segment of the marketplace. I mean, Stacey's not precluded from discussing some of these dynamics. So, I don't know if there's anything you wanted to add there, Stacey, anything that I've missed?

SM: No, I think you touched on a lot of it. The only other things that I would maybe point out is, the Canadian names have been very defensive. And if you look over the last several years, we've had a lot of volatility in oil prices and that plays into, you know, better performance for Canadian names. So, that's been you a tailwind for ENFR compared to AMLP. And then if you look at some of the underlying assets and the asset exposure in AMZI versus AMEI, for you AMZI the underlying index for AMLP, there tends to be more exposure to gathering and processing names, for example, which tend to be more sensitive to what's happening from a commodity price standpoint.

So that's another kind of benefit potentially from a performance perspective for AMEI over AMZI, just given that we've been given a period of a lot of commodity price volatility. Paul covered it very comprehensively. Those are just a couple added comments.

JL: Sure, what would you say, and I may be putting you a bit on the spot here, but would you say that the outlook that you've given to the MLP space for 2021 and beyond in terms of meaningful increases in free cash flow, and then the hope would be that that would eventually trickle into share buybacks and increased distributions? Also, would you say that applies more to an index that's fully MLP based like AMLP than one that's more of a hybrid like ENFR?

SM: Sure. So, maybe just to make the comparison, if we look at 2021 numbers and consensus estimates from Bloomberg and company guidance for capital spending, the top five names in AMZI, which are about 50% of the index are all expected to generate free cash flow after distributions. If you look at the top five names in AMEI, three of the top five are expected to generate free cash flow after dividends next year. So, within AMEI there's two large names Enbridge or TC Energy, which are Canadian names that still have very significant project backlogs and are still doing significant capital investment.

And so that kind of tilt the free cash flow story for AMEI. But if you look beyond the top five names in both indexes, there is a growing theme around free cash flow. And that's certainly true of just energy in general, being focused on pursuing free cash flow as a way to attract generalist investors back to this space, regardless of what happens with commodity prices. So, comparing AMEI and AMZI, there are some differences there from a free cash flow perspective, but we do see that as kind of a broad or midstream theme, and not just specific to be MLPs, even though the top five names of AMZI screen better on that metric.

JL: Nice. So without giving any investment advice here there could be some expectation of reversion in terms of performance going forward here. For people that are maybe considering looking at both of these funds, how much overlap is there between them in terms of the holdings?

SM: So because the AMEI is capped at 25% MLPs there isn't that much opportunity for overlap. You know, the AMZI is 100% MLPs. The AMEI can only invest 25% in MLPs. So, you don't have that much overlap. As I mentioned, Canadian names are about a third of AMEI by weighting. So, there's overlap in the sense that these companies are all kind of doing the same type of operations in terms of pipelines, terminals, processing facilities, but in terms of the individual companies and the overlap between the two indexes, it's really limited by the fact that AMEI’s [indiscernible] the 25%.

JL: Okay, sure. That's good to know.

And now a quick break. So, I can tell you about a Seeking Alpha investing service available via the Seeking Alpha Marketplace. Whether you're an expert or a novice closed-end fund and exchange traded fund investor, you've come to the right place with the CEF/ETF Income Laboratory run by Seeking Alpha author Stanford Chemist. The goal is to help investors benefit from income and arbitrage strategies in CEFs and ETFs, all without having to be an expert, because Stanford Chemist and his team do the heavy lifting for you. That sounds like something you'd be interested in. I hope you'll consider joining CEF/ETF Income Laboratory. The service is currently offering a two week free trial. So, you can check it out without paying a dime. To learn more about CEF/ETF Income Laboratory go to seekingalpha.com/marketplace and look for CEF/ETF Income Laboratory there or enter Stanford Chemist or CEF/ETF Income Library into the search bar at the top of the site.

Alpha trader is a weekly investor focused podcast produced by Seeking Alpha that will dive into the most impactful market news and then set the stage for upcoming market events. We are your hosts, Aaron Task and Stephen Alpher. Episodes are available every Tuesday and will include discussions with market experts on topics that are relevant to active traders who are Seeking Alpha. Be sure to subscribe so you never miss an episode.

JL: And we're back. So, before we wind it down here, Stacey, I wanted to get back to a piece that you've written not too long ago. We're speaking on the morning of September 30 here. Last night was the first presidential debate. I think regardless of which side you're on, I think most people agreed that it was pretty much a national embarrassment in terms of the level of discourse. But putting that aside, you've written about that you believe that there will be the likelihood of potentially different outcomes depending on who wins the upcoming presidential election. Would you be able to just expand on that for listeners in terms of how you see different potential outcomes November 3, affecting this space?

SM: Sure. So, I think at a high level, sometimes the impact of the President on Energy Infrastructure can feel overstated, just because so much seems to end up in the courts today. Just for example, you know, the Trump administration has been very supportive of the Keystone XL Pipeline, but that's still, you have been tied up in the courts and with regulatory issues. Additionally, because the massive infrastructure build-out over the last several years has already been largely complete, there aren't as many large significant projects that are currently in the works. That would be, you know more subject to federal oversight. And if you're looking between the two candidates, a continuation of the Trump administration would be more status quo. And the administration has been more energy friendly overall. But on the other hand, you know, a Biden administration to me appears manageable for the space.

The Biden team has proposed raising the corporate tax rate to 28% and some other tax proposals that would essentially widen MLPs tax advantage. You’re relative to C-Corp’s, which I think would be, you know, potential positive. If that administration goes into power and may offset, you know, some potential negatives. For example, the Biden administration has talked about limiting permitting on federal lands, and basically curbing upstream activity on federal lands, and that could have an impact for, you know, certain producers and you know, even potentially their midstream providers. And, you know, currently those companies that are producing in those areas are stockpiling permits and ahead of that, but anything that we see from a potential Biden administration that curbs production growth probably would actually be supportive for oil and natural gas prices, which could be, you know a potential offset.

You know, certainly a Biden administration would be, you know, more moderate and more energy friendly than some of the other democratic candidates that were in the race earlier. The administrator …

JL: Sure. Yeah, I don't think anybody would accuse him of being a socialist or anything of that nature.

SM: Right. I mean, the campaign is not talking about banning fracking, which is, you know, was something that was put forth by a couple of the other candidates early on. So, overall, I think, you know, either way the election goes, I think it'll be manageable for the midstream space.

PB: Yeah, I would just add, I think we have these conversations a lot with advisors. And there's so many crosscurrents at work from the perspective of more progressive energy policy in the event of not just a Joe Biden victory, but perhaps a sweep in the Senate for Democrats as well. And the impact on legacy fossil fuel companies, the reality of natural gas providing a bridge to between I should say, the current state of energy and a future state of energy and then the tax side, whether it be increased corporate tax rates, whether it be increased individual tax rates, which in theory might be beneficial for investors, looking at MLPs and the benefits of tax deferral.

So, it's hard to make definitive judgments, objective, quantitative judgments on the sort of impact of all of these proposed policies on this segment and investors in this segment more specifically.

JL: Sure, although I suppose that's partially due to the fact that at the end of the day, we're not dealing with democratic candidate who's likely to be extreme on energy policy. If you know, we were let's say talking about a Trump vs. Bernie Sanders, Presidency, I think it would be possible to go out on a [indiscernible] and make some statements about likely effects on the space at that point, I mentioned. Anyway, this is, it's been really fascinating. I'm learning a ton here. So, hope our listeners will as well.

What's the best place for listeners to further research everything we've been discussing here today?

SM: Sure. So, just for more information on the MLP and energy infrastructure space, alerian.com is a great resource we have. You know, primers on the MLP and energy infrastructure space that also walk through the different investment options and what makes most sense for you an investor's individual situation. We also publish research on the space twice a week and you can find that on the research page of our website. And if interested anyone [there] can also subscribe to receive our email updates to get that conveniently, and then of course, you know for the funds, Paul can probably direct you to the best resources for the funds themselves. But our website, alerian.com, is a great general resource for midstream and energy infrastructure information.

PB: And we have a really straightforward URL for listeners as well, amlpetf.com is where they can go.

JL: And what about ENFR, is that as simple to remember, or a little more complicated there?

PB: I think alpsfunds.com/enfr is the easiest way to access information about ENFR.

JL: So, I've got it open. I think it's /products/ETF/ENFR. It's great. And of course, listeners can go to Seeking Alpha. We've got a bunch of data and articles on both of these funds also. And what about social media, either you guys doing the social thing, Twitter or LinkedIn?

SM: Alerian’s on LinkedIn and Twitter.

JL: Okay, nice and ALPS as well I assume.

PB: So, ALPS is not on Twitter. There is a broader SS&C company handle for Twitter, but I personally am just on LinkedIn. So…

JL: Okay, cool. So, go straight to ALPS website if you want those up to the minute updates. Anyway, I want to thank you guys so much. This has been really a great conversation, and I hope we can do it again sometime.

PB: Thank you.

SM: Thanks, Jonathan.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.