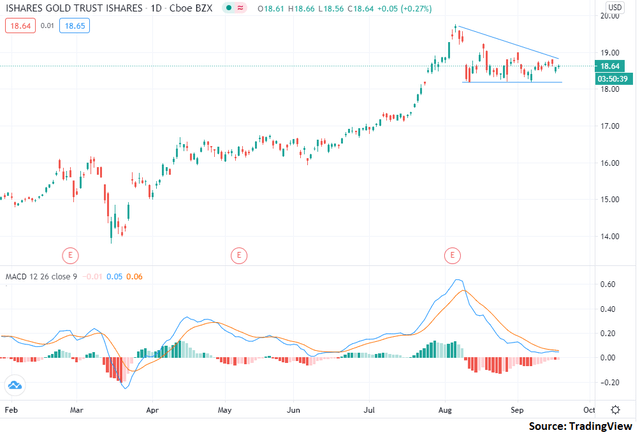

As you can see in the following chart, the iShares Gold Trust ETF (IAU) has pulled back somewhat over the past few weeks in line with a correction in the price of gold.

It is my belief that now is a strong time to buy gold. Not only is this the case, but I also believe IAU is a strong ETF for trading the rally in gold based on its methodology.

Gold Markets

Investors in gold this year have been strongly rewarded with the market selloff earlier this year, leading to a rally in price by nearly 30%. Recent weeks have seen price pull back somewhat; however, I believe a few key economic indicators are strongly suggestive of price gains for gold holders.

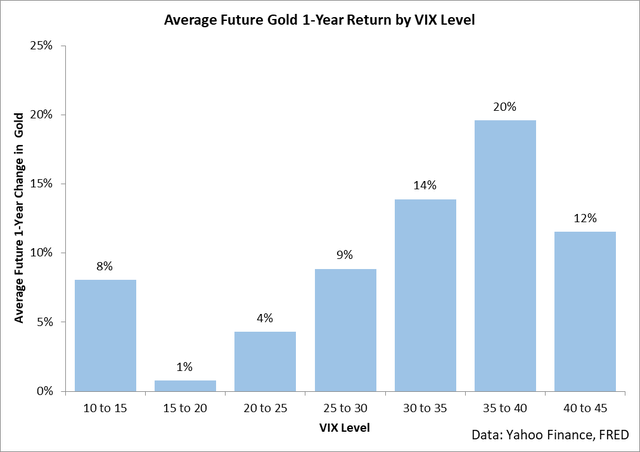

One of the first key relationships I’ve been monitoring is that between the outright level of volatility in the S&P 500 and the future returns of gold.

If you’re unfamiliar with the VIX, it is short for the volatility index - and it is an index which is calculated from the prices of a basket of options on the S&P 500. This might seem like an odd relationship to have predictive power for calling changes in gold; however, when you dig into the methodology of the VIX, you’ll start to see the rationale.

Since the VIX is calculated off of the price of options on the S&P 500, when the S&P 500 collapses, options tend to become more expensive (and therefore the VIX tends to rise). This is what gives the VIX the name "the fear gauge" - as the market collapses, the VIX rallies.

This is why a high VIX is predictive of a strong price in gold. Since the VIX tends to rocket when the market tends to fall and since gold is considered to be a safe-haven commodity, then when fear rises, investors tend to park capital in gold. This makes sense, but what does it say for today’s investors?

Over the past two weeks, we have seen the VIX reach levels as high as 35-40.

As you can see in the prior chart, a VIX reading of 35-40 shows that gold investors are likely going to see further upside in the value of the commodity. Specifically, over the past 27 years, when we have seen the VIX hit 35-40, then on average gold has rallied by 20% over the next year. Indeed, the consistency of the relationship shows that an elevated VIX even reaching above 25 (where it’s at today) has resulted in the VIX rallying over the next year.

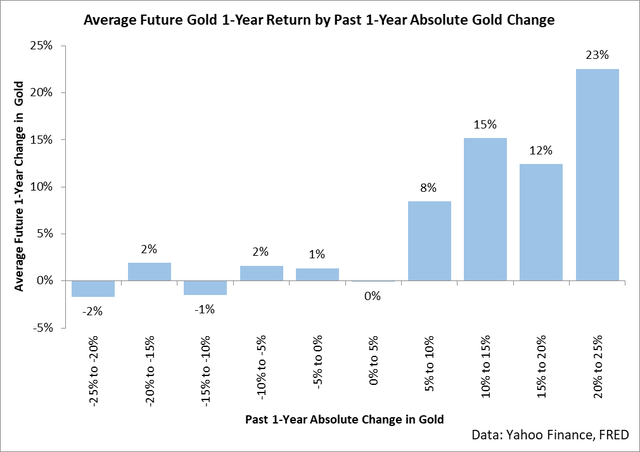

Not only is this the case, but the data also suggests that positive changes in gold are liable to see additional upside to the price of gold.

This chart is very interesting in that it shows that gold exhibits strong momentum: when it has been rising, it tends to continue rising. For example, over the past year, gold has rallied by about 30%. Historically speaking, rallies of this magnitude tend to be followed by additional rallies over the next year.

I believe these studies indicate that the gold is likely going to continue heading higher over the next year with historic averages suggesting that we’ll see a rally of 20% or more. This said, I do believe we need to quickly examine the chart before turning our attention to the specific nuances of IAU.

Since the beginning of August, we have seen IAU turn down as traders have taken profits. However, it is important to note that this full month and a half of selloff has actually not resulted in a terribly strong correction. In other words, the current pullback is just that - a pullback in an existing trend which means that the overall trend is likely going to continue higher.

At present, I am noticing the MACD indicator which is showing bearish momentum waning with another wave of bullish momentum poised to start. I believe that this will lead to another leg upwards. While it’s impossible to call the magnitude of this movement, I believe that the ultimate trend is that we will see gold rally by another 20% over the next 52 weeks in line with historic averages. This said, now is a strong time to buy gold to capture the coming uptrend.

About IAU

When it comes to actually trading gold, investors have a plethora of options - and each of these options has a key benefit or detriment associated with it. In the case of IAU, it is an ETF which is giving exposure to physical gold - unlike other ETFs and ETNs which track the price of gold futures or even gold miners. This might seem like a very minor thing to note, but it actually is material upon returns.

When investors hold an ETP which is tracking futures, they are exposed to something called roll yield. Roll yield is what you get when you’re holding exposure in a futures market and futures converge towards the spot price. Gold is almost always in what is called contango, which means that futures are priced above spot most of the time.

The reason that futures are almost always in contango has to do with the physical cost to store as well as the cost to borrow capital. If a futures contract is priced differently than the spot price adjusted for the cost of storage as well as the cost of borrowing over the time until the delivery of the futures contract, then a form of arbitrage will occur by investors borrowing and storing gold or making or taking delivery on a later-month futures contract. The math basically works out such that gold futures are almost always priced above the spot market.

The problem of roll yield is that since gold futures are priced above spot and since futures converge to be the spot rate (and since the interest rates for borrowing and storing vary with time and time shrinks to be zero heading into expiry), this means that investors trading ETPs holding futures are exposed to losses from roll yield. These losses may be slight (with latest settlements showing losses of possibly 2% per year); however, if you are holding over lengthy periods of time this can add up to result in material decoupling of performance.

IAU is holding physical gold bars which means that it is not exposed to the roll yield losses and commissions associated with trading futures. This places it as a strong option for trading gold and holding for lengthy periods of time. Given that my thesis is calling for gold to rally over the next year, I believe this ETF will do a good job of preserving value during this time frame.

Conclusion

Gold has been rallying strongly during 2020 as markets have pushed capital into safe assets. The recent elevated VIX and momentum of gold suggests that we’ll see gold rally by around 20% over the next year. IAU removes roll yield concerns through holding physical gold, making it a strong alternative for trading the rally in gold.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in IAU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.