It's healthy to, at times, step outside of your comfort zone. So when I received a reader request to take a look at his preferred method of investing, I was hesitant at first. When I sat down and looked things over, I realized something quickly, however.

I needed to write about this - as it directly opposed the notion that the reader had told me he had - and what his goals were with his monthly allocations/investment into the index.

My points in this (rather short) article can be applied to many ETFs, really. The point I make is a general one. I use the iShares MSCI World ETF (URTH) and MSCI World as an example, no more.

Let me show you what I mean.

Investing in broad, worldwide ETFs with a decent yield - a good idea?

To those of you who don't understand where I come from, let me clarify.

Many investors, both in Sweden, Denmark, Finland, Norway, and Germany (which are the primary countries I cover here at home) have either a part of their entire portfolio aimed at a very simplistic approach to investing. They make a monthly deposit of size X into an index/ETFs. A popular choice here is the so-called MSCI world index.

To use MSCI's own description:

The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries*. With 1,603 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country

(Source: MSCI)

The appeal is obvious. iShares' ticker URTH, for instance, offers a nearly 1.9-2% annual yield on what is essentially a fairly worry-free investment. I do not know how savings trends are in North America, or if this approach is a common one, but it's common here.

What was essentially a relatively unknown index years ago has become a gold standard for many investment advisors, investors, and managers. In Germany, the advice is given if you have €50/month in savings, you can push this into the MSCI world index, and you'll get excellent exposure to a broad-based, international mix of securities, companies, and currencies. Even consumer protection organizations in Northern Europe go out of their way to give this fairly "simple" piece of advice to curious investors - "just invest in MSCI World."

The appeal is intuitively obvious. Someone else handles the risk management and just makes sure that your money is continually invested in the ~1600 companies comprising the index.

For someone like myself - and likely countless other readers here - a 2% yield, even based on such an appealing index, might not be enough. However, this advice goes out to investment and finance novices - people who have little interest in finance and just want a "safe" placement for their money. This is what these investments are being sold as, given their supposed broad-based, international nature.

The Problem

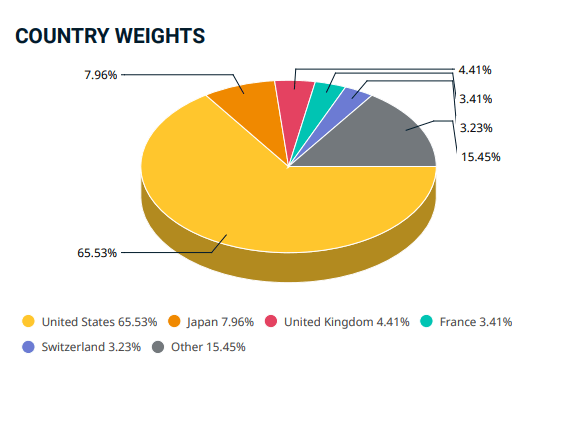

The problem is, the supposed international nature is, at least as I see it and in relation to the impression the description gives, a lie - or at least a bit of an omission.

Anyone who spends even a minute or two looking over the fact sheet will quickly see what the problem is - but the fact that a relatively savvy reader was under a certain impression showed me that sometimes, it's easy to be fooled and believe in essentially what you're being told.

(Source: MSCI)

The simple truth is that when you're putting 1,000 SEK or €100 in MSCI World, you're putting 666 SEK, or €66 out of every €100 if not directly into Wall Street, at least in investments which are intimately tied to the financial destiny of one nation/economy - that of the USA.

If I were to invest in an index called the "World," I would expect exposures to be relatively balanced to indeed reflect the current state of, and the potential future state of that world. Europe would play a large part. China would have to be a part of it (even if it's not necessarily a part of the "developed world") - whether you like China or not. India is also a country some have mentioned that they believe to be represented - yet none of these nations are even close to represented as to their relative economical sizes or potentials. What about other relevant economies not even mentioned here? Nothing about Israel, or similarly developed countries?

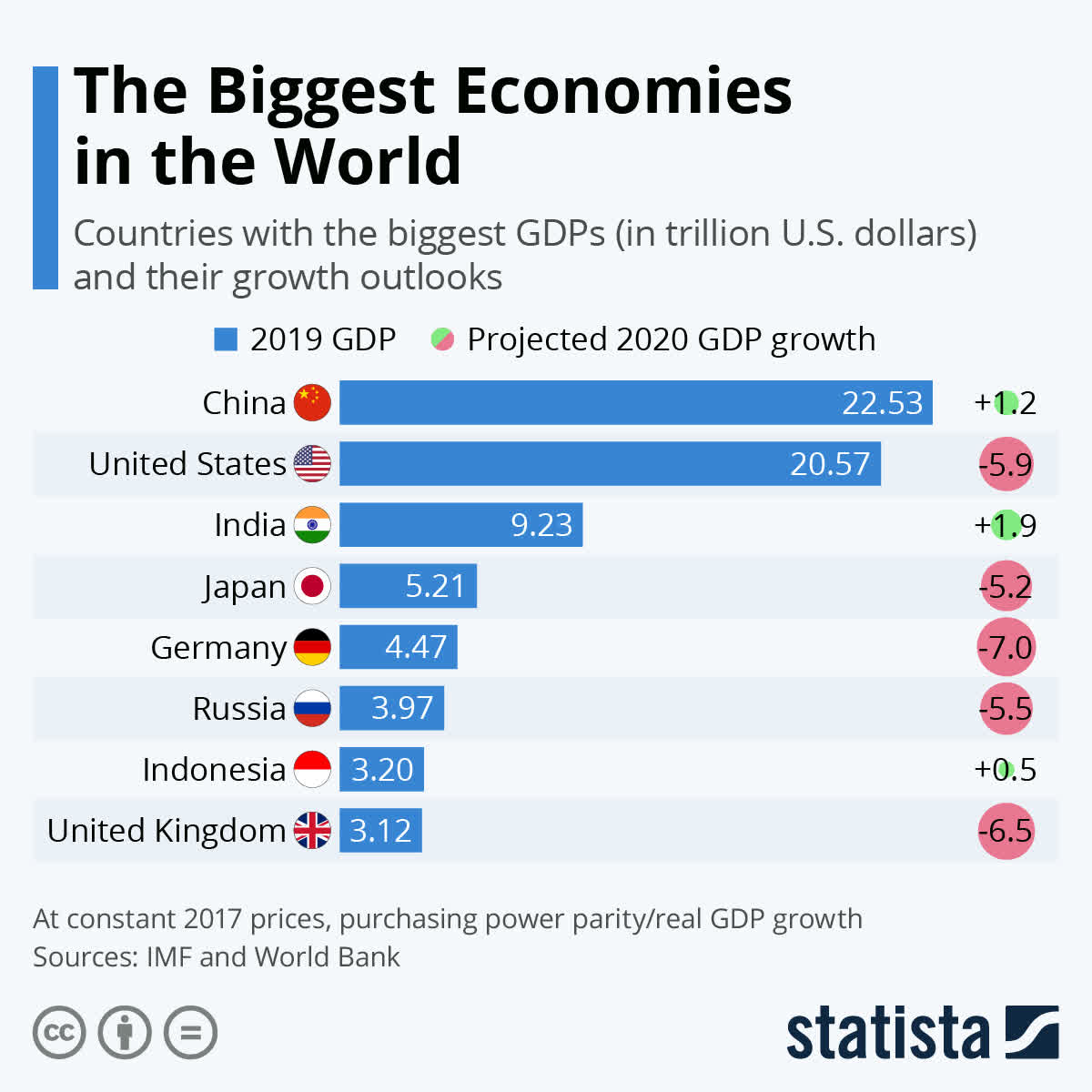

Take a look at some numbers.

(Source: Statista)

The USA is one of the foremost economies of the world - it might even still be the largest one, but it's not in a position where I feel it's "correct" to completely dominate - to more than 66% - an entire index that's known as "MSCI World."

For those of you who like dabbling in history (such as myself), the structure of this index reeks of logic one could see during the middle ages and beyond, where the "world" was considered to be a tiny portion of central and northern Europe, with bits of Russia and the Middle East perhaps included. The rest of the world, that was pretty uninteresting, despite the relative sizes of India, China, Asia, and other parts of the world. I realize that the target here is covering developed countries, but this imbalance stands even in these terms.

(Source: Forbes)

Yet the problems go beyond this, for lack of a better word, nationalism. Consider for a moment that in the MSCI World index, the weights of Apple (AAPL), Netflix (NFLX), Microsoft (MSFT), Facebook (FB), And Google/Alphabet (GOOG) (NASDAQ:GOOGL) together alone represent more than 12% of this entire index.

The result of continuing investments, both passive and active, into these companies can be seen in their ever-increasing multiples.

Now, once again - these are great companies.

If you invest in MSCI World fully aware of the fact that 66% of it is the USA and 12% is these megacorporations, then there's no problem.

The problem is that not a single investor I've spoken to about this has been aware that this is the way things are. One even believed that he had a significant portion of his capital invested in China, which as far as sector exposures are concerned, isn't even listed or included, since it's not considered "developed," with a Human development index of 0.72.

Most of the investors I've spoken to have in their ambitions to invest in a balanced manner, both in current economies and companies, but also in the world's growing economies, and in the economies which may become the economies of the future - such as China and India.

However, the problems go beyond MSCI World. You might say, "Well, MSCI has the MSCI ACWI index. It's supposed to be a 'True World index' - just use that."

Here is the fact for that Index.

The MSCI ACWI Index, MSCI’s flagship global equity index, is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 26 emerging markets. As of December 2019, it covers more than 3,000 constituents across 11 sectors and approximately 85% of the free float-adjusted market capitalization in each market. The index is built using MSCI’s Global Investable Market Index (GIMI) methodology, which is designed to take into account variations reflecting conditions across regions, marketcap sizes, sectors, style segments and combinations.

(Source: MSCI)

Indeed, some of these advisors sell this index as a "safe," all-country alternative to the MSCI World index. But while it also includes emerging markets, these only make up 11% of the index - and this includes China.

What's more, US stocks and securities thoroughly dominate this index as well - more than 58% of the Index is in the US - so even choosing MSCI ACWI, you're lowering your US exposure by 8%, no more.

The same is true for MSCI ACWIIMI, with a 57% US exposure.

The list goes on. It's the same in many indexes.

So why is this such a problem?

Isn't the US the largest and most advanced economy in the world, responsible for huge parts - perhaps even 50% - of the economy, especially including tech?

No, not really.

According to World Bank statistics, the US represents no more than, at most, 25% of all services and goods produced worldwide in a single year. Because of this, any exposure as seen above, grossly over-represent the actual contribution by the US to the world economy, and investors wanting broad-based exposures are - very commonly - left in the dark.

China, who represent 16% of all services and goods produced aren't even represented in the MSCI World index.

The risks

The risks to this approach of investing should be intuitively obvious. An exposure this size to any nation, but in particular to these few companies in one space could have devastating consequences if either the USA, the world, or both start regulating tech megacorporations far more than they currently are. Initiatives in Europe are already underway to do just that. And that's just talking tech.

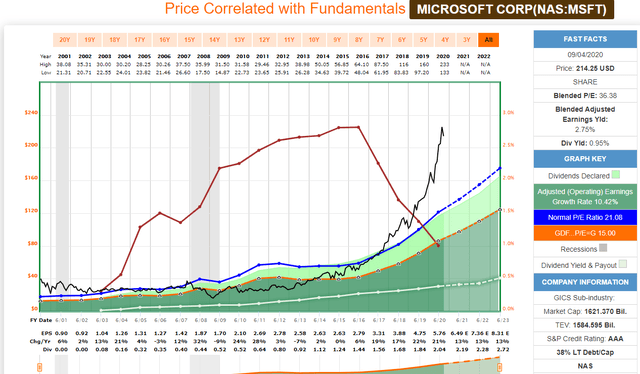

As a valuation-oriented investor, I don't need to tell you that the valuation of a company such as Microsoft doesn't really make sense to me anymore. Take a look at the company's P/E-valuation below, which has completely disconnected from any sort of sensible rationale at a weighted average of over 36X.

Neither does Apple, at even worse valuations. I wouldn't touch either of the companies with a 10-foot pole at these multiples. A 37X+ weighted average P/E multiple versus a historical 12.91X? That's a good time to "sit out" and wait for things to calm down and correct themselves. If you invest cash here, you're essentially hoping that these expectations and realities don't change going forward and that these companies are essentially worth 2-3 times the multiple they were a few years ago. To that, I say "No."

(Source: F.A.S.T Graphs)

The same is true to some degree of most of these companies occupying the largest positions in the index. The fact is that the index known as MSCI World isn't at all a World Index, it's intimately tied to the US economy and how the Nasdaq/DOW develops.

Take yesterday's (at the time of writing this article) massive drop of almost 5% in the Nasdaq, 3% in the S&P 500.

MSCI World dropped over 3% as a result of this - more than the S&P 500. Did this in any way reflect how "The world" developed?

The following day seems to follow suit, with broader tech down more than 5% in two days, with MSCI world down more than 4.3% as I'm writing this article.

Stockholm, as an example, was down only 1.4% and is up 0.1% the day after. Similar things can be seen in other European markets. The notion that these ETFs or this index in any way reflects the broader world, as some of its investors seem to think or how it is marketed, is wrong.

My portfolio isn't weighted towards tech, though it does have a substantial USD portion - and it's down only 0.3% in the last 48 hours, in part thanks to positive FX, but also because large portions of my portfolio are actually up significantly. As of Monday, my entire portfolio is up nearly another 2.8%, with Nasdaq still pointing to the negative in pre-trading.

The current markets and index weightings reflect a position wherein the developed nations continue to lead the charge in terms of growth - but this is a trajectory that cannot be maintained permanently. Sooner or later, emerging markets are bound to outpace these older, already-developed nations in terms of growth - and what happens to these heavily-weighted indexes and the corresponding stocks then is anyone's guess.

What to do with this information

What to do with this information is of course, up to the reader. The point of this article isn't to specifically bash the MSCI world index - it's to point out that as a whole, believing you're somehow diversified when investing in some of these ETFs is really a mirage.

Many indexes and ETFs today have heavy weightings towards things that you either don't realize or that you may not even want.

Personally, this is one of the reasons why I as an investor maintain a relatively balanced investment approach, with weightings both in SEK, NOK, Euro, USD, and CAD, but only in individual companies. However, my weightings are certainly far from perfect at this time.

If you've read my articles, you also know that I'm actually fairly openly hostile to the idea of investing at all in China due to concerns about investment safety/protection and other things in the nation that seems bound to become the largest economy in the world. I don't have a single investment in China - or India, for that matter, and while I may invest in the greater Asian region in the future, I have a very reserved stance towards China or any company from there.

Because of this, don't interpret this as me somehow being hostile or critical of US-weighted investment tendencies. This is a stance having zero to do with politics.

It's my goal to invest more in the USA and the US overall. What drew me to writing this article were investors who wanted to invest a certain way, being told that they could do X to do this, but in reality only pushing money in what I view as overvalued equity and undesirable companies.

There is also the fact of a too-high currency exposure - to any currency, regardless of which it is. It's not something that I ultimately want for myself, and these people voiced similar sentiments - yet again they were told that this was the way to do it.

It's easy for those of us who spend portions of our day working or committing time to the market and to finances as a whole to say "Well, they should've simply read the fact sheet."

Yes - of course, they should have - but in my work and outside of my work, I often come across people with a very simple mindset to investing - and those have a tendency to be able to fall prey to things like this.

It is for these beginner investors that I write articles such as these.

I don't want to warn against investing in MSCI World - I want to caution people to know what you're investing in, and for even novice investors to take a more active hand in their investments. MSCI World is, in the end, in large part a tech-heavy and US-heavy index with no real diversified exposure.

As to the dear reader who sparked this article, my comment to him was - if he wanted ETFs and real diversification, to look at the indexes of:

- MSCI USA - for US exposure

- MSCI World Emerging Markets - for EM exposure

- MSCI Europe - for EU

- MSCI Japan - for Japanese exposure specifically.

I don't give financial advice per se, but I pointed out that a weighting of ~25%, ~40%, ~25%, and ~5% in these indexes respectively more accurately targets the way the current world economy is structured and how service and good contribution is structured. I was quick to also say, however, that any exposure to EM unavoidably comes with a higher degree of overall risk due to the nature of emerging markets - and this is something that every investor needs to consider as well.

The message in this article, in the end, is as follows: Know well what you invest in, and do your due diligence, even if you're a novice/beginner investor.

Thank you for your time.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles.