Interactive Brokers Breaks Down near Market Open on Monday

Shortly after the open on December 7, 2020, Interactive Brokers, a platform that is typically resilient and crash-proof, had major issues. Customers of Interactive Brokers started complaining on Twitter and posting reports to DownDetector very early in the morning, peaking at 9:30 AM Eastern Time, saying they were unable to

/IBKRbanner12072020-70862a7f55ed412d9c78274f1fbb91b0.jpg)

/mutual_funds_shutterstock_517234657-5bfc3af646e0fb0083c4892e.jpg)

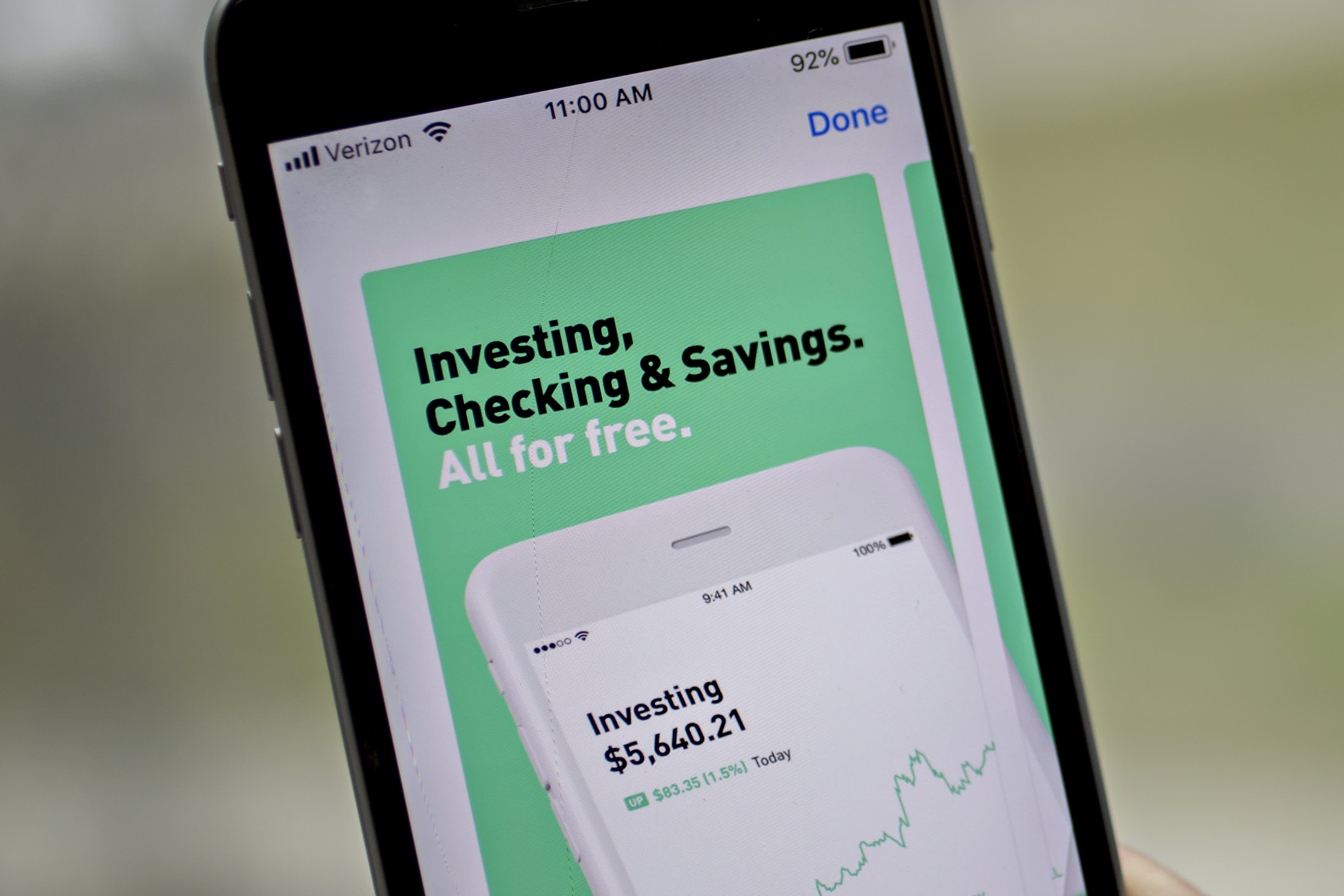

/Fidelityvs.Robinhood-5c61f1a6c9e77c00016626a5.png)

/shutterstock_349461494-5bfc474bc9e77c00514a4202.jpg)

/94674017-5bfc3888c9e77c0026b892d6.jpg)

/shutterstock_445110493-5bfc4679c9e77c00514a1687.jpg)

/NASDAQ_stock_market_display-98fb86e5dbba4295810cec107ed70123.jpg)