Resilience Technologies Jim Simons ETF and financier Jim Simons transformed the trading industry by starting Renaissance Technologies, one of the most prosperous hedge funds ever. Simons demonstrated that conventional analysis and intuition are not necessarily necessary for market success with his novel methodology, which is founded on quantitative analysis and the scientific method. Rather, his team discovered underlying market trends using computers and mathematical models. Jim Simons' trading system's secrets will be unveiled in this post, along with instructions on how to use his tactics to boost your performance. Discover how to trade and think like a real pro in the quant trading space.

Recommended to read: Stocks With Golden Star Technical Signs

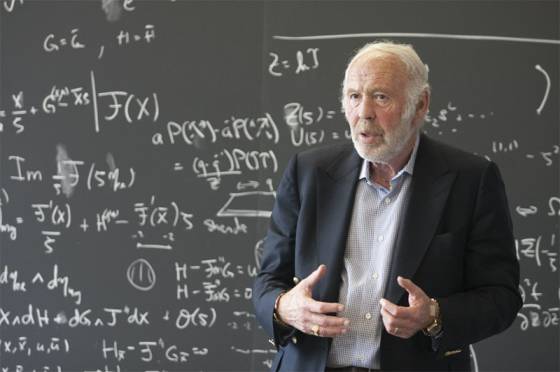

Who Is Jim Simons?

Renowned businessman and mathematician James "Jim" Simons founded Renaissance Technologies, one of the most prosperous hedge funds in the world, and is renowned for his contributions to quantitative analysis. Because of the remarkable performance of his Medallion fund, which was only accessible to firm workers, resilience technologies jim simons etf "The Quant King."

Simons, who was born in Newton, Massachusetts, on April 25, 1938, had a keen interest in mathematics from a young age. He graduated from the Massachusetts Institute of Technology in 1958 with a bachelor's degree and from the University of California, Berkeley in 1961 with a PhD. He subsequently taught at Harvard and MIT before taking a position as chair of the mathematics department at Stony Brook University, where he worked with Shiing-Shen Chern to establish the Chern-Simons invariant and make important contributions to differential geometry.

Simons established the investing company Monemetrics in 1978; it subsequently changed its name to Renaissance Technologies. To create automated trading techniques, he enlisted specialists in a number of scientific domains, including as physics, statistics, and mathematics. The Medallion fund was established in 1988 and has only been accessible to corporate workers since 1993.

Read Also: Investment Management In Retirement

What was Jim Simons' source of income?

Despite being a mathematician, Jim Simons is more well-known for his background managing hedge funds than for his mathematical skills. In 1978, Jim Simons left his academic position to start the hedge fund Monemetrics, which he eventually renamed Renaissance Technologies. Since quantitative analysis was still in its infancy at the time, Simons' use of both technical and fundamental methodologies ran against market volatility, which produced erratic outcomes.

Simons decided to use a fully systemic strategy in order to lessen the impact of emotions on trading choices. He put together a team of scientists, experts from universities and the NSA, since he required analysts and mathematical geniuses, not experts with a business degree. However, he was subject to the same prejudices of many traders.

How much money does Jim Simons have?

Jim Simons was the 55th richest person in the world at the time of his death on May 10, 2024, with an estimated net worth of $31.4 billion. The success of his hedge fund Medallion, which is renowned for its strong returns, contributed significantly to Simons' riches as the creator of Renaissance Technologies.

Simons was an active philanthropist who contributed almost $6 billion to a range of educational and scientific endeavors, including funding studies on autism and mathematics. His philanthropic and scientific achievements have had a lasting impact that goes beyond the realm of finance.

What is the trading strategy of Jim Simons?

Jim Simons identified and took advantage of market opportunities using quantitative trading techniques. To identify and take advantage of market signals, quant trading uses computer algorithms and models, which can range from basic to intricate mathematical models. Another important factor is research that makes use of past data, which enables more precise forecasts of possible trade profitability.

Both major institutions and individual investors utilize quantitative trading for automated, high-frequency, algorithmic, and arbitrage trading. Quants are traders who use quantitative analysis in their business. They create algorithms that analyze real-time data, including quotations and prices, and they heavily rely on systems that offer market indications and data streams. The following resources are resilience technologies jim simons etf:

Examine patterns that seem out of the ordinary.

- The statistical significance of the pattern is crucial. There must be a number of trades and indications accessible.

- The computer cannot be emulated or backtested, so be careful not to override it.

- It is preferable to have more data than less.

- It makes no difference why. It is challenging for traders to explain an outcome because to the large number of factors influencing asset values. Why is unknown. Asking "why" is thus illogical.

- The victory ratio is likely to be about 51%, which is a low percentage.

- The Medallion Fund and Simons do not reveal their trades. They hide their transactions by not purchasing at precisely 11 AM when an asset exhibits an oddity.

- They are able to apply leverage because of their tremendous variety. Leverage is significantly responsible for returns.

- If you are interested in algorithmic trading after reading about Jim Simons, you will need to open an account with a broker that handles algo trading. High trade volumes, cheap fees, and connection speed are important considerations when it comes to algorithmic trading. ECN brokers that fit these requirements and have excellent ratings based on our approach have been compared.

- speed of the connection. Profitability can be greatly impacted by delays in real-time trade execution, which requires fast and dependable connectivity.

- minimal commissions. Maintaining minimal trading expenses is essential for optimizing returns, particularly when making a lot of deals.

- large quantities of trade. Better liquidity is provided by brokers with large trading volumes, enabling deals to be executed more quickly at the required pricing.

Beginner's advise from Jim Simons

Jim Simons gave a speech to students outlining his five life guiding principles, which are as follows:

Avoid following the herd. The secret is originality.

- Join forces with decent people. One individual cannot do the assignment on their own.

- Allow beauty to lead the way. Math can be beautiful. Businesses that are conducted well are lovely.

- It requires perseverance. Positive things take time to materialize.

- Good luck or poor luck. is preventable. Simply wish for luck.

Books are another resource for novices who want to learn more about quantitative trading. Although Simons hasn't authored any books on the subject, reading Quants: How a New Breed of Math Whizzes Conquered Wall Street can help you comprehend quantitive trading and Simons' approach.

In conclusion

The use of mathematical models and algorithms in financial markets may provide resilience technologies jim simons etf, as demonstrated by Jim Simons' approach to quant trading. His accomplishments serve as an example of how science and technology may be applied to create profitable trading plans. Despite shifting market conditions, his fund maintains its position as an industry leader by continuously upgrading models and doing real-time data analysis. To become proficient in quant trading techniques, one needs to be disciplined, knowledgeable, and open to trying new things. Traders will be able to control risk and seize market opportunities if they are dedicated to accuracy and consistently modify their algorithms.