Written by Nick Ackerman, co-produced by Stanford Chemist

PIMCO Dynamic Income Fund (PDI) is finally trading at similar valuations to the other popular MBS fund, the PIMCO Dynamic Credit and Mortgage Income Fund (PCI). This was after several years of PDI trading at larger premiums than PCI. At the CEF/ETF Income Laboratory, we took advantage of this convergence in valuations to trim some of our PCI position and initiate a position in PDI. Though we have held the PDI/PCI twins in the past too.

While that trade was only a short while ago, the funds are now back, racing to higher premium levels. However, the valuations remain similar so the opportunity is still present to add to either fund at this time. That being said, PDI is trading lower to its relative premium history than PCI. Our last coverage on PCI had many readers asking questions on PDI. Rightfully so, as these two hold rather similar portfolio compositions.

PDI "seeks current income as a primary objective and capital appreciation as a secondary objective." To achieve this their investment policy is below.

The fund normally invests worldwide in a portfolio of debt obligations and other income-producing securities of any type and credit quality, with varying maturities and related derivative instruments. The fund’s investment universe includes mortgage-backed securities, investment grade and high yield corporates, developed and emerging markets corporate and sovereign bonds, other income-producing securities and related derivative instruments.

The fund will normally invest at least 25% of its total assets in privately issued (commonly known as “non-agency”) mortgage-related securities. The Fund may normally invest up to 40% of its total assets in securities of issuers economically tied to emerging market countries. The fund will normally maintain an average portfolio duration of between zero and eight years.

They essentially operate as a multi-sector bond fund, as almost all PIMCO funds have broad-based investment policies. In the case of PDI, they do have a heavier tilt towards MBS regularly.

This flexibility has proven to be successful for PIMCO in the past, as they operate fixed-income funds with solid track records. Keeping in mind that the latest swoon in the market earlier this year has set a lot of non-agency MBS funds back. This, for the reason that many people across the U.S. are suffering the economic wrath of the pandemic. Many layoffs don't usually bode well for individuals being able to pay their mortgages. Of course, like any economic crisis, we will survive and thrive afterward.

PDI is a large CEF, with around $2.5 billion in total managed assets. Similar to the other PIMCO funds, they are highly leveraged though, at 42.88% currently. This will, and should, dissuade investors with a lower risk tolerance to never invest find interest in this fund. The expense ratio is high at 1.89% - when including interest expense, this climbs to 3.96%. Some justification for this would be the 'dynamic' approach to following thousands of potential investments. Though the management fee of 1.15% is still excessive for the size of the fund.

(Source)

(Source)

Performance - Long-term Winner

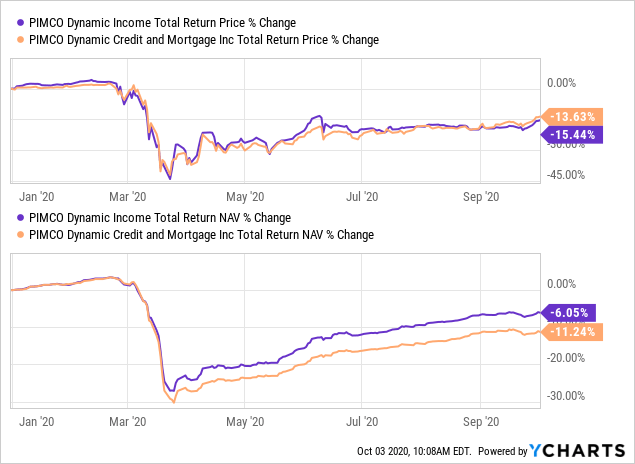

It wouldn't be appropriate to boast about this fund over the short term or to try to avoid it. Unfortunately, the latest black swan event of COVID-19 has put PDI in a precarious position. This has been reflected in poor performance over the short term, as the higher exposure to non-agency MBS keeps the average bond prices below par.

Also hurting the funds was the high amount of leverage that they entered the year with. As the collapse in March was very rapid, they were unwinding assets at rock bottom prices. This means that it is unlikely we see NAV ever return to the former heights - but certainly, there is an opportunity to see greater recovery still. That is, barring any sort of any further major economic harm.

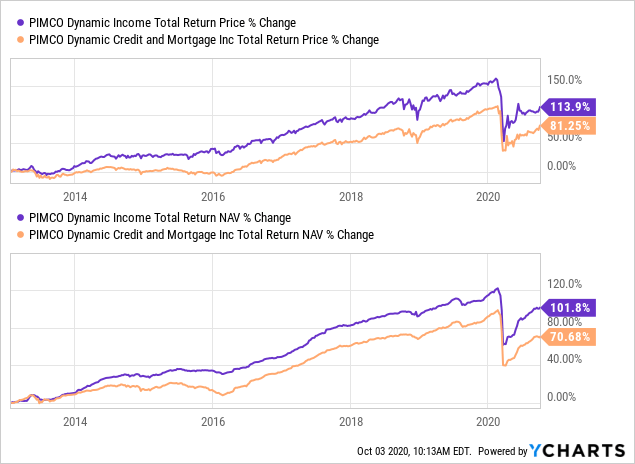

On a YTD basis, the fund has been able to outperform on a total NAV return basis that of PCI. However, as you can see, the convergence in price return is what is more interesting.

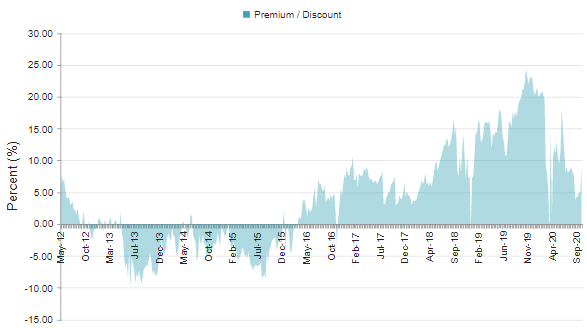

This convergence in prices means that PDI's valuations have come down from earlier this year, while PCI's has increased. At the same time, the divergence in NAV performance has helped exacerbate this. That is how we arrive at the current premium of PDI at 5.64%. (PCI currently trading at a 3.86% premium.)

This can be compared to the last 1-year period presenting an average premium of 13.29%. Further back though, and we see the last 5-year average was at 8.49%. We even saw in March's lows, PDI presenting a discount.

(Source - CEFConnect)

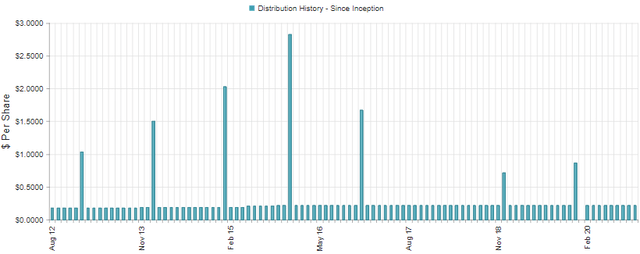

Interesting further, is that the fund had traded at discounts quite regularly pre-2016.

Over the long term, PDI has put up respectable returns especially compared to PCI, though PCI did have a different investment policy before June 29th, 2016.

Adding to the slump that the fund had in September, was the announcement of a secondary offering. When this was announced, the fund fell quite sharply based on investors being nervous about new shares being issued. Though with a CEF offering shares is a bit different than when a typical company offers shares. Due to the fund trading at premium levels, this is accretive to the fund. Additionally, the assets that they invest in are at depressed levels. This all leads me to believe that it is quite positive for the fund to have conducted the offering. They now have fresh assets, that they can further leverage up, to invest in a beaten-down area of the market!

Distribution - Drop In Coverage Sparks Panic

Leading to that latest drop was two-fold, I believe. First, September hit correction levels for the tech sector that caused some panic. Second, the coverage for PDI hasn't looked so great as of late.

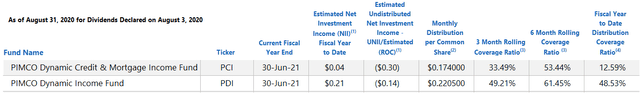

(Source - UNII Report)

This drop in coverage wasn't only for PDI, but PCI as well. This seems to be for obvious reasons of less leverage in the portfolio and the current economic conditions. Though there have been other topics brought up that are less straightforward; from theories of their currency swaps or accounting anomalies. Stanford Chemist touched on this in the last PIMCO Taxable CEF Tear Sheet.

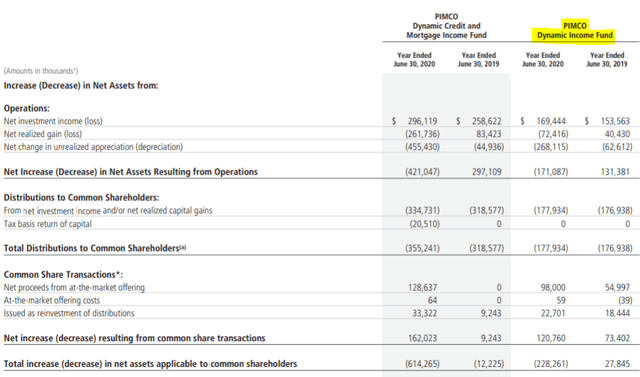

Concentrating only on coverage for a short period of time can give a blurred picture of what is really going on. What we can see, is that for the period ending June 30th, 2020, they reported NII coverage of around 95%. That isn't terrible, but it also isn't great for a fixed-income fund to be at less than 100% coverage from NII. Additionally, that period of time also included a couple of months pre-COVID.

(Source - Annual Report)

From this report, we can also see that the lofty premiums PDI was trading at made a significant contribution to increasing assets. This was primarily from their at-the-market offering, but also still a meaningful amount from the DRIP. This also isn't a secret, as it is one of the items called out in their "fund insights" for contributing to the performance of the fund.

Issuance of additional shares through at-the-market offerings at a premium to net asset value contributed to absolute performance.

For this June 30th, 2020 report, it was good for $0.25 per share increase in NAV.

All that being said, I don't believe PDI is in immediate danger of cutting the distribution. PIMCO generally tends to prolong for as long as possible. As they know that a high, and steady distribution means that they can keep their funds at premium pricing. The premium pricing then allows them to issue new shares that are accretive to NAV. The fund's current 10.70% yield certainly is enticing too.

On a NAV basis, they do have to achieve an 11.30% return though. That does seem lofty. Based on that, I wouldn't mind seeing at least a small trim. That could even bump up NAV over time, potentially allowing them to get back to a NAV level they had been previously.

(Source - CEFConnect)

While a small trim is doubtful, a year-end seems out of the question, however.

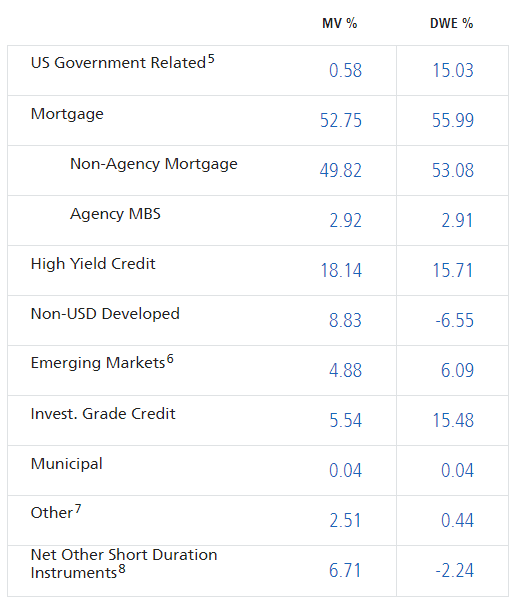

Holdings - A Little Of This, A Little Of That, Mostly Non-Agency MBS

As mentioned above, the portfolio is technically more laid out as a multi-sector bond. Though they primarily hold non-agency MBS. That isn't terrible, just worth mentioning that they have flexibility. That flexibility is what gives us exposure to high-yield, emerging markets, U.S Government debts, investment grade and non-USD developed exposure. Essentially, "a little of this, a little of that."

(Source - Fund Website)

With almost 50% of their portfolio in non-agency MBS, that is the significant part of their portfolio that is being held back. CEFConnect puts the average bond price of PDI's portfolio at $86.49. This does mean that there is still a significant portion of their portfolio under par value. Potentially giving the upside for a continued recovery going forward. They are also adding leverage back into their portfolio. That could contribute to the upside considering they can still buy assets at depressed prices.

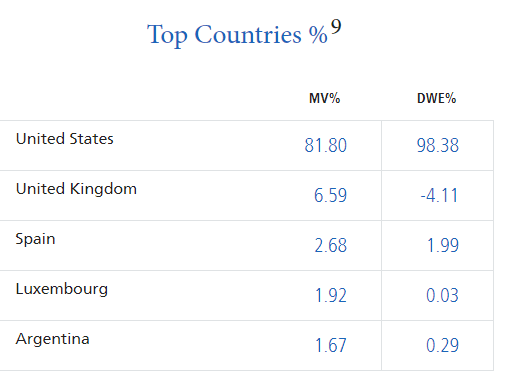

The fund is also overwhelmingly positioned with holdings in the U.S. Even though they offer some exposure to the emerging markets, it isn't a meaningful amount. This can either be viewed as positive or negative, depending on if you are an investor that believes non-U.S. assets will outperform their U.S. counterparts. That being said, PDI's investment policy is open to take advantage of potential anywhere it might present itself.

(Source - Fund Website)

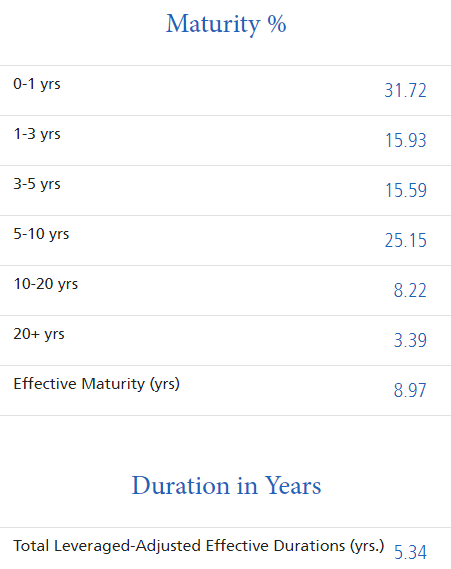

The portfolio is also skewed towards holdings with a shorter maturity. The largest category is 31.72% in the 0-1 year category. This helps lower the overall duration of the fund. Meaning that interest rate changes have less of an impact. Of course, PIMCO portfolios are rather complex - they have swaps and derivatives that can also play a role in their sensitivity to interest rates.

(Source - Fund Website)

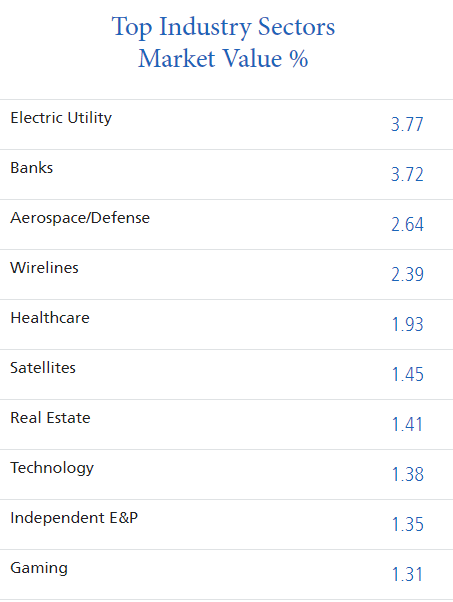

Finally, the portfolio is broken up across a diverse range of industries. The largest exposure is to electric utility at 3.77%. The industry exposure only goes down from there, which isn't a high allocation at all.

(Source - Fund Website)

This exposure provides an immense amount of diversification across many industries. That should result in them not being weighted in too many things that are affected by shutdowns in the economy. On the flip side of this though, that also means they do have exposure to things that are impacted by shutdowns. Ultimately, the fund holds an incredible number of positions. Their portfolio turnover remains quite low as well, and they last reported it was 21%.

At the end of June 2020, they commented on their portfolio positioning. This helps mirror the conclusion that we came to above, high diversification and looking at discounted non-agency MBS.

We continue to emphasize diversification and focus on capturing complexity and liquidity premia to improve risk-adjusted returns. Since the selloff in March, non-agency MBS have seen a significant recovery. We remain focused on non-agency MBS purchased at discounts to par, which provide a potential source of income and capital appreciation and benefit from more resilient fundamentals. We have emphasized assets with seniority in the capital structure and low loan-to-value ratios that we expect to better withstand a deterioration in home prices and consumer credit fundamentals.

Conclusion

The latest drop in PDI presented a brief period of opportunity where the premium was only a few percentages. However, since then the fund has been back to rising higher. That being said, the question between buying PCI or PDI has become harder to decide. Based on that, putting cash to work in either seems a reasonable approach. Perhaps even splitting up a position to invest in both. This could further take advantage of positioning one's portfolio for potential future swaps between this pair.

For PDI specifically, the fund is currently offering investors a 10.39% yield. This is incredibly attractive. Even while the coverage more recently has been rather lackluster, the need for a distribution cut usually isn't on the minds of PIMCO. They are also probably watching for the potential to capitalize on appreciation via investing in discounted MBS securities. That could be another potential source for their distribution. Over the longer term though, we would like to see the fund cover its distribution from 100% NII.

The potential for appreciation would be a bonus, and that could lead to a continued history of year-end specials. This year it should probably be skipped - unless they have already booked gains that they are required to distribute out. Of course, the fund will also presumably have capital losses that can offset these gains.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I am/we are long PDI, PCI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was originally published to members of the CEF/ETF Income Laboratory on October 3rd, 2020.