TAIL: Profit From A Market Downturn With This ETF

A few days ago a subscriber asked for my thoughts on inverse ETFs. Although these funds offer investors an easy way to profit from downturns, I believe them to be generally unwise investment choices, as expected returns are negative, and double-digit annual losses common. I thought it would be interesting to search for a stronger, better-performing, and less risky alternative to inverse ETFs, and I believe that I found one in the Cambria Tail Risk ETF (TAIL).

TAIL's treasury holdings and select S&P 500 put options combine to create a fund that would profit from a downturn, but suffer comparatively limited losses during a bull market, and in the long-term. TAIL provides investors with a simple and comparatively strong way to profit from a market downturn, and makes for a strong investment or trading opportunity for more bearish investors.

Fund Overview

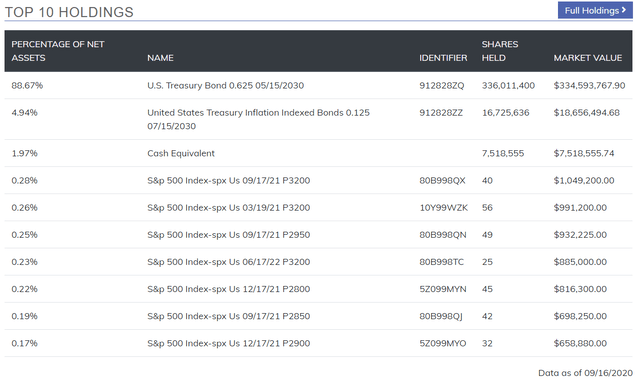

TAIL is a surprisingly simple fund, focusing on treasuries with some smaller investments in S&P 500 put options. The fund's actual holdings are as follows:

(Source: TAIL Corporate Website)

TAIL focuses on treasuries, so let's start by analyzing these.

Treasuries are extremely safe securities with mediocre yields, but what really matters for our analysis is their usefulness as a hedge against market downturns and declining equity prices. During downturns, investors generally buy higher-quality lower-risk assets, especially treasuries, as these still perform reasonably well during adverse economic conditions. During the same, investors generally sell higher-risk assets, especially equities, as companies are sometimes forced into bankruptcy or slash their dividends. Government intervention also plays a role, with the Federal Reserve bidding up the price of treasuries during downturns as part of its toolkit to combat recessions and depressions. Federal Reserve policy also helps to indirectly support corporations and equity prices, but the effect is more muted when compared to treasuries.

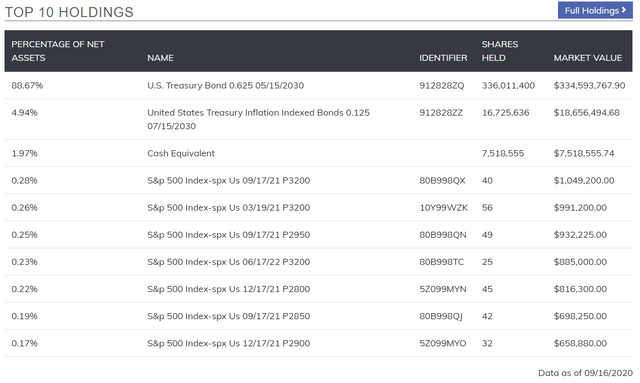

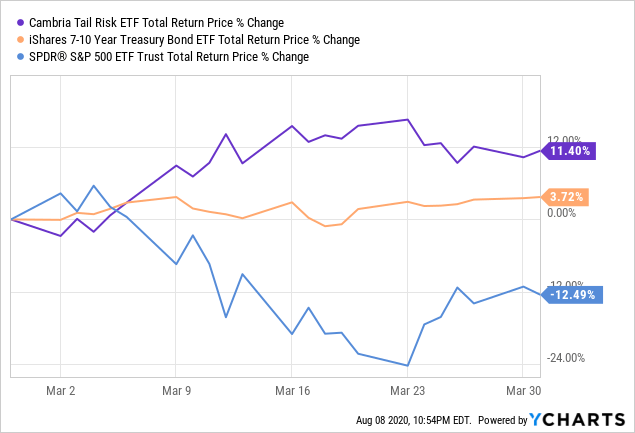

As such, treasury prices and returns are inversely correlated to those of equities, and the former can generally act as a hedge against the latter. For example, treasuries performed reasonably well during this past March, even as equity markets tumbled at the start of the ongoing coronavirus outbreak:

Data by YCharts

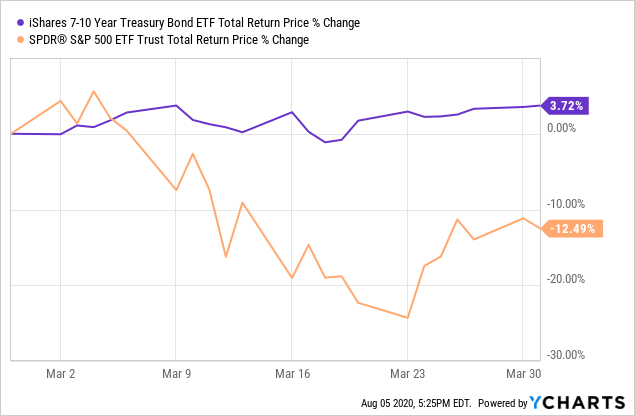

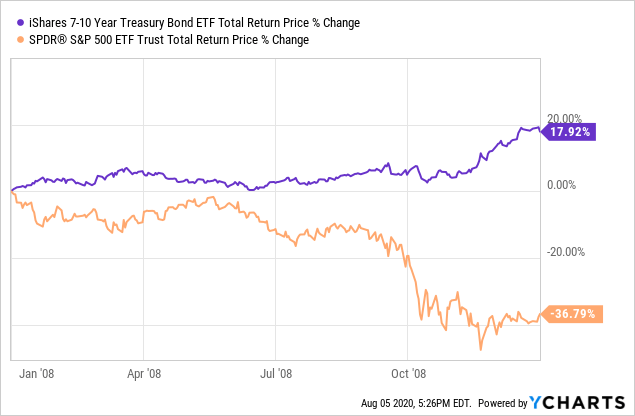

Data by YChartsAs can be seen above, treasuries posted some modest gains even as equity markets collapsed as the reality of the coronavirus outbreak set in. The same happened during the past financial crisis, during 2008:

Data by YCharts

Data by YChartsTAIL's treasury holdings are effectively a hedge against further market downturns, and should significantly outperform during these. Treasuries also have positive expected returns, basically equivalent to their yield, and effectively zero credit risk, both of which are of some benefit to shareholders.

TAIL also invests in several S&P 500 put options, which give the fund the right to sell shares of said index for a predetermined strike price at a later date. These options can be profitably exercised and increase in value as the S&P 500 goes down in price, and also appreciate as volatility increases, which almost always happens during downturns, as increased volatility implies a greater probability of further index losses. Due to a combination how options are priced, market expectations, and investment choices, TAIL is able to buy many put options at comparatively low prices, which has some positive implications for the fund and its shareholders.

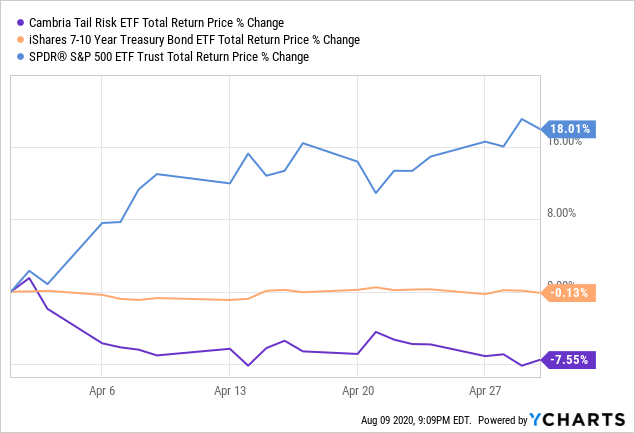

As options are plentiful, gains are comparatively large if equity markets collapse, as they did during this past March:

Data by YCharts

Data by YChartsAs can be seen above, TAIL's gains were only marginally lower than the losses of the S&P 500, with most of these being attributed to the fund's options, with treasuries playing a smaller role.

As options are cheap, losses are comparatively small even if these are never profitably exercised. Compare TAIL's performance with that of the S&P 500 during this past April, when equity markets rebounded after the March coronavirus-induced crash:

Data by YCharts

Data by YChartsAs can be seen above, TAIL's losses were equivalent to just under half of the S&P 500's gains, and these were almost completely due to the fund's put options, as treasuries were flat.

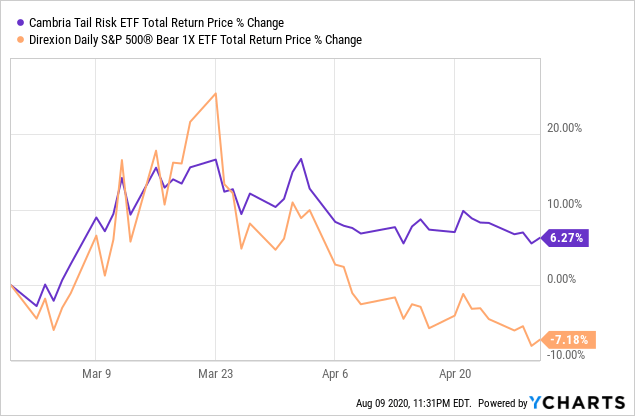

TAIL's combination of reduced downside but plentiful upside combine to create a reasonably well-performing market hedge, and one that outperforms more traditional inverse ETFs, including the Direxion Daily S&P 500 Bear 1x Shares ETF (SPDN) during most downturns. I think that comparing the performance of these two funds during this past March and April might prove instructive:

Data by YCharts

Data by YChartsAs can be seen above, SPDN outperformed as equities markets tumbled during March, but then underperformed as these rallied in April. On net, however, TAIL strongly outperformed, as it experienced most of the gains but few of the losses of SPDN. TAIL's comparatively strong performance was due to its simply superior investment and option strategy: a combination of treasuries and put options are almost always a better market hedge than a simple directional bet on falling equity prices like SPDN. Results are broadly similar for other inverse ETFs.

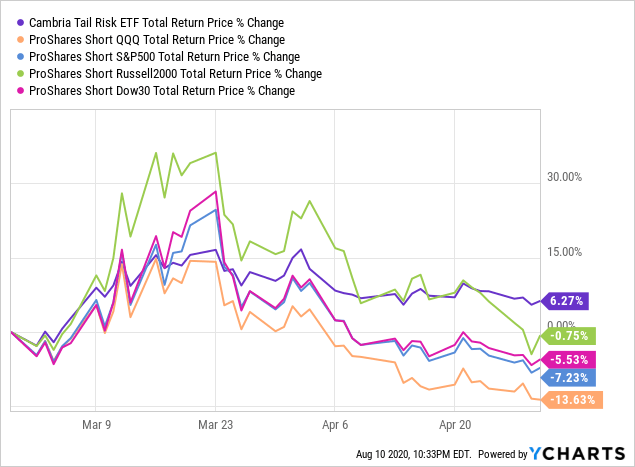

Data by YCharts

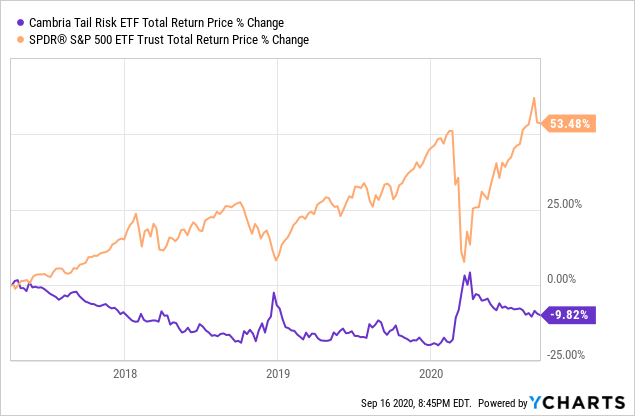

Data by YChartsAs a final point, I would like to remind readers that TAIL is still meant to act as a hedge or trading vehicle for bearish investors, as the fund will almost certainly experience long-term losses, as it has since inception:

Data by YCharts

Data by YChartsConclusion

TAIL offers investors a particularly easy way to profit from a possible market downturn, while minimizing losses during rising markets. I believe that the fund is a better investment opportunity than more common directional market bets, including SPDN, as its holdings and overall investment strategy minimize downside while ensuring significant upside. Bearish investors expecting a downturn or bear market could consider a short-term investment in TAIL, as the fund would provide them with strong profits if they are right, but only moderate losses if they are wrong.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.