How Interest Rate Moves Drive Bond Returns?

Ongoing unpredictability in security markets according to financing cost assumptions has introduced one more trial of certainty for multi-resource financial backers, especially those clients put resources into lower-risk, high security assignment portfolios. However, the higher-for-longer financing cost standpoint is a significant explanation multi-resource financial backers ought to hold their nerve in the midst of the disturbance.

Yields on 10-year government obligation in the US, euro region and UK rose (mirroring a drop in costs) following national bank strategy gatherings and key expansion information discharges in late September, in particular remarks from the US Central bank (Took care of) and Bank of Britain (BoE) that proposed loan fees may not descend when markets were anticipating.

Everything boils down to the impact of loan cost assumptions — and how they change — on bond returns. Given the agreement that rates are near or at top levels and the market's aversion to changes in the standpoint for rates, this present time is as great an opportunity as ever to investigate the job of loan fee assumptions in security market returns.

Why have bond markets been volatile?

Ongoing security market unpredictability came directly following remarks by Took care of and BoE policymakers at their September strategy gatherings, which came as a shock for business sectors. The market agreement at the time was that loan costs would begin falling in mid 2024.

Loan fee assumptions are a critical consider security costs, so understanding how security markets will generally move because of loan costs can assist financial backers with figuring out market choppiness and at last spotlight on the long haul.

Why interest rates influence bond prices?

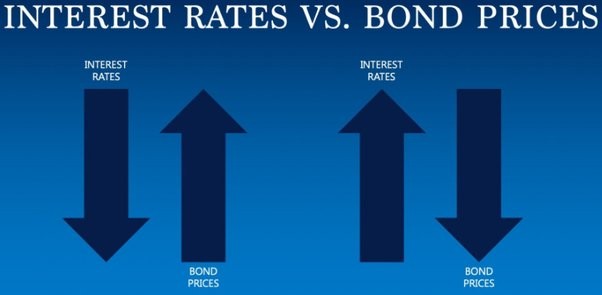

An expansion in financing costs pushes the cost of existing securities down, while falling rates would normally see long haul security costs rise. This repricing of securities depends on the return a financial backer would get assuming they held the cling to development (respect development). Assuming rates are going up, existing security costs will generally fall since financial backers can procure more on fresher securities with higher coupons, so the cost of existing securities ordinarily drops, giving financial backers a motivator to purchase those securities. The inverse is valid when rates are falling.

On account of government securities, assumptions regarding future financing costs can biggerly affect security costs than genuine developments in rates. This is on the grounds that when the approach rate, set by national banks, is supposed to rise or fall from here on out, portions of the market will change their security possessions to streamline returns, which can see costs move additionally founded on expanded request.

For instance, on the off chance that financial backers expect loan fees to tumble from current levels, there will in general be expanded interest for longer-term securities as these will yield a better yield over the long haul than more limited term securities. Then again, in the event that markets expect loan costs to rise, transient securities become more appealing as they are less delicate to loan fee changes.

Aversion to loan fee changes is alluded to as span risk, which is estimated in years and thinks about a security's qualities, for example, yield, coupon rate and development. We make sense of term risk — and its job in the uncommon 2022 security market auction — in more profundity here.

While it could seem like a basic relationship that financial backers can take advantage of for their potential benefit, markets — including numerous expert financial backers — can fail to understand the situation. In the event that loan costs don't move true to form, financial backers that have taken a strategic situation with their security possessions could experience far more prominent misfortunes than a security portfolio that is enhanced across the yield bend.

Regardless of whether loan fees truly do move true to form, the yield bend, which tracks yields across the range of security developments, doesn't necessarily in all cases move in equal, i.e., portions of the bend might move more than different pieces of the bend, thus taking gathered positions anytime along the yield bend causes an elevated degree of hazard.

At last, security possessions have generally offered an offset to the unpredictability in value markets1, so it's vital that multi-resource financial backers think cautiously prior to acquainting further gamble with their security openings.

Why multi-asset investors should hold their nerve?

While the higher-for-longer message from US and UK policymakers in September broke the market agreement that rate cuts would come in mid 2024, multi-resource financial backers shouldn't fail to focus on the master plan - that the forceful rate-climbing program by significant national banks in the beyond year and a half has particularly further developed our drawn out return standpoint for security financial backers, because of more prominent pay returns proceeding.

The outline beneath shows our typical yearly return assumption for authentic financial backers across various value/bond parts. The numbers in sections show the improvement in our middle return assumption between 31 December 2022 and 30 June 2023, with lower-risk, higher bond distribution portfolios seeing the best elevate in anticipated returns.