Sign up for Let's Talk ETFs on your favorite podcast platform:

My guests today are Stacey Morris, Director of Research at Alerian and Paul Baiocchi, Senior Investment Strategy Advisor at SS&C ALPS. This is the first episode of Let's Talk ETFs to focus on Master Limited Partnerships (MLPs), a sometimes misunderstood investing vehicle with notoriously complex tax-filing rules for shareholders.

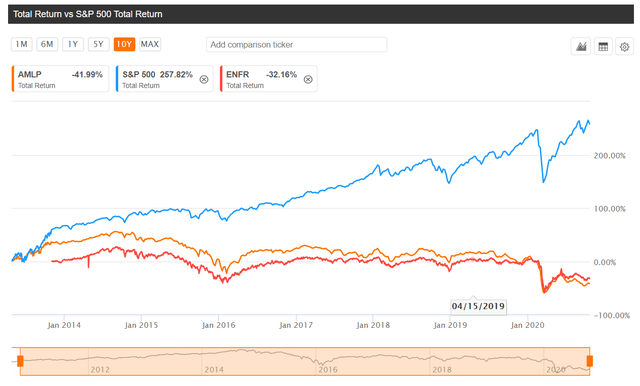

MLPs have had a rough go of it of late - a secular bear market in natural gas certainly hasn't helped performance. Neither has the declining oil and gas production brought on by COVID-19. As you can see from the performance (below) of the two ETFs discussed in today's episode - the ALPS Alerian MLP ETF (AMLP) and the ALPS Alerian Energy Infrastructure ETF (ENFR) - even double-digit yields haven't been able to offset poor overall performance:

10-year comparison chart courtesy of Seeking Alpha Premium

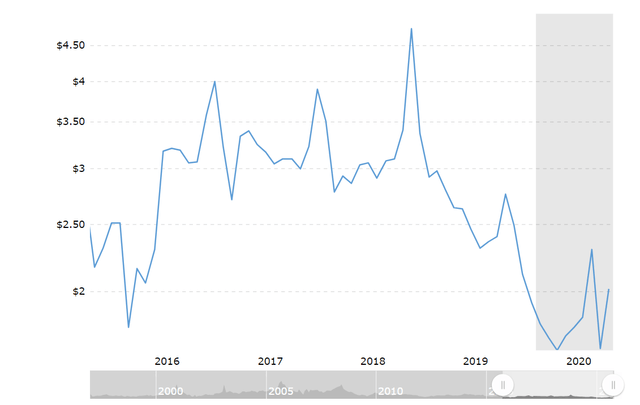

This prolonged underperformance counter-intuitively makes MLPs ripe for a reversion to the mean. For one thing, natural gas prices may finally have bottomed, twice bouncing off lows in 2020:

Chart courtesy of MacroTrends.net

For another, Alerian has made a compelling case around the idea that falling production may not actually be negative for MLPs heading into 2021.

Finally, reductions in MLP capital spending will lead to meaningful increases in free cash flow and dividends in 2021 and beyond.

With this in mind, I decided to tackle the subject of MLPs in an ETF wrapper. During our conversation, Stacey, Paul and I get into everything from why companies would choose the master limited partnership structure, the unique and often confusing tax code around MLPs (and how ETFs like AMLP and ENFR manage to largely sidestep it), differences between American and Canadian Partnerships, and how various outcomes in the upcoming Presidential election are likely to affect the broader MLP sector.

I hope you find this conversation as useful as I did.

Show Notes

- 3:30 - How has the pandemic affected Stacey and Paul's work lives?

- 8:00 - What makes a company an MLP? What are the benefits of this structure?

- 10:30 - How are MLPs insulated from price movements in crude oil and natural gas?

- 14:15 - The outlook for MLPs in 2021 and beyond: Lowering CapEx, increasing FCF

- 22:00 - Dealing with the taxman: How does ALPS get around issuing K-1s in AMLP?

- 26:00 - How are holdings selected and maintained for both ENFR and AMLP?

- 28:30 - Divergent performances: Why has ENFR outperformed AMLP?

- 34:45 - How much overlap is there between the holdings of these two funds?

- 37:00 - Biden vs. Trump: How will the outcome of the upcoming presidential election affect energy midstream players?

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.