iShares Short Treasury Bond ETF (SHV) holds over $21.2 billion in assets when we last looked at it. It is one of the larger ETFs around and assets have actually gone up over the last few years. We examine this one today as its numbers gave us a mild case of indigestion.

Returns Are Nothing To Write Home About

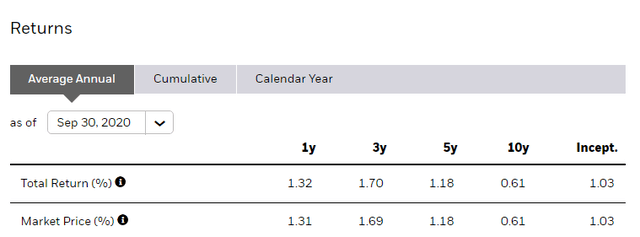

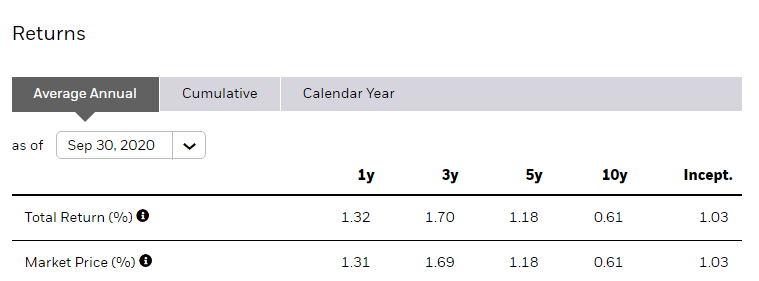

SHV is a great cash proxy and over the last few years has delivered near cash-like returns.

While 1.32% over the last year may seem small, do remember that it was possibly the least volatile way to make that return. The fund also did rather well during the pandemic and allowed investors to access cash to buy bargains. We have no qualms with the past performance of the fund and it has matched its benchmark as well as possible.

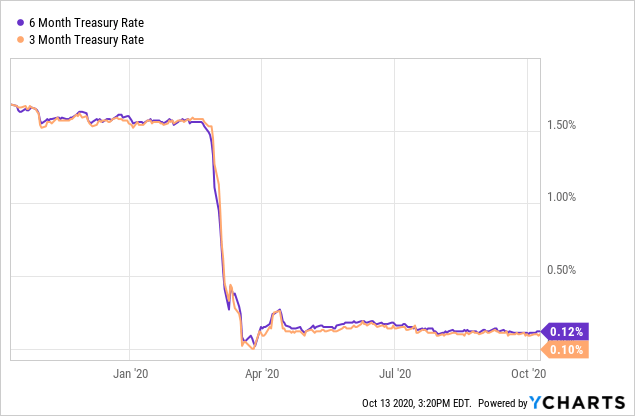

However, the past returns will still draw nostalgia compared to what will happen in the future. At this point though, the fund has taken a rather extraordinary route in the land of ETFs. The COVID-19 induced Federal Reserve has pushed Treasury rates to hug the zero line like a life vest.

Data by YCharts

Data by YChartsThe 3 month Treasury Bills yield 10 basis points and the 6 months give 12.

SHV's Future Returns

People hold cash for many reasons but to lose money is certainly not one of them. But that is exactly what will happen with holding SHV. We explain why below.

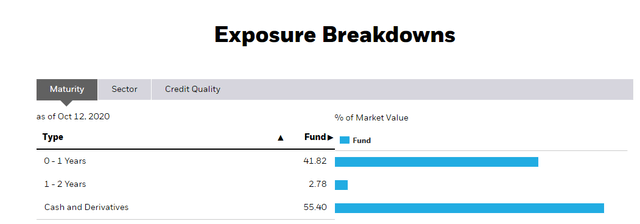

SHV ETF, as of the most recent update, holds about half of its assets in US Treasuries with a maturity of less than 1 year.

Source: iShares

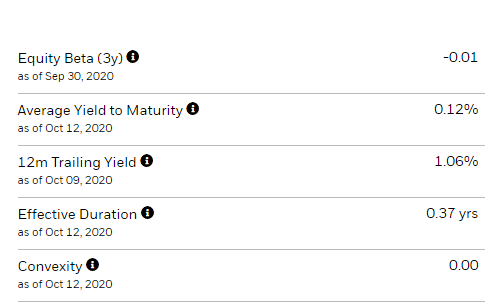

It does have a small amount in slightly longer dated Treasuries but the rest is actually in cash. This has led to the fund having a weighted average bond duration of 0.37 years.

Source: iShares

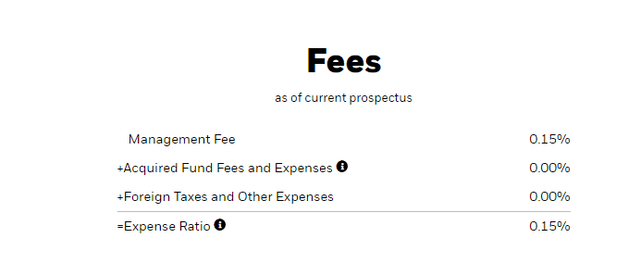

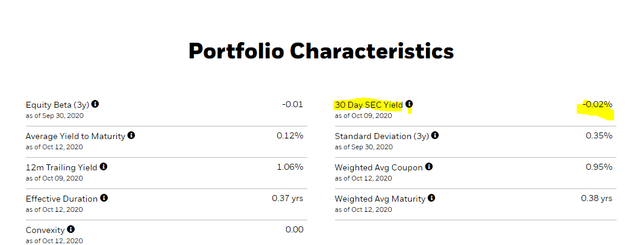

The fund does quote the trailing 12-month yield, which came to 1.06% but that is not remotely useful for what the fund is about to give in the form of returns. The current weighted yield to maturity is 0.12%, matching the 6 month Treasury Bill rate. That is a gross number and it fails to take into account management fees. Those come in at 0.15%, consuming all of your returns and then some.

Source: iShares

At this point you are probably wondering what more is left to say here, but management fees are just one part of the equation. Beyond that there are fees and transaction costs which get passed on to ETFs. iShares does an amazing job of keeping these low and in the case of SHV they seem to be a rounding error. That good fortune however does not negate the fact that this fund yields, if we can use that word, a negative 2-3 basis points.

Source: iShares

Even though you do get dividends/distributions still, do note that these are NAV depletive returns. Literally every dollar made on this fund and more, goes in some shape or form to the company running iShares.

What Should You Do?

SHV has over $21 billion earning negative returns. Investors should consider whether they need this in their portfolio. Some money market funds and bank CDs do offer decent returns, and certainly beat the fun exercise of slowly losing money. It is probable that SHV will cap expenses at some point so as to not lose investors their hard earned cash, but even then, what is the point of investing here?

SHV's negative returns is a stark reminder that the war on cash has unintended consequences. That said, there are opportunities in the current market, because of the volatility structure. That same structure makes the idea of writing cash-secured puts or even deep in-the-money covered calls very lucrative and investors can actually get paid to wait.

Investors actually hold cash for either unexpected expenses or to buy shares on the cheap. Such an opportunistic investor is the perfect person to write cash-secured puts or deep in the money covered calls. Whatever you do decide, do know that SHV has got negative yields to our shores.

If you enjoyed this article, please scroll up and click on the "Follow" button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the "Follow" button next to my name to not miss my future articles. Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.