IAU: It Is Time To Buy Gold

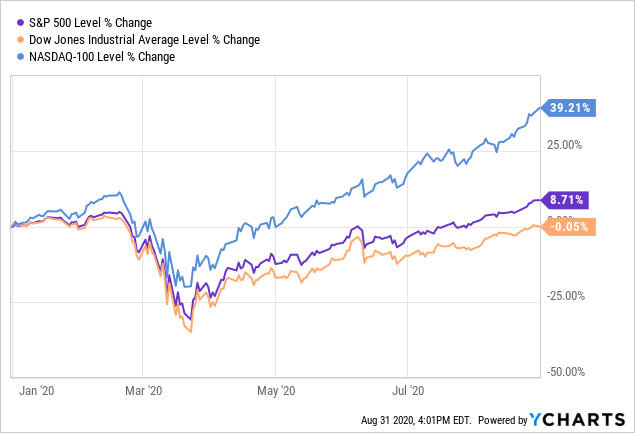

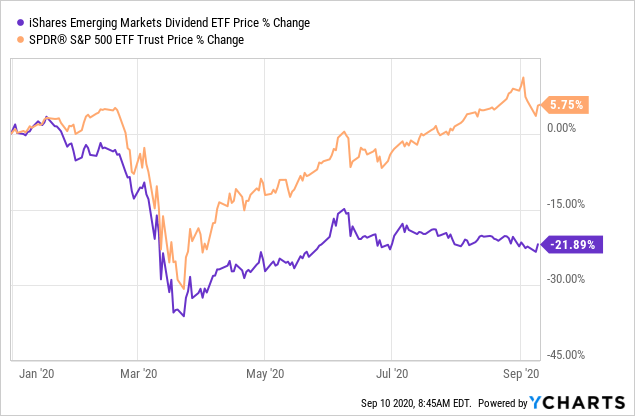

As you can see in the following chart, the iShares Gold Trust ETF (IAU) has pulled back somewhat over the past few weeks in line with a correction in the price of gold. It is my belief that now is a strong time to buy gold. Not only is this