The chase for yield has created a lot of distortions, and investors are reaching out to more and more unusual choices to satiate their yield cravings. As a general rule, this creates more risk, and one has to be aware that the crowd that canters in can also be a part of the stampede that gallops out. Hence, caution should be the name of the game. But then, what should an investor use to get returns without dialing up the risk?

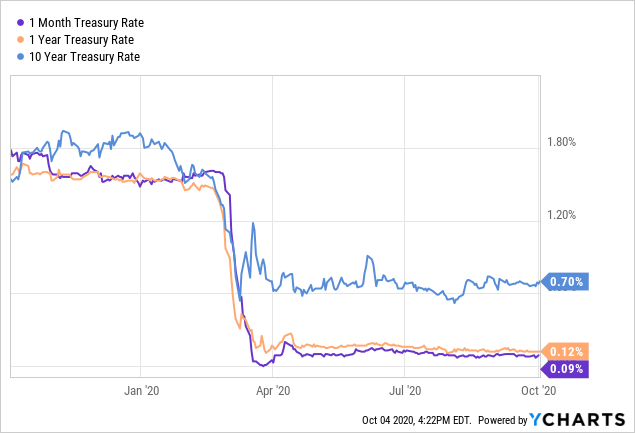

At the shorter end, Treasuries are yielding zero percent. At the longer end, they are yielding virtually zero percent.

Data by YCharts

Data by YChartsEven the 10-year note with its 0.7% yield, when transferred into an ETF with expenses and management fees, gives one as much satisfaction as a stifled yawn. Enter the protagonist of our story.

PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT)

While the ticker might have been suited for an ETF focusing on toothpaste manufacturers, MINT actually invests in investment-grade short-term corporate bonds. The key point that we like about this ETF is the varying maturities it holds, resulting in it having an overall portfolio bond duration of less than one year. This is ideal for an ETF when investors are trying to get a relatively higher yield while maintaining a cash-like stability.

The fund is actively managed and states that it aims to maintain an overall portfolio duration of less than 12 months. It is run by the bond giant PIMCO, which has marketed MINT as a cash alternative.

Current Holdings

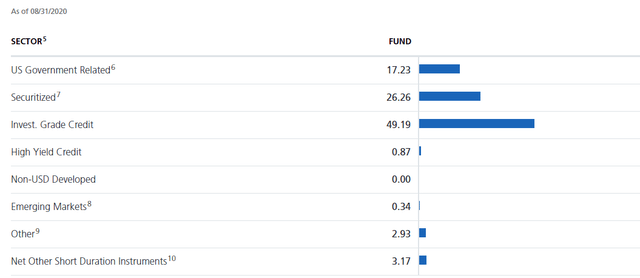

As of the most recent update, MINT holds 17% in US government-related instruments and almost half in investment grade bonds.

Source: PIMCO

As far as credit ratings go, the fund is extremely conservative. BBB and below holdings make up only about 10% of the fund. Investors should note, though, that in the past, the fund has been more cavalier about holding sub-BBB bonds.

Source: PIMCO

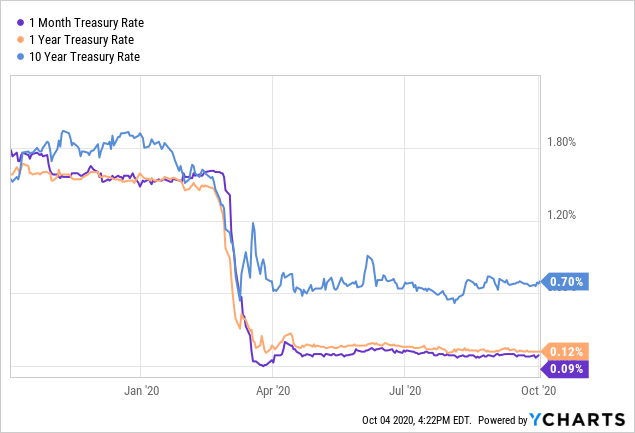

While most shorter-term duration funds stay close to home, PIMCO has gone globetrotting to find bonds of all shapes and sizes.

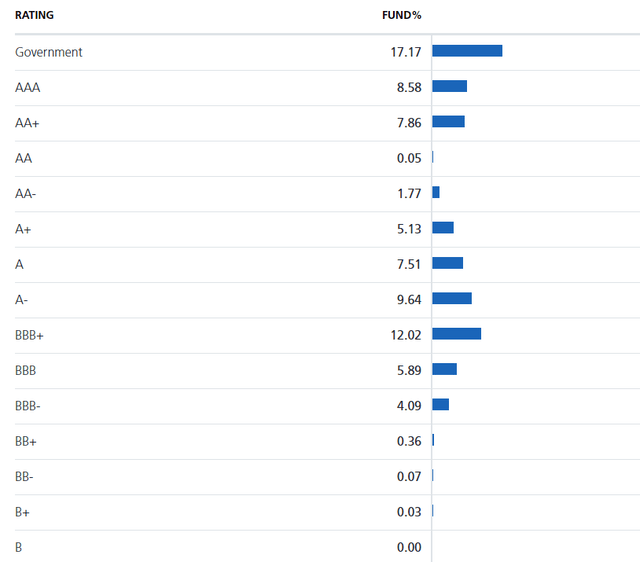

Source: PIMCO

The fund has an astounding 784 holdings as of the last update. That, alongside the very low exposure to speculative issues, makes capital loss risk a non-issue. While the fund may increase lower-graded bond holdings, diversification will continue to be an ongoing theme.

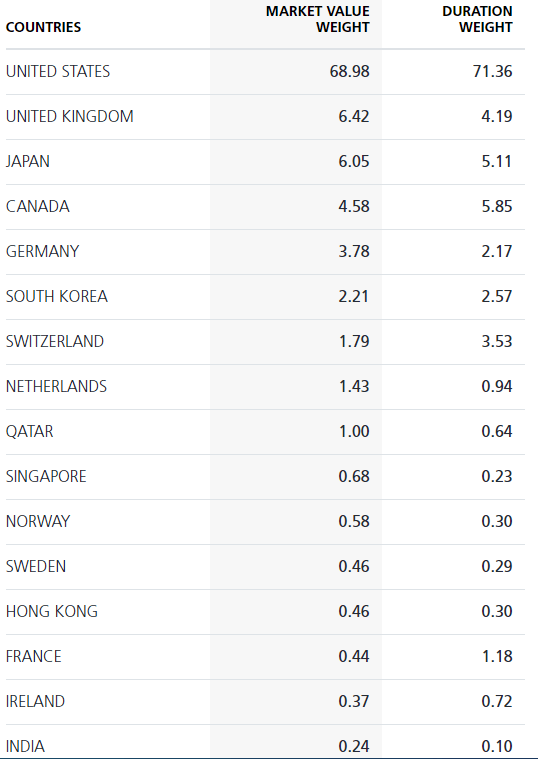

March Madness

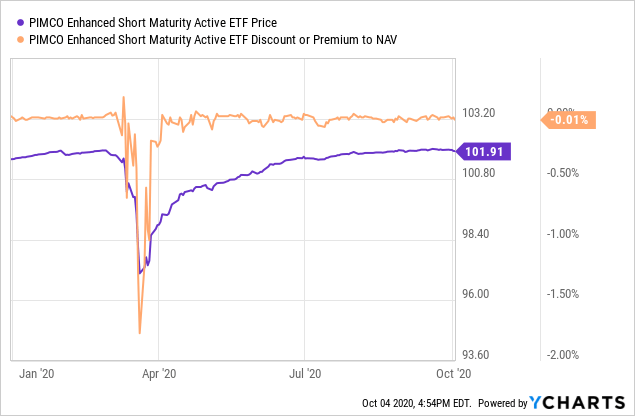

While the bonds that MINT holds are safe when held till maturity, shorter-term pricing is another issue. We saw that in March when MINT's price fell rather briskly for what was supposed to be a near-cash equivalent investment.

Data by YCharts

Data by YChartsThe drop was partially due to a very sudden credit spread widening. It was also driven by an unusual discount to NAV - something you do not normally see in ETFs, except in selloffs like we had this March.

Data by YCharts

Data by YChartsThe fund did recover quickly as markets stabilized, but also taught a valuable lesson to anyone who had to liquidate in that bad environment.

Current Yield

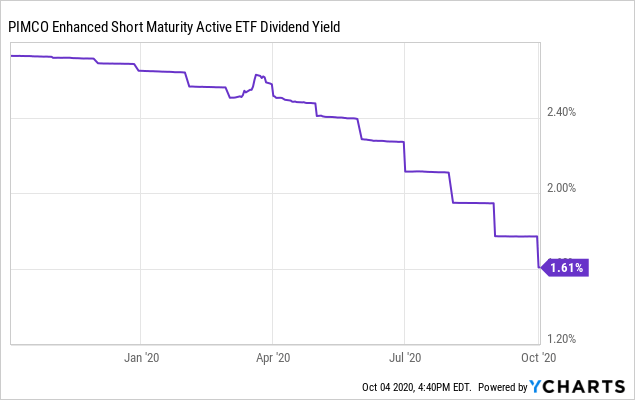

MINT's YChart suggests a much higher yield than it produces today.

Data by YCharts

Data by YChartsWhile investors might think that a 1.61% return is coming their way, the return is way smaller in reality. All the numbers on the fund's website help get at the estimated forward numbers. The estimated yield to maturity of current bonds is just 0.72%.

Source: PIMCO

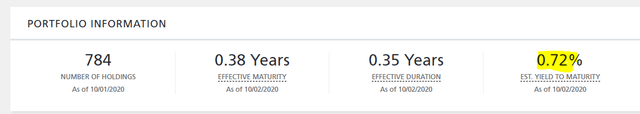

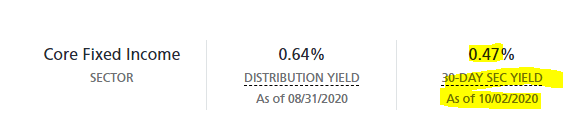

If you subtract the fees out from that, you are left with something that looks like a rounding error.

Source: PIMCO

That gets us to about a sub-0.4% yield. The 30-day SEC yield which is reported on the fund's website also backs this conclusion.

Source: PIMCO

Now, none of this is written in stone, and the manager can actively take more risk by either increasing duration length or by going long on more lower-rated credit. It is possible that this happens post a vaccine and economic stabilization. PIMCO certainly has the strongest measure of credit quality, and it might pick a few strong spots out. However, with overall yields this low, and half of it going as expenses, there is little to get excited about over here.

Alternatives?

Expecting a high return from MINT is the equivalent of expecting someone to squeeze blood from stone. It won't happen as long as Powell and associates remain determined to wage a war on savers and interest rates are being lowered by all means, natural and artificial.

But while MINT cannot generate even 0.5% annually after expenses from this point, we do believe that the current volatility structure in the market makes the idea of writing cash-secured puts or even deep in-the-money covered calls very attractive. Conservative investors can go further out and away from the money and generate attractive returns on their cash. A lot of investors actually hold cash for one of two reasons. The first is for emergency expenses. The other is to buy attractive opportunities. That second category is very well-suited for writing these puts and making annualized returns that far exceed the yield that they can generate via shorter-term corporate bonds.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

We just started a limited time sale and are offering 100 spots (20 left!) at the Lowest-Rate-Ever-Offered. Learn more about our method and why it might be right for your portfolio. Click Here For A Free Trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.