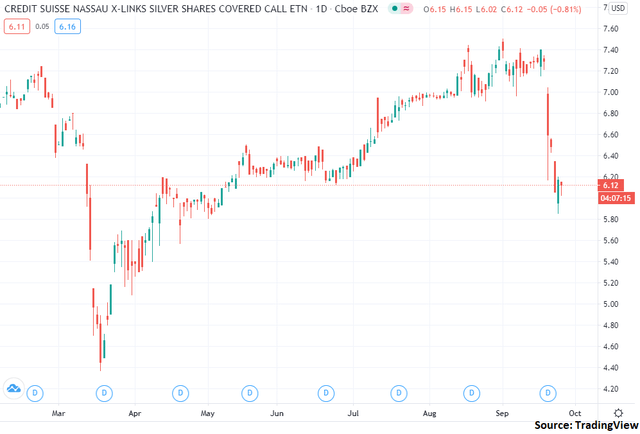

As you can see in the following chart, it's been a bit of a volatile year for the Credit Suisse Silver Shares Covered Call ETN (NASDAQ:SLVO) with shares seeing both substantial upside and downside throughout the course of this year's market turbulence.

I believe that buying SLVO at these levels makes for a good play, depending on your investment objectives. In short, I believe that silver is likely going to rally over the next year, and if you are primarily looking for dividends, then buying the ETN at this point is a solid play.

About SLVO

To start this piece off, let's examine the nuance of the SLVO ETN. This is a somewhat complicated ETN in that it is actually a note which is an investment strategy that is built on top of an ETF. SLVO is giving investors the return as though they were to hold the SLV ETF and selling covered calls against the position on a monthly basis, with the covered call sold 6% out of the money.

Right off the bat, we must acknowledge that this is a complicated ETN and therefore should only be traded or held by those who understand what is happening beneath the surface. This ETN is a complete investment strategy in and of itself, so investors should carefully consider their financial objectives and goals before holding this product.

Put simply, SLVO is a good way of earning dividends if you have a bullish or neutral view on silver. How the ETN works is that you are basically capping yourself to a maximum price appreciation gain of 6% in a given month in exchange for a consistent and decent dividend check. The recent selloff has pushed the dividend yield up to 19.77% at the time of writing (however I believe that a more fair long-term number is probably in the territory of 12% per year).

It is very important to stress that when you are trading SLVO, you are exchanging your upside for this dividend check so if you are expecting to see large gains from upside movements in silver, this is not the ETN for you. For example, the last six months have seen SLV rally by 62% - but SLVO has only increased 11%. And considering the size of the dividend check, your total return has been substantially less than that seen in SLV.

So is SLVO a good ETN to buy and hold in your portfolio? Well, it depends entirely on what you're trying to accomplish. If you're looking to earn dividends through time and don't care too much about capital appreciation, then during certain times SLVO is a good hold. But if you're trying to maximize capital gains, then SLVO is not for you.

This said, let's turn our eyes to the fundamentals at work in silver to get a recommendation as per the outright direction of a holding in SLVO.

Silver Markets

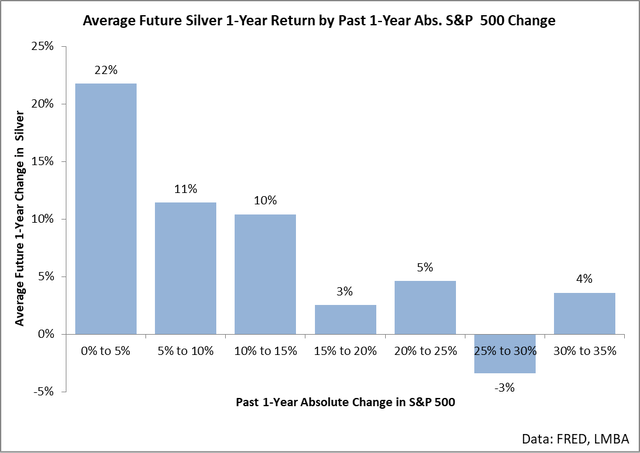

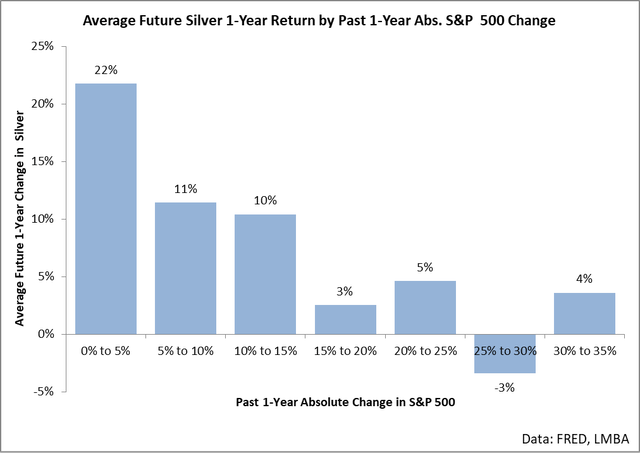

Despite the substantial amount of volatility seen this year, the S&P 500 has actually not gone much of anywhere - when seen from a year-over-year change that is. At the time of writing, the S&P 500 is sitting on a year-over-year gain of about 9% (which is somewhat less than prior years). This may seem like arbitrary figure to observe, but there's actually an interesting relationship at work in that lower outright returns in the market are correlated with higher future returns in silver.

This chart shows that over the past five decades or so, when the S&P 500 doesn't really go anywhere over a given year, we tend to see silver rally fairly strongly going forward. For example, in the past when we've seen the market move at about the pace that we've seen today, silver has rallied by 11% over the next year.

I believe this relationship captures the yield-seeking nature of investors. If a given market is not delivering the expected or desired return, then other asset classes are explored. Given that the S&P 500 is only up about 9% over the past year, this relationship would indicate that investors are likely going to park capital in silver for the next year in search of yield. By knowing this relationship ahead of time, we can position ourselves to profit from this movement.

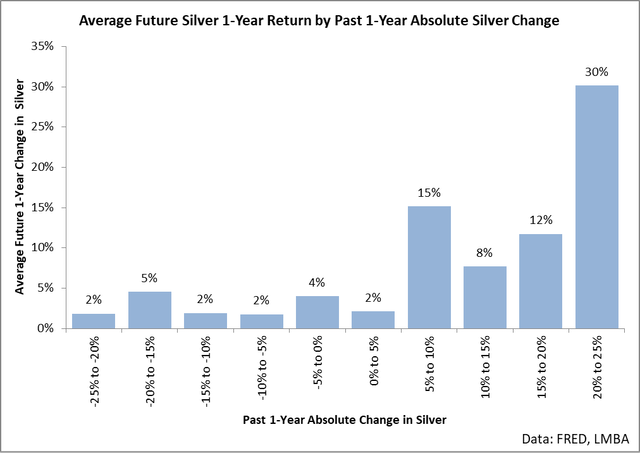

This said, silver has actually already seen a good degree of rally. That is, over the past year, silver is up around 24%. Interestingly enough, historically when we see silver rally by this amount, momentum tends to carry forward into the next year.

What this chart shows is that over the past five decades, when silver has rallied by around 20-25% in a given year, on average it rallies 30% over the next year. Additionally, the clear pattern in the data shows that bullish momentum tends to work in the favor of silver: when prices have been rallying by 5% or more over a year, then there is an increasingly strong expected return in the asset. In other words, we are likely going to continue to see investors pile capital into silver for at least the next year which will prop prices higher going forward.

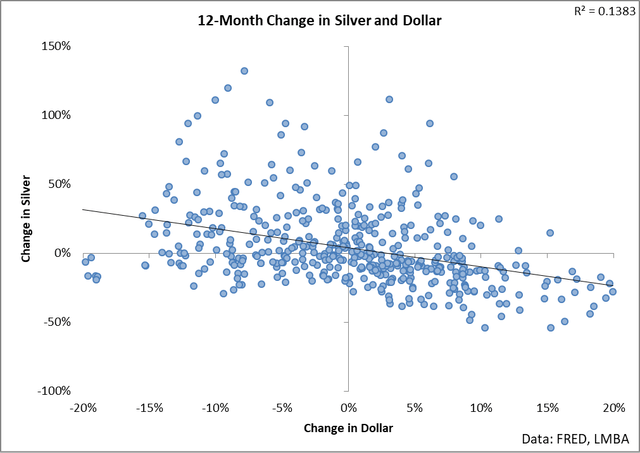

Another interesting relationship driving the price of silver is the moderate correlation between changes in the dollar and changes in silver.

What this chart shows is that when the dollar declines in value, silver tends to rise. This year has seen a very interesting pattern in the dollar in which the global financial panic in March propelled the dollar skyward due to a flight to safety trade; however, the dollar has rolled over into outright declines on a year-over-year basis as investors pull capital from the U.S. markets once again. At present, this trend is continuing with the dollar weakening for about six months straight at this point. As long as this trend continues, silver is likely going to remain generally stronger.

I believe the fundamentals are very clear at this point and they suggest that silver is going to trade higher over the next year. If you're looking for dividends, then I believe SLVO is a good play for you at this time. However, if you're trying to capture the outright change in silver, then I would avoid this ETN and focus on one of the many silver ETPs available to investors.

Conclusion

SLVO is an ETN which is exchanging the upside in silver for a consistent dividend check to investors. Silver fundamentals remain strong which suggests that we are going to see the price of the commodity rally over the next year. If you're looking for dividend yield, then now is the time to hold SLVO.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.