By Jeff Weniger, CFA

Not many investors in 2020 give much consideration to the days of European and Asian communism.

But maybe they should.

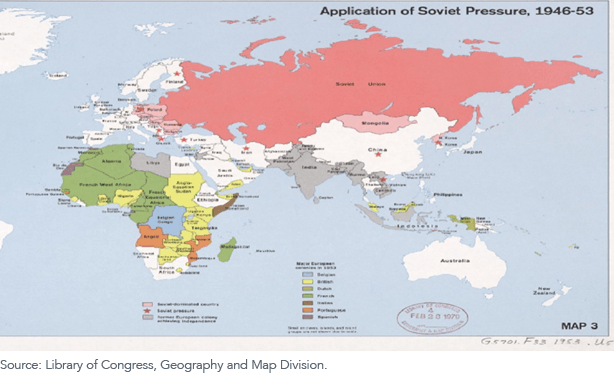

The map below shows the reach of the USSR in the postwar years. Stalin negotiated well.

One legacy the Cold War had on our industry was to leave us with a laundry list of state-owned enterprises (SOEs) that litter indexes such as MSCI Emerging Markets. Placing profits below political consideration, these bureaucratic bloats-mostly incorporated before the fall of the Berlin Wall and still comprising one-quarter of that Index-often drag performance and add risk. So it is with geopolitical hot potatoes.

Figure 1: "Application of Soviet Pressure, 1946-53"

When the World Bank's Antoine van Agtmael coined the term "emerging markets" in 1981, it was probably assumed that by 2020 many of them would have, ahem, emerged. But most are still stuck in the category. Some, like South Korea and Poland, are in that purgatory where some indexers have graduated them to "developed" status but other indexers still declare them emerging. Others, like Israel, built up a tech sector and graduated. And some unfortunates went the other way: "submerging." Venezuela, for example.

China is now the elephant in the room.

None of us had equities in that country 40 years ago. It was not even "a thing."

Though Deng Xiaoping started to open the country shortly after Mao's 1976 death, let's get real: it could only be engaged by Western capital in the last quarter century or so, and in a heavily restricted manner at that. For that matter, everywhere else with a red star on the Cold War map above was basically uninvestable, too. Even after the USSR finally crumbled in 1991, Eastern Europe remained a mess throughout the 1990s.

With 25% of the MSCI Emerging Markets Index still populated by the Cold War's leftover SOEs, many investors have significant capital tied up in companies that incorporated under Mao Tse-tung and Joseph Stalin.

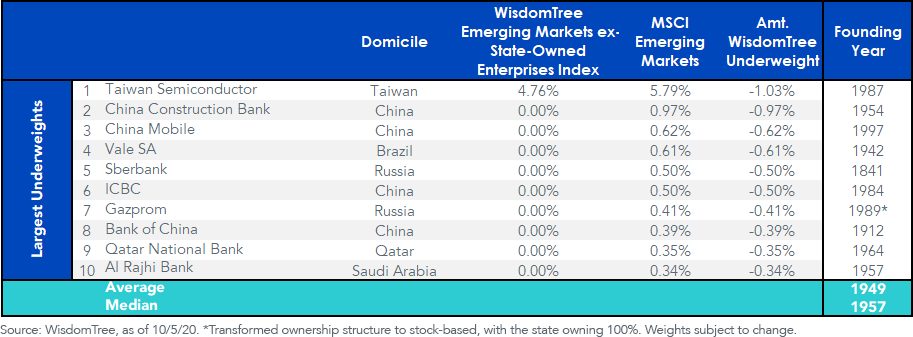

Figure 2 shows the founding years of the 10 largest underweights in the WisdomTree Emerging Markets ex-State-Owned Enterprises Index, which kicks these companies out.

Figure 2: WisdomTree Emerging Markets ex-State-Owned Enterprises Index's Underweights' Founding Year

You thought you were in emerging markets to capture 21st century growth, right?

Look at China Construction Bank, incorporated in 1954, 18 years before Richard Nixon visited the country. How about Sberbank? That one makes the Chinese banking monoliths look like fintech start-ups. Forget Stalin or Khrushchev; this Russian megabank came into being during Tsar Nicholas I's reign.

Not that old companies are "bad," per se. Procter & Gamble (NYSE:PG) has been around since 1837, Pfizer since 1849 (NYSE:PFE). But those are U.S. companies, founded to turn a profit.

State-owned companies are often a different animal.

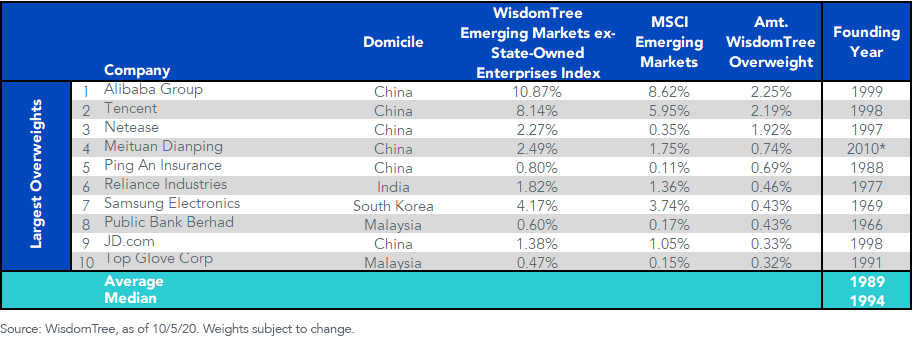

Figure 3 shows the over-weights in our Index. Of the six that are Chinese, Mao never met them. The median founding year for the list is 1994.

Figure 3: Founding Year, 10 Biggest Overweights in the WisdomTree Emerging Markets ex-State-Owned Enterprises Index

When we look at the emerging world, there are hundreds of listed SOEs that make their way into indexes such as MSCI Emerging Markets. If we could write their real mission statements, is it "to further the interests of entrenched politicians?" I think it is.

WisdomTree has three emerging market ETFs that are designed to stay away from SOEs.

Because really, why own them if you do not have to?

The ETFs are:

XSOE: WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (Expense ratio = 0.32%)

CXSE: WisdomTree China ex-State-Owned Enterprises Fund (Expense ratio = 0.32%)

IXSE: WisdomTree India ex-State-Owned Enterprises Fund (Expense ratio = 0.58%)

To see their performance, please see their factsheets here for XSOE, here for CXSE and here for IXSE.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. CXSE focuses its investments in China, including A-shares, which include the risk of the Stock Connect program, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. CXSE's exposure to certain sectors may increase its vulnerability to any single economic or regulatory development related to such a sector. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. IXSE focuses its investments in India, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Due to the investment strategy of IXSE, it may make higher capital gain distributions than other ETFs. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. CXSE, IXSE and XSOE invest in the securities included in, or representative of, their Index regardless of their investment merit, and the Funds do not attempt to outperform their Index or take defensive positions in declining markets. Please read the Fund's prospectus for specific details regarding the Fund's risk profile.

Jeff Weniger, CFA, Director, Asset Allocation

Jeff Weniger, CFA serves as Director, Asset Allocation at WisdomTree. Jeff has a background in fundamental, economic and behavioral analysis for strategic and tactical asset allocation. Prior to joining WisdomTree, he was Director, Senior Strategist with BMO from 2006 to 2017, serving on the Asset Allocation Committee and co-managing the firm's ETF model portfolios. Jeff has a B.S. in Finance from the University of Florida and an MBA from Notre Dame. He is a CFA charter holder and an active member of the CFA Society of Chicago and the CFA Institute since 2006. He has appeared in various financial publications such as Barron's and the Wall Street Journal and makes regular appearances on Canada's Business News Network (BNN) and Wharton Business Radio.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.