The Aberdeen Asia-Pacific Income Fund (NYSEMKT:FAX) is a closed-end fund that invests in Asia-Pacific region bonds and debt securities. While the COVID-19 pandemic has represented a challenging market environment, the fund has been able to overcome significant volatility to return 2% thus far this year. The actively-managed fund currently yields 8.3% distributed monthly, making it a compelling income vehicle. We are bullish on FAX as macro data suggests the Asia-Pacific region is well-positioned to deliver strong economic growth setting up a positive outlook for region bonds. The combination of attractive yields and strong fundamentals makes FAX a good option to diversify investor portfolios with upside on a total return basis.

(Source: finviz.com)

FAX Background

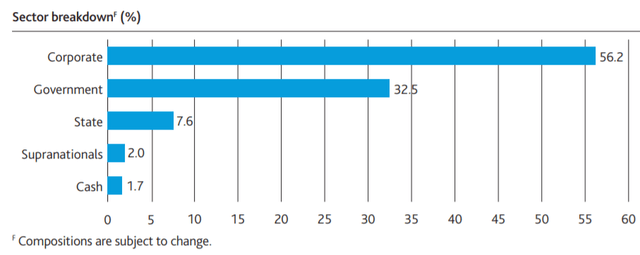

FAX with over $1.2 billion in total assets and an inception date in 1993 is one of the oldest CEFs investing in the region backed by a long-term track record from a credible management team. The fund holds a combination of sovereign debt issued by national and state governments, representing 40.1% of the fund along with regular corporate bonds issued by companies incorporated in the region comprising 56.2% of the weighting. The investment strategy includes emerging and developing economies, including countries in the Middle East.

(Source: Aberdeen)

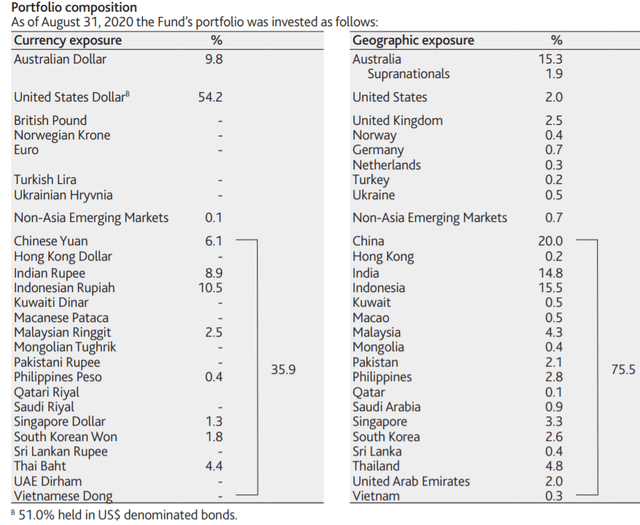

In terms of foreign currency exposure, bonds denominated in the Indonesian Rupiah and Australian Dollar each have a 10% weighting followed by the Indian Rupee at 8.9%. Other bonds denominated in smaller currencies include issuances in Thai Baht and Malaysian Ringgit each under 5%. It's important to note that 54.2% of the total holdings are denominated in US Dollars, which helps to reduce the inherent FX risk of the fund.

(Source: Aberdeen)

The actual geographic exposure by country differs from the currencies as the fund also invests in bonds issued in global currencies. An example here is China, which represents 20% of the exposure by geography but only 6.1% denominated in the Chinese Yuan. Curiously, the fund does not hold any Japanese debt, which is likely related to the low yields of the yen and as a strategic allocation decision by the investment management team.

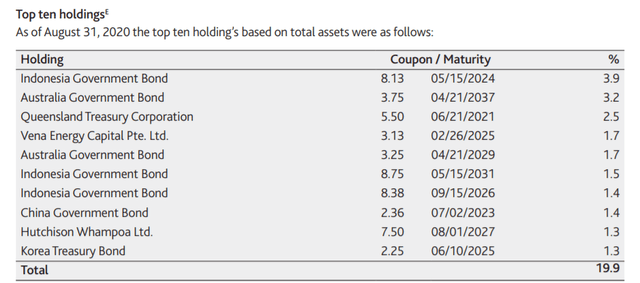

By individual holdings, the current portfolio includes over 230 issuances at different maturities and coupons. The largest single position is in a 2024 8.1% coupon bond from the Indonesia government, representing 3.9% of the fund.

(Source: Aberdeen)

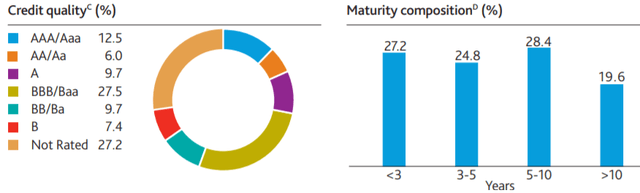

The credit quality is tilted towards investment grade, as 55% of holdings are rated 'BBB' or higher. 'AAA' Australian government bonds add strength to the overall credit profile. The reported modified duration of the fund is 4.8 years with the majority of the holdings classified as short-term or intermediate bonds.

(Source: Aberdeen)

FAX Performance

It's important to note that the risk profile of FAX is on the higher-end, given a combination of several factors. First, the fund utilizes leverage currently representing about 25% of the asset base. The use of leverage helps the fund achieve its income objectives while adding to the share price volatility.

While some of the issuers have strong credit ratings, the fund also includes high-yield or non-investment grade bonds which often reflect weaker fundamentals. Emerging markets are inherently higher risk, given weaker credit profiles at the country level. For the sovereigns, fundamentals like public debt to GDP levels, economic stability, and the underlying strength of the economy often reflect each government's ability to repay their debts reflected in higher market yields and lower credit ratings. Emerging market corporates face common credit risks along with potential challenges in servicing debt in a foreign currency like the US Dollar while generating revenues in local currency for the global bonds.

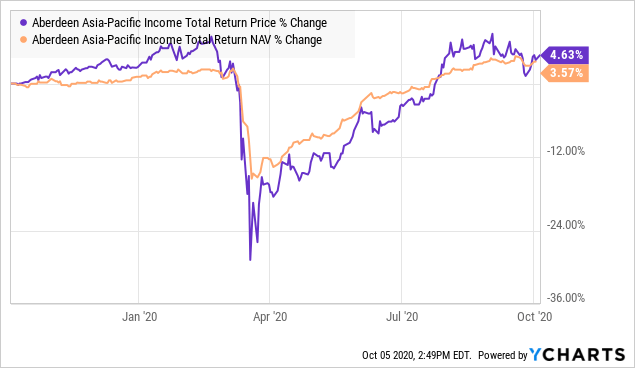

The result here is that the risk can translate into high rewards in a favorable market environment. Indeed, even with the extreme levels of market volatility since the emergence of the COVID-19 pandemic, FAX has returned 4.6% on a total return basis over the past year and is up 2% year to date. Efforts by global central banks to provide stimulus measures and quantitative easing programs to support lower rates have had a favorable impact on market conditions.

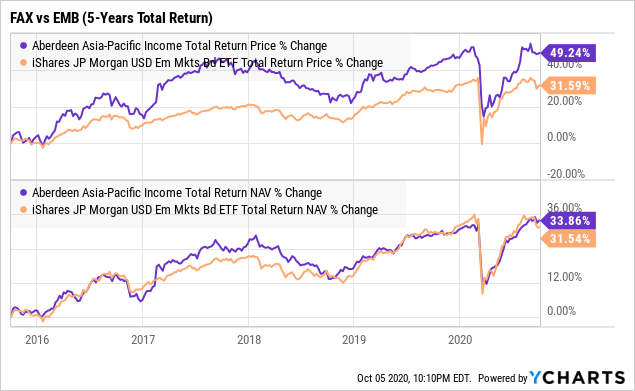

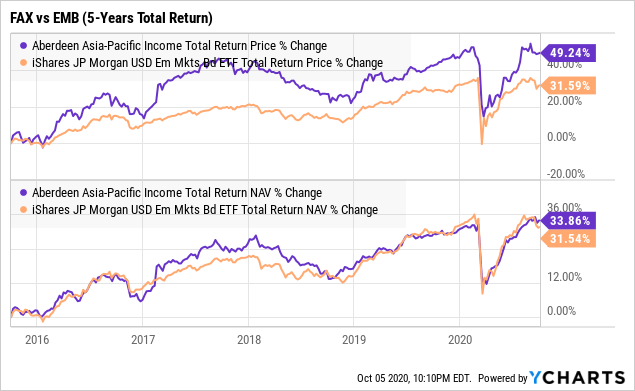

Data by YCharts

Data by YChartsWhile FAX is not meant to track any particular index, we look at the performance of the iShares J.P. Morgan USD Emerging Markets Bond ETF (NASDAQ:EMB) for reference. EMB is one of the largest passive bond ETFs and is a good benchmark for the performance of EM debt market denominated in US Dollars. Over the past 5 years, FAX has been able to favorably outperform EMB with a return of 49.2% compared to 31.6% for EMB on a total return price basis. In terms of the net asset value, the returns are more similar, with FAX up 33.9% compared to 31.5% for EMB.

Remembering that FAX is specific to the Asia-Pacific region and also holds foreign-denominated bonds, the performance here is impressive in the context of a US Dollar strength in a recent year period. We expect FAX to outperform EMB more meaningfully to the upside in a scenario where the US Dollar weakens going forward.

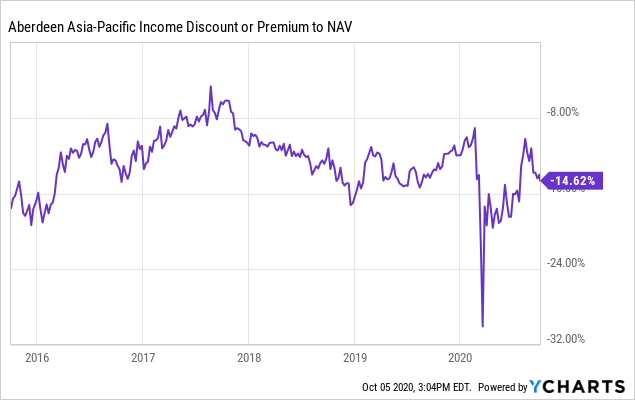

FAX Discount to NAV

The other point to highlight is that the spread in the fund's performance at the share price level to its net asset value. Historically, shares of FAX have traded at a discount to the reported net asset value of the fund. Reasons for this recurring dynamic include the liquidity profile of some underlying holdings, particularly among the smaller issuances. The current discount of 14.6% is slightly wider compared to a 5-year average of 13%. By this measure, FAX is relatively inexpensive and further supports the attractiveness of the fund at the current level. Long-term shareholders that have consistently reinvested their dividends have also benefited from occasional share repurchasing activity by the fund manager.

Data by YCharts

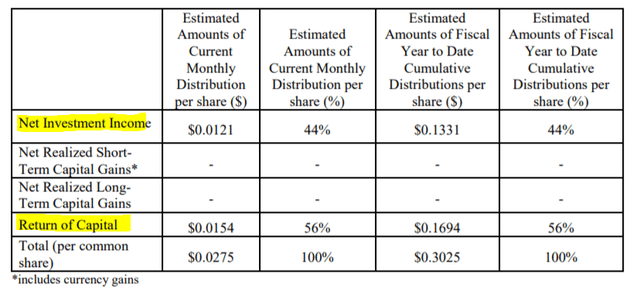

Data by YChartsFAX Distribution

As mentioned, FAX pays a monthly dividend at a rate currently set at $0.0275 per share. Over the past year, approximately 56% of the distribution has been a return of capital "ROC", while 44% is from net investment income. The portion that is recognized as a ROC is untaxed but reduces the investor's cost basis. While the ROC ends up chipping away at the NAV of the fund as it pays out more than the underlying investment income, the level appears sustainable for the immediate future.

(Source: Aberdeen)

Shareholders have the option to take the cash option or do an automatic reinvestment through the DRIP program, which can maximize the total return. We believe the high yield offers flexibility for shareholders depending on market conditions. Taking the cash option can help to reduce risk in a bearish market environment, while reinvesting with a bullish outlook can help maximize total returns. The current yield is 8.3% at the share price level or 7.1% based on the current reported NAV.

Analysis and Forward-Looking Commentary

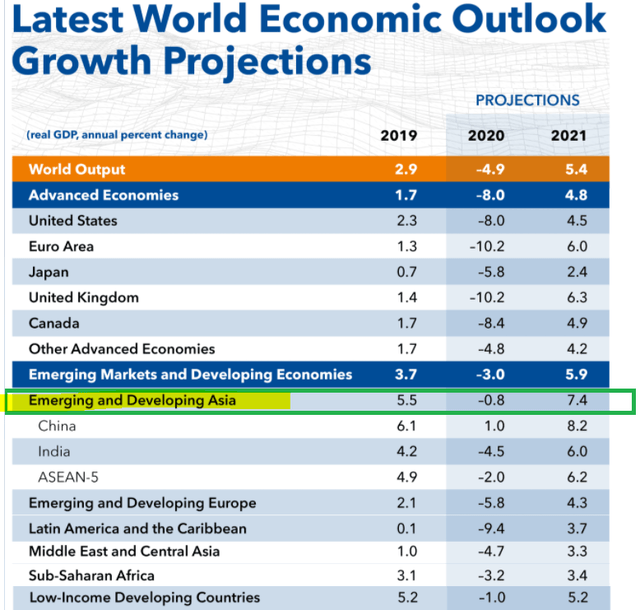

What we like about FAX is that the exposure to government and corporate bonds in the region is supported by some of the most resilient macro environments in the world. The COVID-19 pandemic has been a global disruption, affecting most countries and industries. Still, data by the International Monetary Fund "IMF" shows that the Asia region, including China, has been relatively more resilient with smaller economic impacts this year. Furthermore, the outlook is stronger for 2021 in Asia with an expectation that the economies recover faster compared to the United States and other regions of the world.

(source: IMF)

With data from the last official update in June, the IMF was estimating only a 0.8% decline to Emerging and Developing Asia GDP compared to an 8% decline for global advanced economies. For 2021, Asia is set to rebound by 7.4%, while advanced economies may have a more moderate 4.8% rebound. China is one of the few countries in the world expected to offer positive GDP growth this year and expected to further gain momentum into 2021. Asian countries have generally fared better with a more controlled pandemic outbreak while maintaining stronger underlying organic growth momentum.

Indonesia, which represents 15% of the FAX's exposure by country, reported GDP growth of 5% in 2019. While the government expects a tepid environment this year between a 0.2% growth rate to a 1.1% contraction, estimates are for a rebound in GDP between 4.5% and 5.5% next year.

Indeed, Aberdeen fund managers offered some commentary during its quarterly update back in August highlighting the stabilizing market environment given supportive Central Bank policies in the region.

Asian local-currency bonds contributed significantly to the Fund’s relative performance for the quarter. These markets stabilized during the period due to aggressive monetary policy easing and sufficient market liquidity. In particular, the Fund’s position in Indonesia enhanced performance as expectations of further rate cuts supported the front end of the yield curve, in which the Fund was invested. We switched out from 15- and 20-year bonds into five-year securities in an effort to position the Fund more effectively for the recovery. Similarly, lower yields in Malaysia and India bolstered Fund performance.

From a top-down perspective, there are multiple macro themes in play here that will drive the future performance of FAX. Broad themes like growing populations and the emergence of a middle class and financialization are long-term bullish dynamics for the region. We believe the macro environment of low interest rates and tamed inflationary pressures, while economies continue to rebound favor fixed income in the region.

In terms of risks, we are looking at the fund's 45% exposure to foreign currencies and highlight the direction of the US Dollar as an important monitoring point. While the fund exposure is diversified, significant strength in the Dollar could drive negative sentiment towards emerging markets, and Asia-Pacific bonds. On the other hand, we expect structural weakness from the Dollar, considering weaker economic growth from the U.S. relative to other parts of the world.

Takeaway

The Aberdeen Asia-Pacific Income Fund is a high-quality CEF offering investors diversified exposure to a unique and important market segment. We like the fund's structure and holdings in high growth emerging markets. While we expect volatility to remain a theme in the market for the foreseeable future, the Asia-Pacific region debt is supported by overall strong fundamentals with a positive long-term outlook.

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.

Disclosure: I am/we are long FAX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.