Two months ago, I wrote a piece on Aris' RPAR Risk Parity ETF (RPAR). In it, I argued that the fund was "a great gateway approach to improve a portfolio's risk-adjusted return potential quickly and without frills", and that RPAR "could not only complement, but even replace equity-only investments altogether".

Since then, and although the ETF continues to display enviable absolute and risk-adjusted performance since inception, RPAR has started to face the second challenge of its short life - the first being the start of the COVID-19 crisis. How will it fare this time?

(Image Credit: Investment Executive)

A quick word on RPAR

Before moving forward, let's briefly recap what risk parity is and what RPAR is currently invested in.

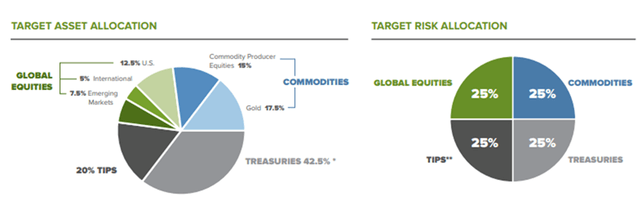

Risk parity is an investment strategy developed by my former employer, Bridgewater Associates, in the mid-1990s that seeks to diversify a growth portfolio beyond stocks. It does so by allocating funds across different asset classes that should perform well in various economic environments. By targeting volatility-based balance (i.e., heavier allocation to less risky assets, and vice-versa), a risk parity portfolio should grow without enduring the same levels of volatility that stocks, for example, might.

RPAR is currently invested in global equities, nominal and inflation-linked treasuries, and diversified commodities, including gold. In order to deliver slightly higher return, RPAR is leveraged by a factor of 1.2x through the use of long positions in futures contracts.

(Source: RPAR Fact sheet)

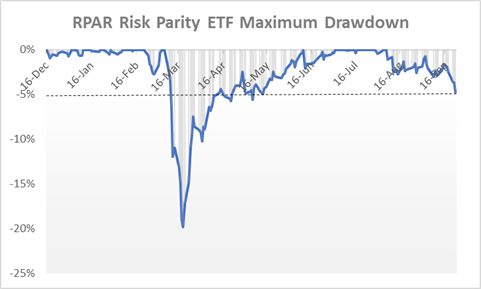

The end of the everything melt-up

The chart below provides a visual representation of what RPAR has been dealing with lately. Currently, the fund is down nearly 5% from its most recent all-time high, reached in the first week of August. While this may not sound like a sharp decline, it is the farthest under water that RPAR has been since mid-May 2020.

RPAR's dip began when stock-only investors were still riding the last leg of the S&P 500's rally. Beyond the horizon, however, a storm had already started to form. Most asset classes, from treasuries (TLT) to corporate bonds (VCLT) to gold (IAU) and even Bitcoin (BTC-USD), had been moving sideways to lower, sharply so in some cases. The sudden spike in the VIX index in the last week of August and first couple of days of September was probably the last indication that equities would be the next to crumble.

(Source: D.M. Martins Research, data from Yahoo Finance)

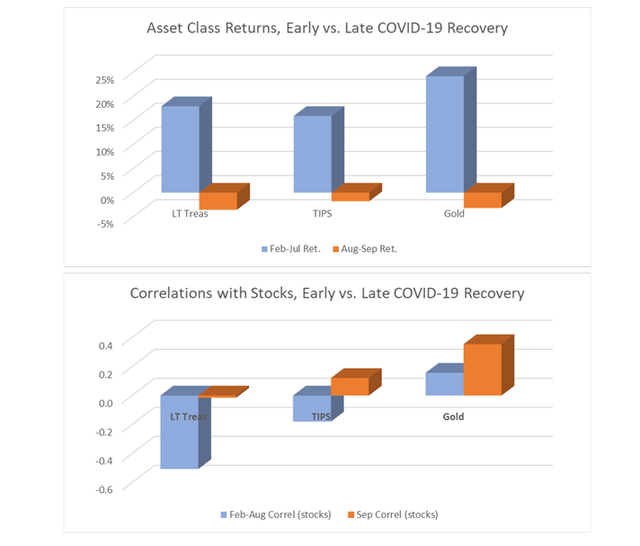

Not unlike March 2020, but to a much lesser extent, diversification has stopped working as the markets (plural, i.e., beyond stocks) seem to have gone into risk-off mode. The charts below show how the first part of the COVID-19 crisis recovery across treasuries, TIPS, and gold was generous to investors. All asset classes were up strongly, and correlations with stocks were either loose or negative.

Now, the tables have turned. Returns have headed south since August (except equities) and losses accelerated into September (including equities), while correlations headed higher. In my view, this might be evidence that the "everything rally" that was sponsored by lavish quantities of cash infusions in the system and promises of fiscal support to the economy may have either run too far for the moment or finally come to an end.

(Source: D.M. Martins Research, data from Yahoo Finance)

What happens next?

It is hard to tell what will happen to multi-asset class diversification in general and to RPAR specifically. If I had to take one educated guess, I would say that weakness will likely persist until (1) asset prices correct to levels that are more consistent with the reality of the economy in a year of global pandemic and deep recession, and (2) the end of the electoral cycle in the US.

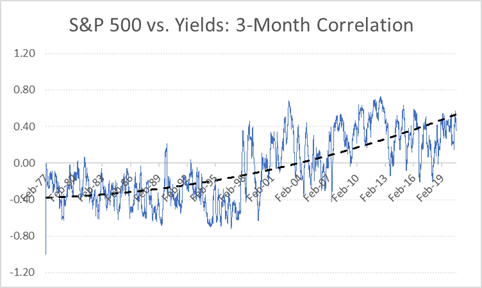

But over time, and if history can serve as a guide, diversification should eventually start working once again. Asset class correlations with stocks have deviated from the longer-term trend from time to time, especially during periods of market distress. However, they end up mean-reverting at some point -- see chart below, treasury yield vs. the S&P 500 since 1977.

(Source: D.M. Martins Research, data from Yahoo Finance)

For this reason, I maintain my views that RPAR will continue to produce substantially better risk-adjusted returns than stocks going forward, while doing a better job at protecting investors against sharp losses.

Beating the market by a mile

In 2018, I developed a multi-asset portfolio that has outperformed RPAR and the S&P 500 by a good margin. To dig deeper into how I have built a risk-diversified strategy designed and back-tested to generate market-like returns with lower risk, join my Storm-Resistant Growth group. Take advantage of the 14-day free trial, read all the content written to date and get immediate access to the community.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.